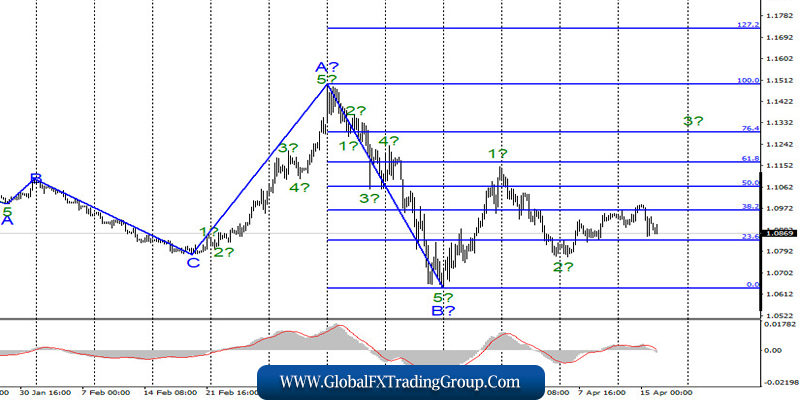

EUR / USD

On April 15, the EUR/USD pair lost about 70 basis points and thus considerably complicates the internal wave structure assumed by wave 3 in C. If the current wave marking is correct, then the increase in quotes of the instrument will resume with targets above the 11th figure. On the contrary, the departure of quotes below the minimum of wave 2 in C will indicate that the instrument is not ready to build the rising wave and will require adjustments and additions to the current markup.

Fundamental component:

The news background for the EUR/USD instrument on Wednesday was interesting. Two economic reports were immediately released in America, the first of which showed a decrease in retail sales by almost 9%, and the second showed a decrease in industrial production by 5.4%. Thus, if the markets paid attention to these reports, then the demand for the US currency should have decreased during the past day.

However, instead of this, markets just began to actively buy the dollar yesterday, which suggests the ignoring of all statistics at this time. Consequently, today’s report on applications for unemployment benefits in America may also have no effect on the movement of the instrument. Although the expectations of the market are lowered again to more than five million new applications.

In addition, the IMF forecast for the global economy yesterday particularly for the US, was published. According to this report, the global economic contraction will be much stronger than in 2008-2009, and the general crisis may be comparable to the Great Depression in the 30s of the last century. The number of people infected in America began to increase again.

Therefore, it is still early to say that the “peak” in the USA has passed. In Europe, the situation is also no better. During a few days of respite, many experts announced the alleged passage of the “peak” of the pandemic, but the death rate rose again in Italy yesterday.

General conclusions and recommendations:

The euro/dollar pair continues to build the estimated 3 upward wave 3 in C. Thus, I now recommend to wait for the MACD signal up and buy an instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. Also, I recommend placing Stop Loss protective orders below wave 2 minimum.

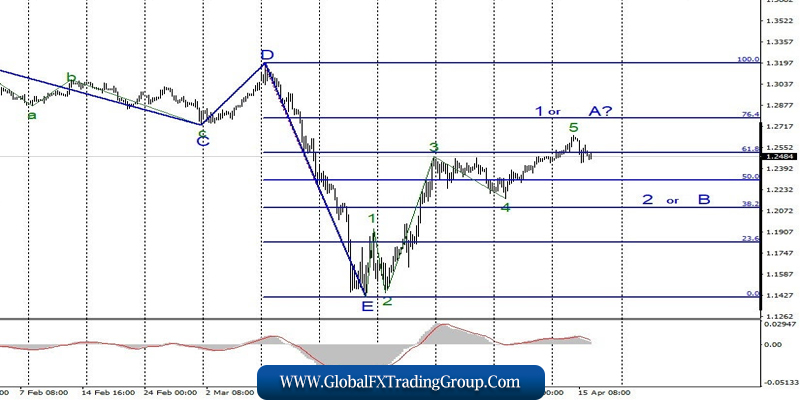

GBP / USD

On April 15, the GBP/USD pair lost about 110 basis points, losing all that was gained the day before. Thus, the alleged wave 1 or A completed its construction. If this is correct, then the decline in quotes will continue as part of the construction of wave 2 or B of the upward trend section with targets located near the levels of 50.0% and 38.2% Fibonacci. WWave 1 or A took a pronounced five-waveform.

Fundamental component:

The news background for the GBP/USD pair on April 15 was similar. The US currency began to sharply increase, despite the fact that the news background from the USA was weak. Today, quotes continue to decline, and there will be a report on applications for unemployment benefits in the United States in the afternoon, which has shown almost 17 million requests in the last three weeks.

Thus, the demand for the dollar today may decline, but looking at yesterday’s picture, this conclusion is no longer so obvious. There is no news at all in the UK. Recent estimates indicate that the country’s economy may lose about 35% in the second quarter of 2020. However, the situation in America is no better; therefore, it cannot be concluded that the dollar is growing because of this.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals located about 21st figures in the calculation of the construction of the correctional wave, or wait for the completion of this wave, so that is why it is suggested to buy at the beginning of the rising wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom