EUR / USD

Monday, August 19, ended for the EUR / USD pair with a decrease of another 15 basis points, while Tuesday begins with a new fall. The only remarkable event of the past day was the report on inflation in the Eurozone for July. As you might guess, based on the title of the article, the consumer price index fell to 1.0% per annum, and on a monthly basis, it completely lost 0.5%.

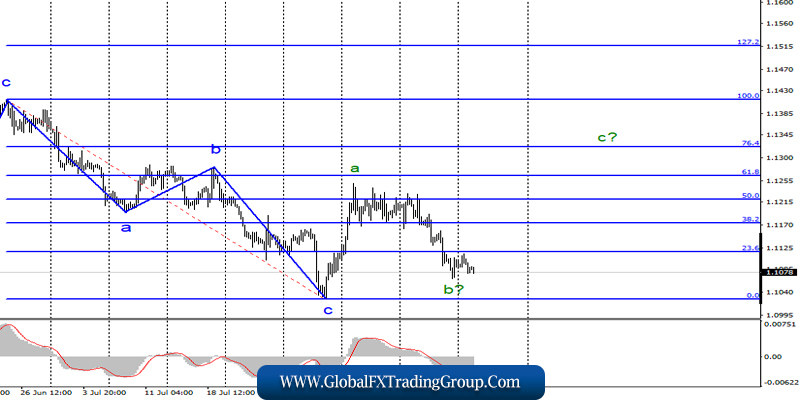

The euro immediately began a new decline, and the expected wave b at this rate will soon transform into an impulse wave of a bearish trend. The whole wave pattern literally suffers from a news background that has not changed for the euro-dollar pair over a long period of time. The prospects for the euro currency can be said, if economic reports repeatedly get worse and worse over again.

The global recession negatively affects the economy of the European Union that America does not feel particularly strong pressure from this factor, although it also has a trade war with China. Thus, the wave pattern still involves the construction of an upward wave with targets located above 1.1250, but a successful attempt to break the minimum of August 1 will lead to a new decrease in the Euro currency.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build the upward trend section. Given the proximity to the minimum of wave c, now is a good time to buy an instrument in the calculation of building a wave c with targets located above the level of 1.1250. I recommend placing restrictive orders under the minimum of August 1, as the news background is the main factor that speaks in favor of continuing to decline the quotes of the instrument.

GBP / USD

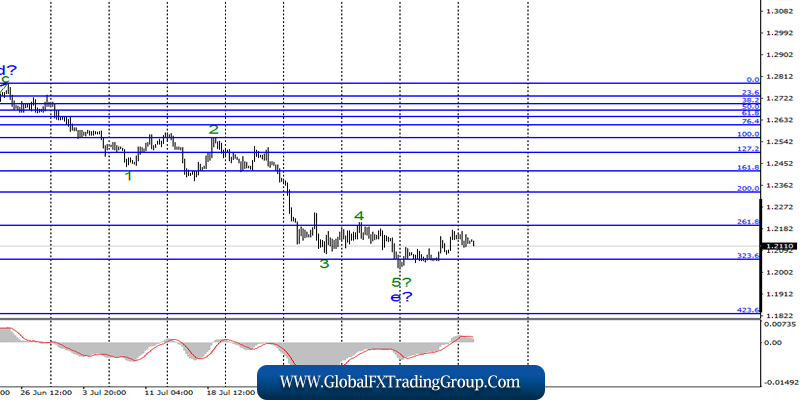

On August 19, the pair GBP / USD fell by 25 basis points, but overall, it continues to move away from previously reached minimums. Currently, the fifth wave e is still considered to be completed; however, the news background still allows one to complicate the downward trend section.

A new complication can be determined by a successful attempt to break through the minimum of August 12. It can be said that both pairs, the euro-dollar and the pound-dollar, are now being kept from a new decline only due to previous minimums. Meanwhile, British Prime Minister Boris Johnson, made a new attempt to revise the current Brexit agreement by sending a letter to the President of the European Council Donald Tusk, in which he expressed his thoughts on the regime of “back-stop mode” on the Irish border.

Although Tusk’s answer is still unknown, but to be honest, few people believe that negotiations that have reached an impasse can be reanimated. It is because of this that the pound still does not receive any support from the news background, since there is no hope for an orderly Brexit.

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2334 – 200.0% Fibonacci

General conclusions and trading recommendations:

The downward trend section may become even more complicated. Despite the fact that the wave e looks complete, it can take an even more complex form. Thus, by breaking through the minimum of August 12, I recommend considering the sale of the pair with targets near the level of 1.1830, which corresponds to 423.6% Fibonacci. There are certain chances for the pound to grow. The main thing is that the news background does not interfere with the difficult recovery of the UK currency.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom