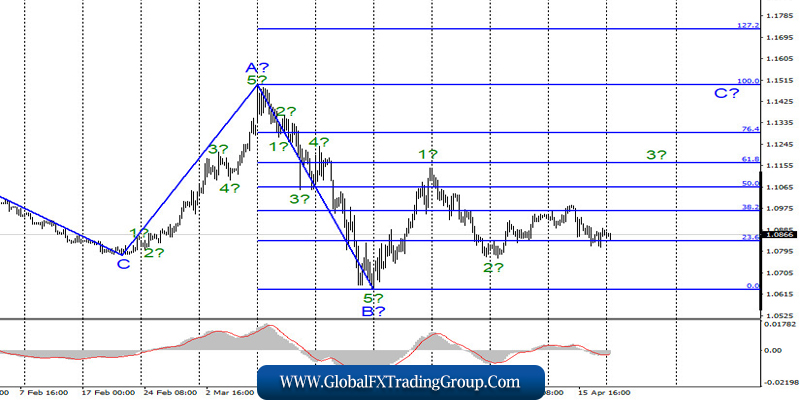

EUR / USD

On April 17, the EUR/USD pair gained about 35 basis points and made an unsuccessful attempt to break through the 23.6% Fibonacci level. Thus, increasing the quotes of this instrument may be resumed in the near future within the framework of the proposed third wave in the composition C. Even if the current wave marking requires corrections and additions and is transformed into a more complex one, the third wave of the upward trend section, originating on March 23, must be completed. That is, the markets are entitled to expect an increase in the area of the 11th figure.

Fundamental component:

There is still little positive news in the currency market. The topic of the pandemic remains the most interesting to all. There has been a decline in the growth rate of new infections and casualties In America, Italy, Spain and some other countries of the world which is pleasing. At the same time, not a single country in the world has managed to completely overcome the pandemic, come up with a cure or a vaccine.

For a while, China was considered such a country, however, according to global opinion, Beijing openly hides the facts and underestimates the real numbers of infection and deaths. Thus, the first signs of the pandemic’s retreat in Europe and the USA can be noted, which gives hope for economic recovery in the second half of 2020. However, the issue of the second wave is now extremely important. If quarantine measures are weakened in these countries, then the epidemic may begin to grow again.

As regards to this, the vaccine is still needed by the world, and it is too early to establish a pandemic retreat. On Friday, the European Union released a report on inflation for March, which showed its deceleration to 0.7% y / y. However, the markets did not attach much importance to these figures. In general, trades are held in a very calm direction in recent days. Thus, I believe that neither the US dollar nor the Euro can now count on additional market demand.

I now see the most logical increase in instrument quotes in accordance with wave marking. In general, in recent days, trades are held in a very calm direction. Thus, I believe that neither the US dollar nor the Euro can now count on additional market demand. It appears that the most logical way to increase the quotes of the instrument in accordance with the wave markup is now.

General conclusions and recommendations:

The euro/dollar pair continues to build the estimated upward wave 3 in C. Therefore, I recommend waiting for the MACD signal up and buying an instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I recommend placing Stop Loss protective orders below wave 2 minimum.

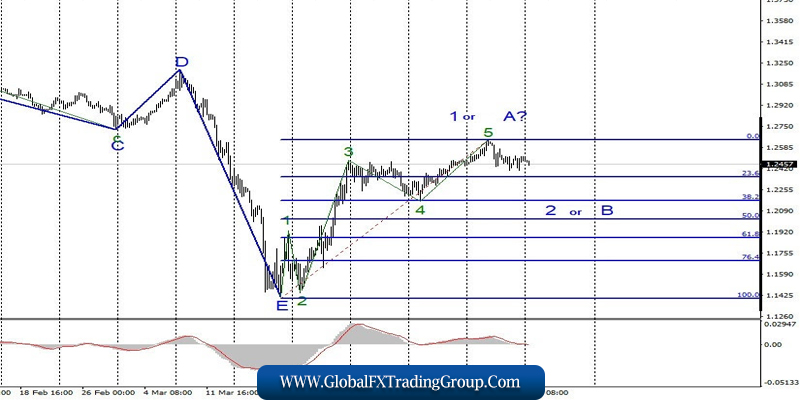

GBP / USD

On April 16, the GBP/USD pair gained about 45 basis points, however, it remained within the framework of building wave 2 or B, which implies a further decrease in quotes of the instrument with targets located near the 38.2% and 50.0% Fibonacci levels. After completion of this wave I anticipate the resumption of increasing the quotes of this instrument within wave 3 or C. On the other hand, wave 2 or B can take a pronounced three-wave form.

Fundamental component:

There was no news background for the GBP/USD pair on April 17. The United Kingdom is not one of the countries in which there is a slowdown in the spread of coronavirus. According to medical experts, it is Britain that could become the center of a pandemic in Europe in the near future. If this is true, then the British economy could suffer even more than originally allowed.

And together with Brexit, which remains on the agenda, the economy of Britain can shrink significantly more than any other country in the world. On Monday, no economic reports are planned in Britain, the European Union or the United States. There will be no news background today, so the amplitude of movement of both instruments may be low.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals located around the 22nd and 21st figures per building correctional wave or wait for the completion of this wave, then buy at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom