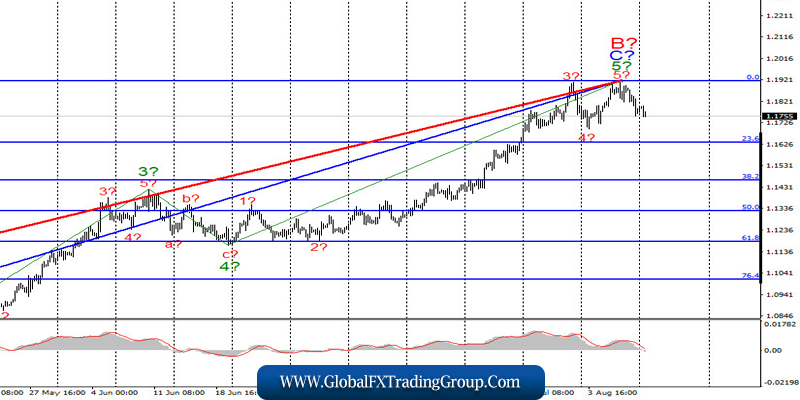

EUR/USD

On August 7, the EUR/USD pair lost about 90 basis points, so there is more and more confidence that the wave 5, 5, C, B is complete. If this assumption is correct, then the decline in quotes will continue within the new downward set of waves with targets located near the Fibonacci levels of 23.6% and 38.2%. The wave structure of the upward trend section looks quite convincing, so there is no reason to assume its complexity. However, the news background can still affect it.

Fundamental component:

On Friday, August 7, all the attention of the markets was focused on the extremely important economic reports from America. However, in addition to this statistical information, there was other very important news. But first things first. There was no news on Friday morning, but in the afternoon it became known that the unemployment rate in America fell to 10.2%, the number of new jobs outside the agricultural sector increased by 1.763 million, and the average wage increased by 0.2%.

All three reports exceeded market expectations. Thus, the increase in demand for the US currency was logical. Then, over the weekend, it became known that the number of children infected with coronavirus in America in recent weeks has increased by 40%. It would seem that this news is so important, if you do not take into account the fact that we are talking about children? In America, several tens of thousands of diseases continue to be recorded every day. However, just a week ago, Donald Trump said in an interview that children “somehow magically have immunity against the virus, so in September we need to open American schools”.

Immediately, Trump once again came under a barrage of criticism, rallies of teachers against the opening of schools began on the streets of many cities, doctors, as usual, criticized the president for words that absolutely do not correspond to the truth, and at the weekend it became known that the number of diseases among children is growing. In addition, Donald Trump somehow managed to sign several executive orders that prescribe financial assistance to all unemployed Americans, tax breaks, as well as resolving issues with overdue housing rentals.

Many experts are now busy trying to understand whether Trump had the legal ability to make such decisions without the participation of Congress. So far, everything suggests that he didn’t.

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of an upward wave C, B. Thus, at this time, I do not recommend new purchases of the instrument, and I recommend closing the old ones. I also recommend starting to look closely at sales with the first goals located near the estimated levels of 1.1634 and 1.1465, which is equal to 23.6% and 38.2% for Fibonacci.

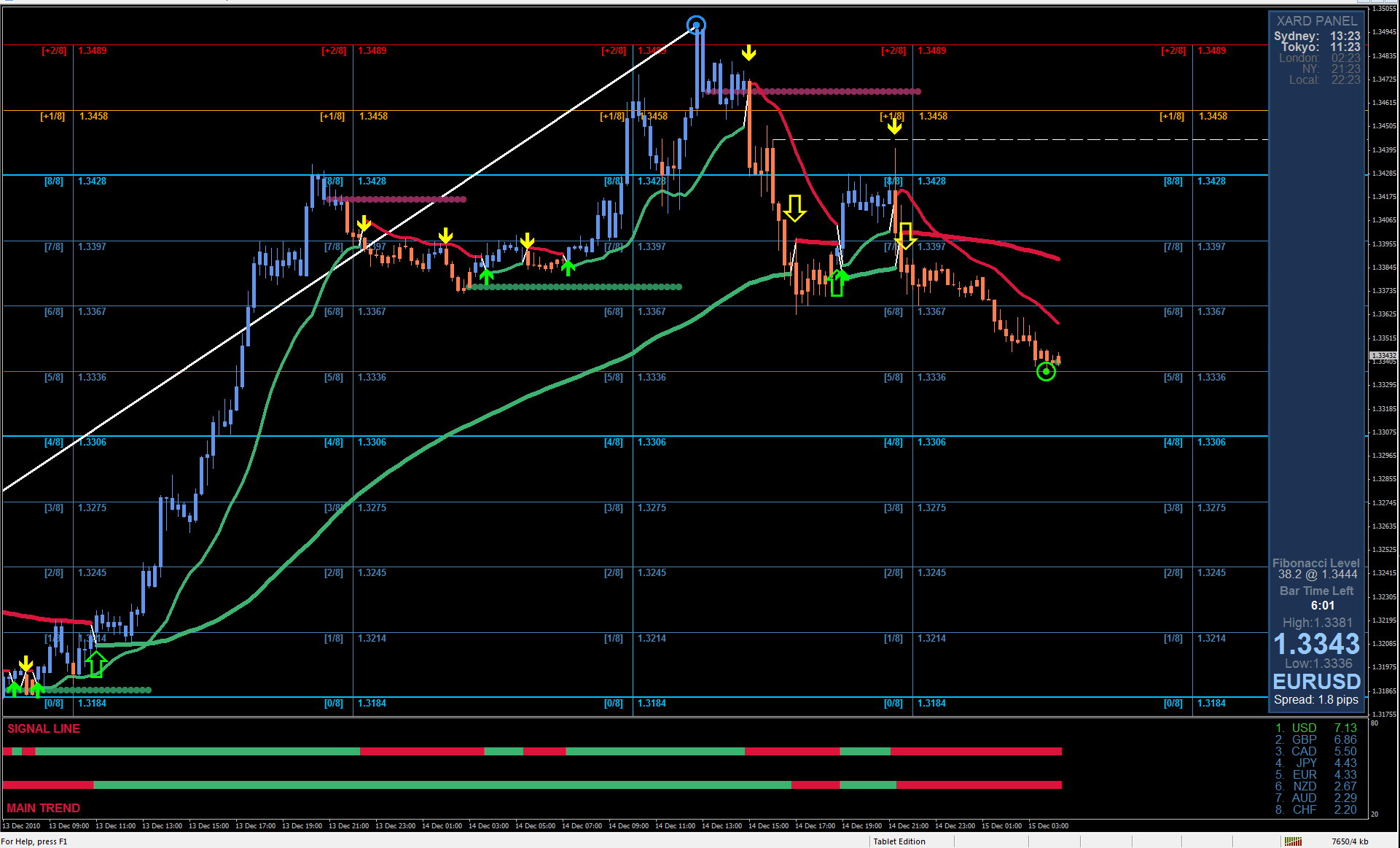

GBP/USD

The GBP/USD pair lost about 95 basis points on August 7 after an unsuccessful attempt to break the Fibonacci level of 127.2%. Thus, the markets have shown their unwillingness to make new purchases of the instrument. Thus, the wave structure of the upward section of the trend looks fully completed, and the fact that the euro/dollar wave pattern also implies the completion of a long ascending set of waves, increases the probability of a fall in the British quotes.

Fundamental component:

Demand for the US currency rose on Friday, and is growing today. However, all this has not yet resulted in a strong increase in the dollar, although the current wave markup predicts this option. On Friday, the news background for the instrument was the same as for the euro/dollar. There was no news from the UK. On Monday, the news background is also absent, and the markets continue to buy the dollar moderately, taking advantage of the opportunity.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward wave 5 around the 1.3183 mark. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break the Fibonacci level of 127.2% and adjust for a possible long-term decline in quotes within the new downward trend section with the first goals located around 1.2832 and 1.2719, which is equal to 38.2% and 50.0% for Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom