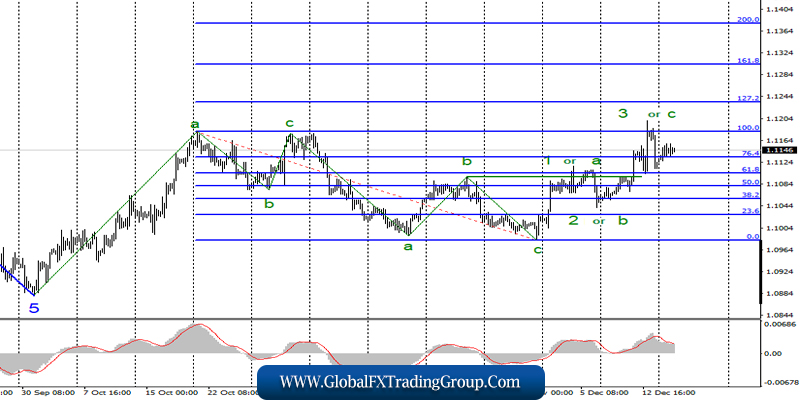

EUR / USD

On December 16, the EUR / USD pair completed with an increase of 15 basis points. The growth of the Euro currency did not affect the current wave marking, which still involves the completion of wave 3 or C and, with a high degree of probability, the entire upward trend section.

This is what the unsuccessful attempt to break through the 100.0% Fibonacci level indicates. If this is true, then the euro-dollar instrument with targets located about 10 figures may begin to decline in the near future.

Fundamental component:

On Monday, the news background for the euro-dollar instrument was quite interesting again. This time, it came down to economic reports on the business activity of the countries of the European Union, the European Union itself as a whole, as well as America.

Unfortunately, I have to admit the weakness of the numbers from the eurozone again. Business activity in the manufacturing sector of France decreased to 50.3, in Germany to 43.4, and in the European Union – to 45.9. In the service sectors, the situation is slightly better.

In France – an increase to 52.4, in Germany – an increase to 52.0, and in the European Union – an increase to 52.4. However, most of the markets are worried specifically about the manufacturing industry, and it continues to show contraction and deterioration.

Thus, the information background of the past day and as a whole remains negative for the European currency. To this news package, I can also add the consumer price index in Italy, which slowed down to 0.2% y / y – inflation in Italy has slipped completely to meager values and threatens to go into deflation.

In America, there was also a deterioration in business activity in the manufacturing sector, but much milder and more acceptable – from 52.6 to 52.5. In the services sector – growth to 52.2. Thus, US economic reports left the dollar with the opportunity to resume growth in the coming days.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section.

Thus, I recommend buying an instrument with targets near the calculated levels of 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci, but only in case of a successful attempt to break through the level of 100.0%.

Moreover, you can sell the instrument in small lots with a restrictive order above the maximum of the expected wave of 3 or C.

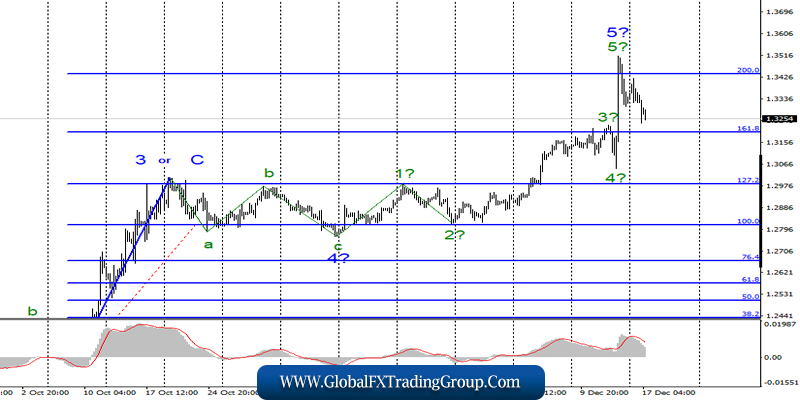

GBP / USD

On December 16, the pair GBP / USD lost literally 5 basis points at night. But for today’s trading, December 17, it managed to decline by 75 points.

Thus, there is increasing confidence that the upward trend is complete, at least its internal wave structure looks quite convincing and complete, and an unsuccessful attempt to break through the Fibonacci level of 200.0% indirectly indicates that markets are not ready for new purchases of the British pound.

Thus, the instrument can continue to build a new downward trend section and its wave 1 or a with targets located about 30th figure from current positions.

Fundamental component:

On Monday, the news background for the GBP / USD instrument was similar. As it turned out, the business activity index in the manufacturing sector fell to 47.4, “burying” the hopes for the restoration of this industry, which appeared after the previous two months. In the services sector, there is also a decline – to 49.0.

Thus, both main sectors in terms of business activity show a decline in the UK. Meanwhile, Boris Johnson intends to submit a bill on the Brexit deal to Parliament on Friday, December 20, and complete all formalities and begin the negotiation process with Brussels on terms that will determine further relations between the UK and the European Union by the end of January 2020.

Therefore, I believe the UK should complete all Brexit issues as quickly as possible, since economic reports from period to period are getting worse and worse.

At the same time, the British pound could not rise on the optimism of the markets alone. So, it is possible that a long upward trend section has been completed and now a long downward trend section has begun, which fully supports the current news background.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, now, I recommend considering new purchases of the instrument with targets located around 1.3823, which equates to 261.8% Fibonacci, only after a successful attempt to break through the level of 200.0% Fibonacci, which will indicate a complication of the upward trend section. Moreover, I also recommend paying attention to sales.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom