EUR / USD

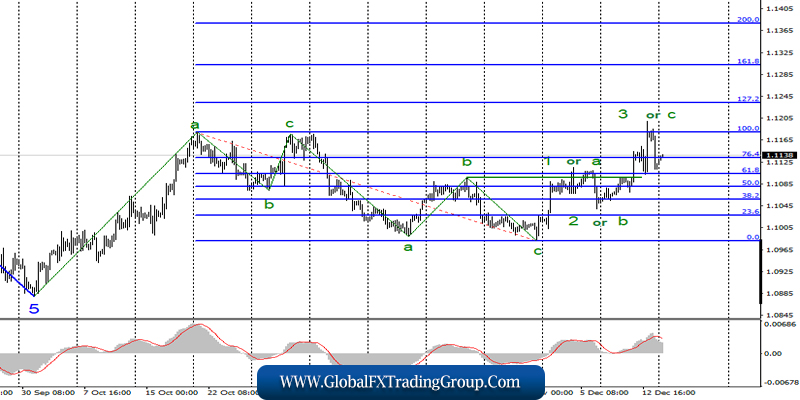

On December 13, the EUR/USD pair completed with a decrease of 10 basis points, although it made a dash up 70 points during the day. However, an unsuccessful attempt to break through the 100.0% Fibonacci level led to quotes moving away from the highs reached. It can be clearly seen from the illustration that earlier waves a and c completed their construction near the same level.

Thus, the current wave may end near the highs reached on Friday. If this assumption is true, then the entire wave structure of the trend section, which originates on November 29, takes a completely completed form. It can be transformed into a 5-wave, but only a successful attempt to break the level of 1.1179 will indicate the readiness of traders for further purchases of the instrument.

Fundamental component:

On Friday, the news background for the euro-dollar instrument was quite interesting. All the attention of the currency exchange market was riveted on the counting of votes in the UK Parliamentary elections. Since the first results were known at night, the instrument first jumped 80 points up, and then quickly dropped to its original position.

Meanwhile, regarding the economic reports on Friday, only retail sales in America can be noted, which showed very weak growth in November, only + 0.2% m / m. Moreover, retail sales excluding automobiles grew by only 0.1% mom, and the “retail control group” by 0.1%. All three reports were below market expectations, but this did not stop the US currency from enjoying demand in the second half of Friday.

This discrepancy between the news background and the movement of the instrument is explained by the same elections in the UK. In conditions, that were formed for the instrument at the end of last week, one could expect anything. It remains to hope that the markets will calm down or have already calmed down and more logical movements await us now.

On Monday, December 16, I draw attention to economic reports on business activity in the sectors of production, services of the European Union and America. Both are expected certain improvements as of mid-December. Thus, the question is: how much do the expected values of all indices coincide with the real ones? It is precisely on this day that the dynamics and direction of movement of the euro-dollar instrument can depend.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I recommend buying an instrument with targets near the calculated levels of 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci, but only in case of a successful attempt to break through the level of 100.0%. At the same time, you can sell in small lots with a restrictive order above the maximum of the estimated wave of 3 or C.

GBP / USD

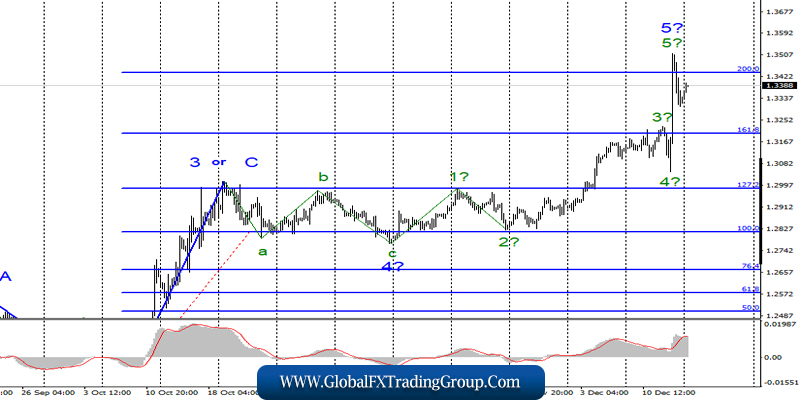

On December 13, the GBP/USD pair gained about 160 basis points, although the British pound could have gained much more at the end of the day. The departure of quotes from the reached highs, which began in the afternoon, was a hindrance.

Thus, the breakdown of the 200.0% Fibonacci level can be called false. Today, there may be a second attempt to break through this level and how successful it will be will allow us to draw conclusions about the future prospects of the instrument.

The current updated wave marking involves the completion of the construction of the trend section, which dates back to August 9 and has taken a 5-wave form. However, a successful attempt to break the level of 1.3439 can lead to even more complications of this area.

Fundamental component:

On Friday, the news background for the GBP / USD instrument was the most important for the entire current year. The victory of the Conservative Party in the parliamentary elections practically guarantees Brexit until the end of January 2020.

Moreover, party members of Boris Johnson withdrew more than half of the mandates and will be represented by 358 in Parliament. That is, the other parties put together even theoretically will not be able to block the decisions put forward by Prime Minister Johnson.

Thus, it is clear that the first thing Johnson hurries to implement is the completion of Brexit. However, further decisions will need to be made regarding the UK, and such a “non-opposition” government can still play a cruel joke with Britain. Mostly, all power is now concentrated in the hands of Boris Johnson, and only his own members of the same party can prevent him from passing a bill.

General conclusions and recommendations:

The pound/dollar instrument continues to build an upward trend. I recommend considering new purchases of the instrument with targets located around 1.3823, which equates to 261.8% Fibonacci, after quotes roll back down and after a new successful attempt to break through the Fibonacci level of 200.0%. The fulfillment of this condition will show the readiness of the currency market for new purchases of the pound.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom