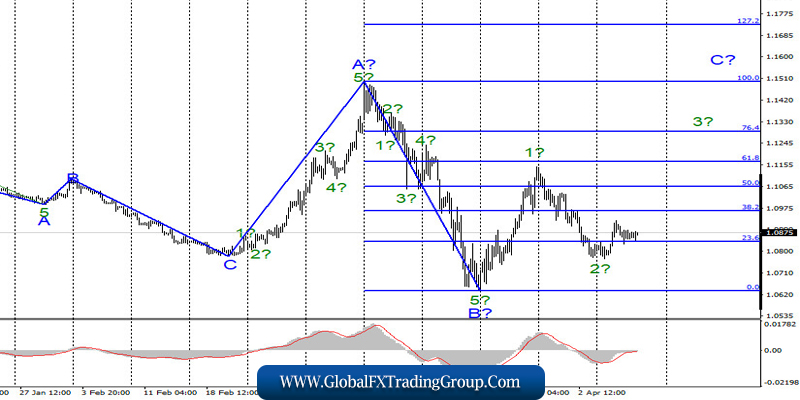

EUR/USD

On April 8, the EUR/USD pair lost about 35 base points but remained within the framework of the predicted wave 3 in C of the new uptrend which was formed on March 20. If scenario is right, then the quotes may continue to rise above the level of 11. At the same time, a breakthrough of a low in the wave 2 will signal that the markets are not ready for the quotes to grow further. The whole wave pattern in this case will require a correction and additions.

Fundamental factors:

On Wednesday, the news background for the EUR/USD pair was rather strong. The only important event of the day – the minutes of two latest emergency Fed meetings – came out late in the evening. However, this did not cause any significant movement as can be seen from the euro/dollar chart. Nevertheless, the minutes contained important information. In early March, Fed leaders saw a big threat to the US economy due to the impact of the Covid-19 pandemic.

That is why the Fed lowered the key rate to near zero. Fed officials note that forecasts for the US economy have deteriorated sharply in recent weeks and are now hard to define. Besides, the Fed cannot say for sure when the country’s economy will begin to recover and what other measures should be taken. “The timing of the resumption of growth in the US economy will depend on measures taken to curb the spread of the virus,” the minutes said. In addition to a deep rate cut, the Fed decided to expand its assets purchases.

Thus, the Fed has done everything it could. Further stimulation of the economy will be carried out only through the QE program which is not limited in these circumstances. Economic reports issued in April (for the previous month) will show whether the measures taken have been effective and how deep the economic downturn is.

General outlook and recommendations:

The euro/dollar pair is likely to continue formation of the upward wave C and the beginning of internal wave 3. Therefore, it is recommended to open long deals on the pair with the targets at 1.1165 and 1.1295 which correspond to 61.8% and 76.4% according to Fibonacci. The uptrend signal MACD has already been received. I recommend placing Stop Loss orders under the low of wave 2.

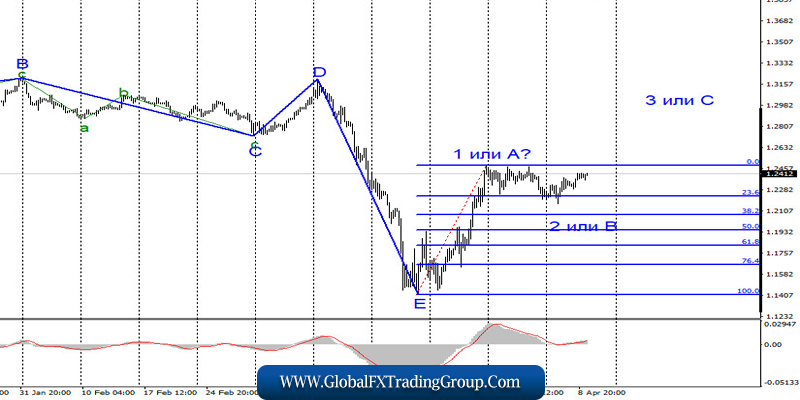

GBP/USD

On April 8, the GBP/USD pair gained about 40 base points. So the wave 2 or B may have been already completed. Otherwise, it may take a horizontal shape. In any case, the price is unlikely to form the wave 3 or C unless it breaks through the high of wave 1 or A. The wave pattern of the pair is now completely uncertain and may require adjustments and additions.

Fundamental factors:

There was no important news for the GBP/USD pair on April 8. On April 9, the UK released several reports that could have caused some reaction in the markets. For the pound, however, there was no positive news. The GDP decreased by 0.1% in February compared to January while industrial production slowed by 2.8% year-on-year and increased by only 0.1% on a monthly basis.

Such results could not support the British currency. The pound is probably rising on the data from the US where markets expect another pessimistic report on initial jobless for the third week in a row. Today, this report can show more than 5 million jobless claims. Accordingly, the unemployment rate will increase significantly with all the consequences to follow. At the moment, the US economy has come to a standstill.

General outlook and recommendations:

The pound/dollar pair is likely to complete the formation of the first upward wave. Thus, now I recommend selling the pound with the view of the wave 2 or B being formed with the targets at 1.2072 and 1.1944 which correspond to 38.2% and 50.0% Fibonacci. For this, the pair will need to break through the 23.6% Fibonacci level. An alternative scenario will be to wait until the wave 2 or B is formed and enter the market with long deals when the wave 3 or C starts forming.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom