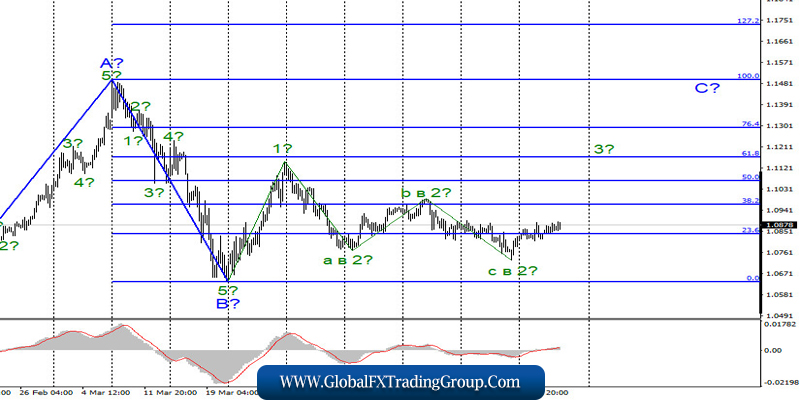

EUR / USD

The EUR / USD pair gained about 50 basis points yesterday and, thus, continues to build a prospective wave 3 in C. If the current wave marking is correct, then the increase in quotes of the instrument will continue with targets located near 11 of the figure. However, with a successful attempt to break through the minimum of the expected wave c in 2, the entire wave picture will become more complicated and corrections and additions will be required.

Fundamental component:

The news background for the EUR / USD pair on Wednesday was quite strong. As markets expected, the US GDP report for the first quarter showed an almost 5% decline in the US economy. Thus, the decline in demand for the greenback during the day was logical. At the same time, I would like to note that, in the literal sense of the word, the greenback did not fall. This is in favor of the fact that markets did not expect better statistics on GDP from the eurozone. However, we can say that they were mistaken. Today it became clear that the eurozone GDP in the first quarter lost only 3.8% QoQ and 3.3% YoY.

In any case, this is a multi-billion dollar reduction that will have to be restored within a minimum of a year. However, it is not as serious as in America. Thus, against the background of this information, demand for the euro is growing today, and the greenback continues to decline. In addition to this, the unemployment data for March was released today, which unexpectedly turned out to be better than market expectations and amounted to 7.4%, which is only 0.1% more than a month earlier in February.

The inflation data also came out today and they also turned out to be much better than what was expected. The main inflation indicator showed a slowdown of only 0.1% to 0.9% YoY. This is certainly a low value but could be much worse. In addition to all the information that has already been released, a meeting of the European Central Bank is scheduled for today, after which a press conference will be held. In general, the information will be enough in the afternoon.

There will also be interesting information from the US in the form of a report on applications for unemployment benefits. If it shows an increase in the attendance of several million unemployed, this could further reduce the demand for the dollar.

General conclusions and recommendations:

The EUR/USD pair has presumably begun to build the rising wave 3 in C. Thus, now I recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I recommend placing Stop Loss protective orders below the wave minimum at 2.

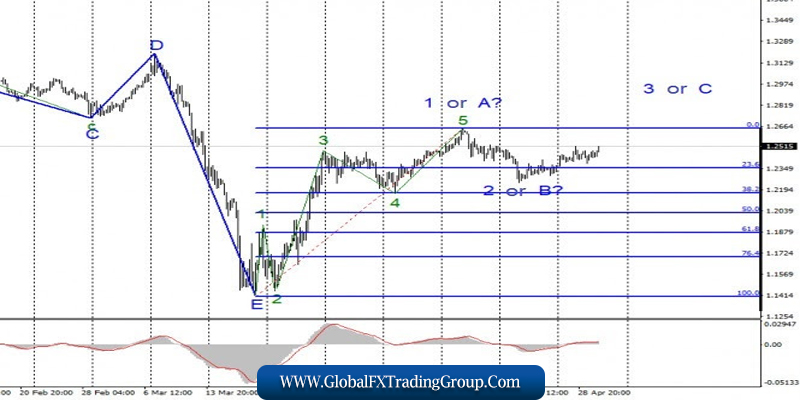

GBP / USD

On April 29, the GBP / USD pair gained 45 base points, thus continuing to build the rising wave, which may be wave 3 or C or a correction wave of 2 or B, after which the quotes of the instrument will resume declining with targets located near 22 figures. This is the main issue of the current wave counting. Successful attempt to break the maximum wave 1 or A indicates the willingness of markets to buy the pound as part of the construction which is wave 3 or C.

Fundamental component:

The news background for the GBP / USD pair on April 29 was quite strong thanks to the events in the US. However, to some extent, the Fed meeting disappointed the markets as the organization did not give any signals about future actions.

On the contrary, Jerome Powell noted that rates will continue to remain at levels close to zero for a long time until the US economy begins to show stable growth, which in the near future, of course, is not expected due to the pandemic. Powell also said that the extent of the economic downturn is unknown in the exact same way as its duration since there is still no cure for the COVID-19 virus.

General conclusions and recommendations:

The GBP / USD tool supposedly completed the construction of the first wave of a new upward trend section. Thus, now I recommend selling the pound with targets located around 22 and 21 figures, based on the construction of correction wave 2 or B using the new MACD signal down, or waiting for the completion of this wave, and then buying the instrument at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom