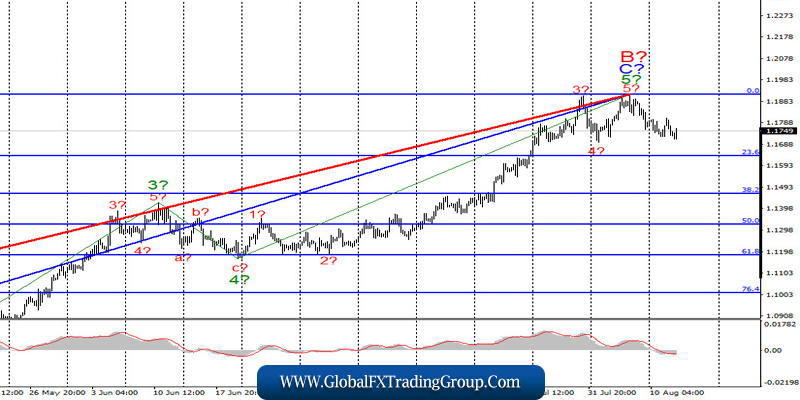

EUR/USD

On August 11, the EUR/USD pair lost only a few basis points and thus continues to build the expected first wave of a new downward trend section. The wave structure of the upward trend looks fully completed, which increases the probability of continuing the decline of the instrument with targets located near the 23.6% and 38.2% Fibonacci levels. Only a successful attempt to break through the 0.0% Fibonacci level will indicate the complication of the upward section of the trend and the resumption of price increases.

Fundamental component:

On Tuesday, August 10, there was little economic news in America and Europe. Nevertheless, the world continues to monitor the political battles in the United States, the spread of the COVID-2019 virus, as well as the election campaigns of two US presidential candidates, Donald Trump and Joe Biden. However, there is not much news on these topics at the moment. Perhaps the most exciting topic remains the coronavirus.

America continues to rank first in the world in the number of cases and in the number of deaths from this virus. Dr. Anthony Fauci, who is the country’s chief medical epidemiologist, has repeatedly said that the virus is out of control, clearly hinting that the US government needs to take active action to contain its further spread. However, the President of the United States Donald Trump has a different opinion. He believes that the increase in cases is only due to an increase in the number of tests conducted in the United States. It is unclear how Trump’s opinion cancels the fact that America has the most cases of the disease in the world.

Nevertheless, Trump believes that this explanation fully justifies the inaction of the US authorities in terms of quarantine. This morning, the euro currency is in demand, despite the fact that the report on industrial production in the EU for June was weaker than market expectations, showing growth of 9.1% mom and -12.3% y/y. In the US session, I am waiting for the US inflation report, which should help return demand for the US currency on August 12.

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of an upward wave C, B. Thus, at this time, I do not recommend new purchases of the instrument, and I recommend closing the old ones. I also recommend starting to look closely at sales with the first goals located near the estimated levels of 1.1634 and 1.1465, which is equal to 23.6% and 38.2% for Fibonacci.

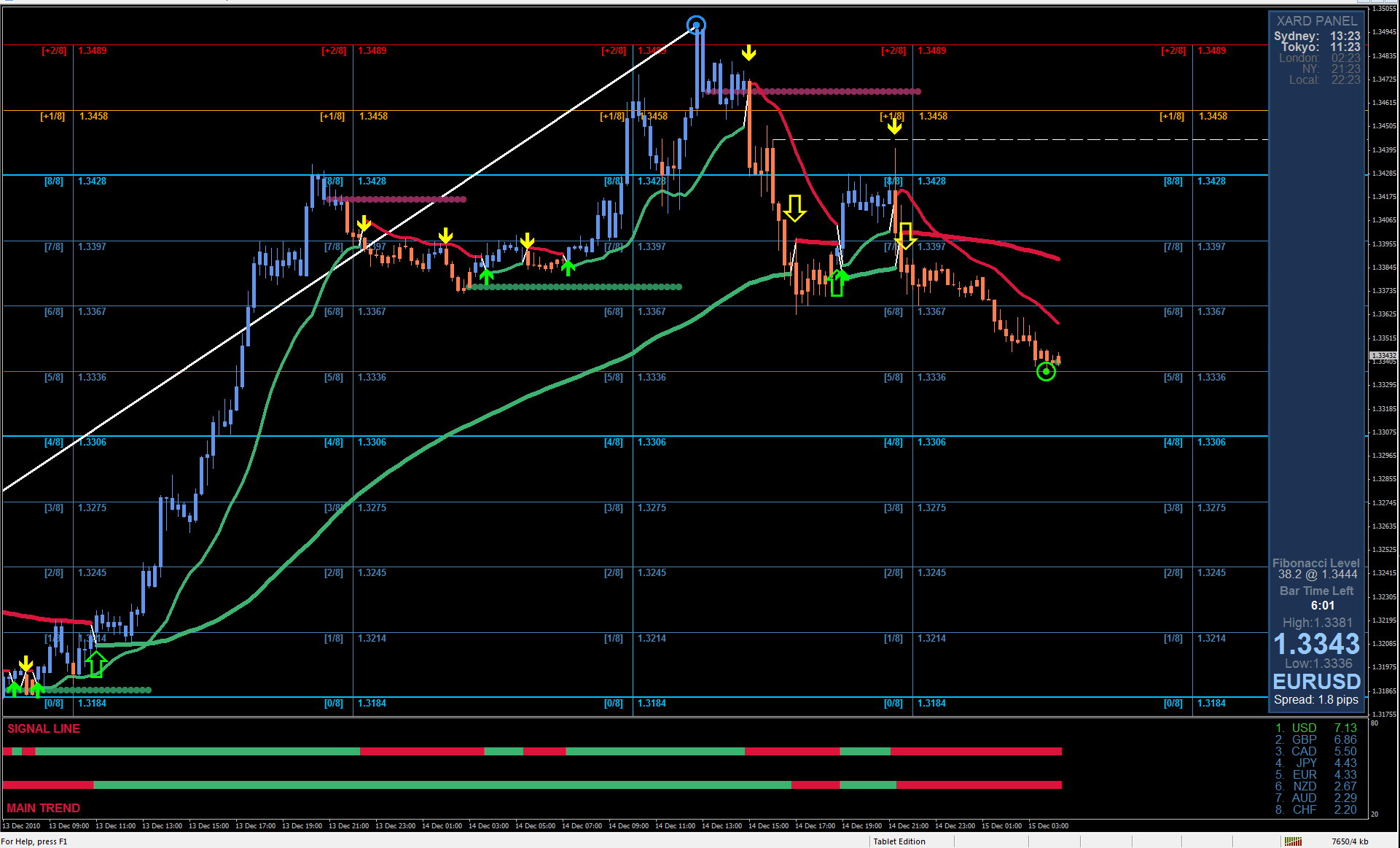

GBP/USD

The GBP/USD pair lost about 20 basis points on August 11 and thus continues to build the expected first wave as part of a new downward trend. If this assumption is correct, then the decline in quotes will continue with targets located near the 23.6% and 38.2% Fibonacci levels. The entire upward section of the trend looks fully equipped. I don’t expect any price increases in the near future.

Fundamental component:

In the UK, unemployment and wage figures were released yesterday. It turned out that in June, unemployment remained unchanged at 3.9%, although market expectations were 4.2%. Average wages in the UK fell by 1.2% in June. Today, it became known that Britain’s GDP fell by 20.4% q/q and 21.7% y/y in the second quarter. Since these values almost coincided with market expectations, the expected reaction in the form of a new fall in the British pound did not happen. Markets are still wary of strong purchases of the US currency, which hinders the implementation of wave markup.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward wave 5 around the 1.3183 mark. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break the 127.2% Fibonacci level and adjust for a possible long-term decline in quotes within the new downward trend with the first goals located around 1.2832 and 1.2719, which is equal to 38.2% and 50.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom