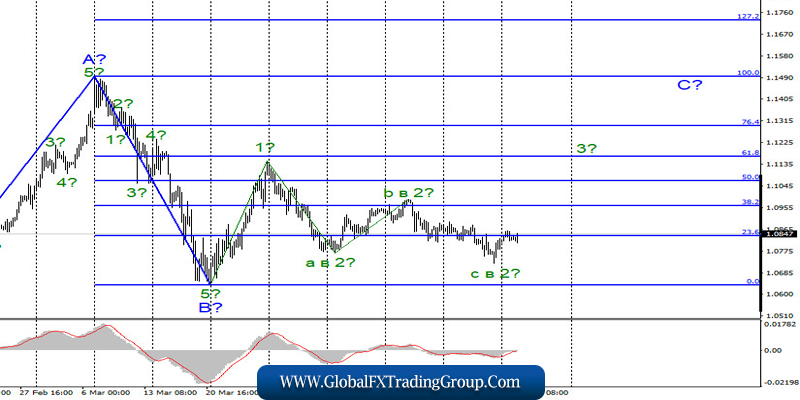

EUR / USD

On April 27, the EUR/USD pair gained about 10 basis points. Thus, it managed to move away from the previously reached lows and, presumably, complete the construction of wave C and 2. If this is true, then the growth of quotes will continue from current levels in the direction 11th figure, near which the minimum targets of wave C are located. At the same time, a new update of local minimum will lead to the need to revise the entire wave marking of the instrument.

Fundamental component:

There was practically no news background for the EUR/USD pair on Monday. There was no news or economic reports that day in either the United States or Europe. Thus, the markets conducted fairly calm trade, and there were no sharp movements. However, a rather large number of important statistics, as well as extremely important events, are planned for this week. Of course, first of all, these are meetings of the ECB and the Fed. However, the data on GDP in the eurozone and the United States will also be very interesting.

Despite the fact that the pandemic continues to spread, the US president sees an improvement in the situation and plans to open the country’s economic borders in May. It appears that as an experiment in Texas, quarantine will be lifted on May 1, as reported by state governor Greg Abbott. According to the governor of Texas, quarantine measures have reduced the number of diseases and have done their job. Now, it’s time to think about restoring business and normal life.

Starting May 1, home quarantine will end for all residents, and this, for a minute, is 29 million people. Moreover, cinemas and shopping centers will open on the said date, which will operate with certain restrictions. Libraries and museums will also open. Therefore, the whole world will be watching Texas to see what quarantine measures can do during an outstanding pandemic.

European countries, on the other hand, are also thinking about partial relaxation of quarantine measures, but so far they are not talking about lifting home self-isolation and opening shopping centers.

General conclusions and recommendations:

The euro-dollar pair has presumably begun to build the rising wave C. Thus, I now recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I also recommend placing Stop Loss protective orders below the wave minimum at 2.

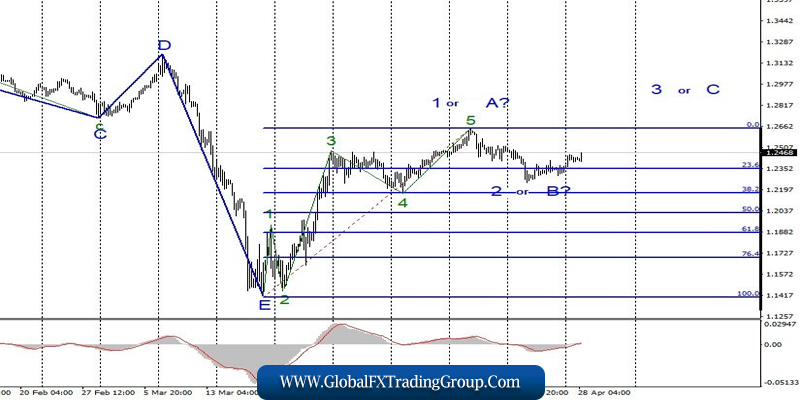

GBP / USD

On April 27, the GBP/USD pair gained about 60 basis points. However, it remains unclear whether the construction of the proposed wave 2 or B is completed or whether it will take a three-wave form. In the first case, the quote of the instrument will resume decline while in the second one, the increase will continue. It is believed that wave 2 or B will take a three-wave form, because wave 1 or A has taken a clearly expressed five-wave. Thus, the decline in quote may resume with targets located around 21 and 20 figures this week.

Fundamental component:

There was also no news background for the GBP / USD pair on April 27. Today, there will be one retail report from CBI in the UK, which may show a 40% reduction in volume in April. However, this is not news to anyone right now. Economic indicators are falling in all countries of the world and have no special effect on exchange rates.

Thus, we need to wait for more important news and reports from the United States, since there will be practically no news in the UK this week, which may affect the demand for the dollar or pound sterling.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals located around 22 and 21 figures, based on the construction of correction wave 2 or B using the new MACD signal down, or waiting for the completion of this wave, so that buying at the beginning of upward wave 3 or C can be considered later.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom