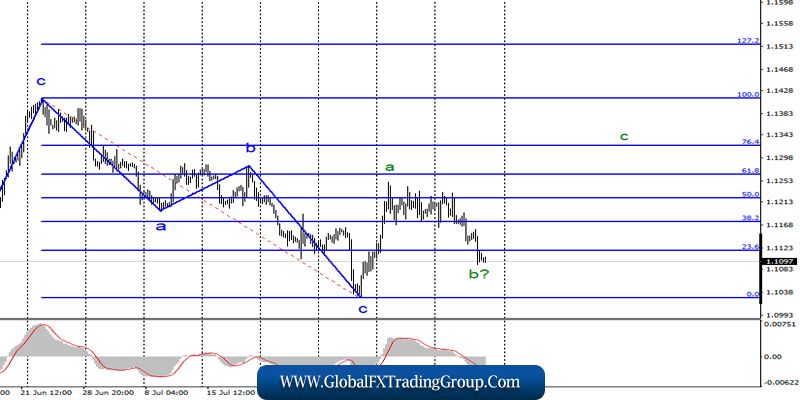

EUR / USD

Thursday, August 15, ended for the EUR / USD pair by a decrease of another 30 bp. Thus, the estimated wave b takes a very long form relative to the size of wave a. At the same time, the current wave marking remains valid for now. The main opponent of the current wave pattern is the news background. Yesterday, the US retail sales showed higher growth in July than the markets expected to see. This supported the dollar.

Also, yesterday, the head of the Bank of Finland and member of the ECB board of directors, Olli Rehn, made a speech. He said that during the next meeting of the ECB, not only a reduction in the key rate by 0.1% will be announced, but also significant purchases of bonds under the program of quantitative easing. The ECB’s monetary committee will come to such measures because of the impending global recession, as well as the growing threats and risks to the world economy in recent times.

In addition, the long-term lending program for commercial banks TLTRO may become more convenient and beneficial for banks, as it may increase the terms of loans or lower interest rates. However, one way or another, any easing of monetary policy is a testament to the weakness of the economy and its need for stimulation. This is a negative moment for the euro, and because of this, the currency of the European Union may continue to fall.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build the upward trend section. Thus, I recommend buying a pair with targets near the calculated levels of 1.1264 and 1.1322, which is equal to 61.8% and 76.4% according to Fibonacci signal, as well as according to the MACD signal upwards, counting on the construction of the ascending wave s. This scenario is valid until a successful attempt to break the minimum of August 1.

GBP / USD

On August 15, the GBP / USD pair gained about 30 base points and continues a sluggish departure from previously reached minimums. At the moment, the fifth wave e is considered to be completed, however, the news background may lead more than once to the complication of the downward trend section until October 31.

Yesterday, the pound received unexpected support from a report on retail sales in the UK, which grew by 3.3% y / y in July. However, the British currency will not always be so. Let me remind you that the country is in a political crisis, as well as in the “Brexit crisis”. Yes, it is now quite possible to say that the entire Brexit process is also experiencing a deep crisis, since 3 years after the referendum, it is not even clear whether Brexit will remain, whether Boris Johnson will remain at the helm of the country, or whether there will be a new transfer of Brexit.

Thus, I do not rule out a new fall of the pound sterling, but I recommend selling it after a successful attempt to break the minimum of the e wave.

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The downward trend section may become even more complicated. Despite the fact that wave e looks complete, it can take an even more complex form. Thus, with the new MACD signal down, I recommend considering selling the pair with targets near the level of 1.1830, which corresponds to 423.6% Fibonacci. It is even better to wait for the breakthrough of the minimum of August 12 – 1.2014.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom