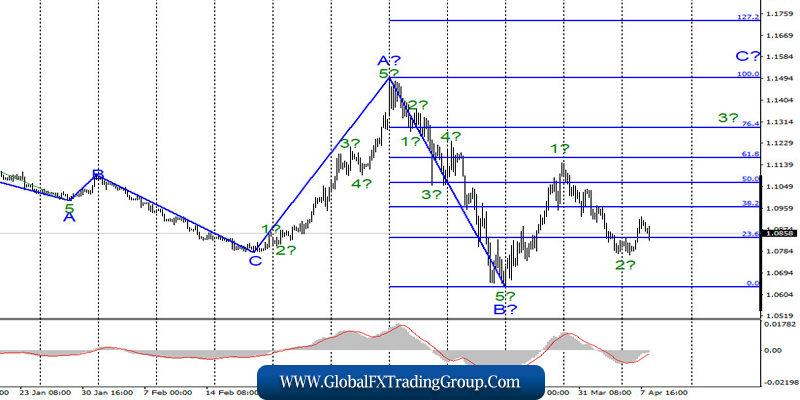

EUR / USD

On April 7, the EUR / USD pair gained about 100 basis points and thus began, presumably, building an upward wave 3 in C. If this is true, then the increase in the instrument will resume with targets above the 11th figure after a small departure of quotes from the reached highs. On the other hand, the alleged wave 2 in C took on a pronounced three-wave form, which corresponds to its status of the correctional wave. In this regard, wave 3 in C can be very long.

Fundamental component:

On Tuesday, the news background for the EUR / USD instrument continues to concern the COVID-2019 and its spread in the European Union and the United States. The news is still controversial. Nevertheless, there has been a slight decline in the growth in the number of diseases in Germany, Italy, and France, as well as fatalities, but in Spain and the UK, high growth rates remain.

In America, the situation is also very difficult. It is the United States that leads among all countries in the world in the number of people infected with the coronavirus. To date, 400,000 cases. Thus, the US economy continues to “stand still”, and various experts in the field of economics continue to terrify their forecasts.

For example, many economists believe that the contraction in the US economy caused by the coronavirus epidemic will be comparable to the depression of the 1930s. Then industrial production fell by 25-30%. Now, despite all the economic assistance packages approved by the US government, the main indicators continue to decline, especially in the labor market. But in Europe, the situation is also not good.

The European Council is going to invest about 500 billion euros in the EU economy to smooth out the consequences of the epidemic. Thus, the general news background does not increase demand for either the dollar or the euro. At the same time, minutes of the FOMC meeting will be released tonight. In this document, the markets will be able to see a broader view of the Fed members on the current situation, as well as to learn further plans of the US Central Bank.

General conclusions and recommendations:

The euro-dollar pair supposedly continues to build the rising wave C and began its internal wave 3. Thus, now, I recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci, since the MACD signal “up” was already. I recommend placing Stop Loss protective orders under the low of wave 2.

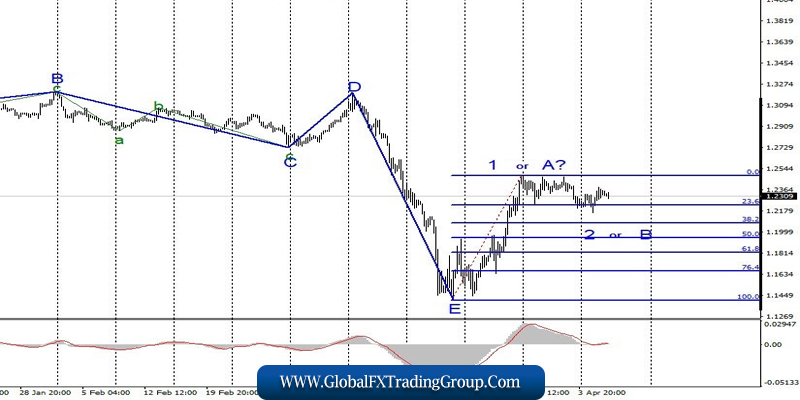

GBP / USD

On April 7, the GBP / USD pair gained about 110 basis points, so wave 2 or B will either be very shortened, or all wave markings will require certain corrections and additions. Two unsuccessful attempts to break through the level indicate that the markets are not ready now for new purchases of American currency. A successful attempt to break through the maximum of wave 1 or A will indicate a willingness to further increase quotes.

Fundamental component:

The news background for the GBP / USD pair on April 7 was also empty. The only thing that worried the markets was the condition of Boris Johnson, who continues to be in the intensive care unit. However, the condition of the Prime Minister is now assessed as stable. In the UK, there will be no news of the economic plan again today.

But tomorrow, markets will be able to study data on GDP, industrial production. What is more important will be information on applications for unemployment benefits in the United States. Thus, tomorrow will be crucial for EUR / USD and GBP / USD.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the first rising wave. Thus, now, I recommend selling the pound with the expectation of building wave 2 or B with targets located near the calculated levels of 1.2072 and 1.1944, which corresponds to 38.2% and 50.0% Fibonacci. Two attempts to break through the 23.6% Fibonacci level were unsuccessful, so you need to wait for the third or wait for the completion of building wave 2 or B and enter the market with purchases at the beginning of building wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom