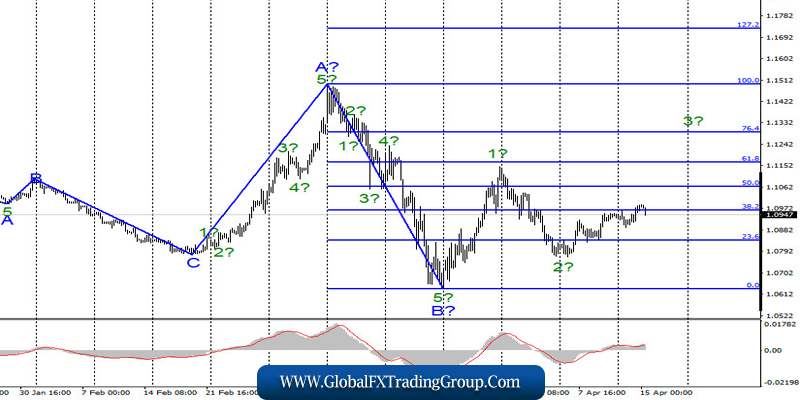

EUR/USD

On April 14, the EUR/USD pair gained about 70 basis points, but today, it already managed to lose about 50 at the morning trading. Thus, the alleged wave 3 in future C continues to be formed, but can take a very long and complicated form. The minimum of the expected wave 2 in C is a support for the upward trend section. A successful attempt to break this level will lead to the need to make adjustments and additions to the current wave marking.

Fundamental component:

The news background for the EUR/USD instrument was contradictory yesterday. As always, a lot of news came from the White House, personally from Donald Trump. According to his latest comments, the American economy cannot afford to be without work for a long time. Despite the coronavirus pandemic, Trump is going to resume the work of most enterprises and companies in May, otherwise, the country may face irreversible consequences.

In particular, it is noted that a second mortgage crisis may begin, as the US banking system is already preparing for a huge number of defaults on loans, mortgages and simply bankruptcies. Accordingly, the banks will also not be able to pay their bills, which will cause a new wave of non-payments and bankruptcies. So, if the COVID-2019 epidemic started to recede in some countries, then its consequences will continue to affect the economy for a long time. But it is difficult to judge how right Donald Trump is, intending to lift the economic blockade.

On one side of the scale, the health and life of Americans, and on the other, the country’s economy, its future. By the way, the probability of a mortgage crisis is not a purely American threat. In principle, the same thing is expected in the European economy. The longer the epidemic is not contained, the more serious the economic consequences will be. In this situation, it is absolutely impossible to say that the dollar or the euro currency is now more attractive for investment, due to the fact that both the EU and the US will experience big problems with their economies.

General conclusions and recommendations:

The euro/dollar pair continues to build the rising wave 3 in C. Thus, I now recommend continuing to buy the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I recommend placing Stop Loss protective orders below wave 2 minimum.

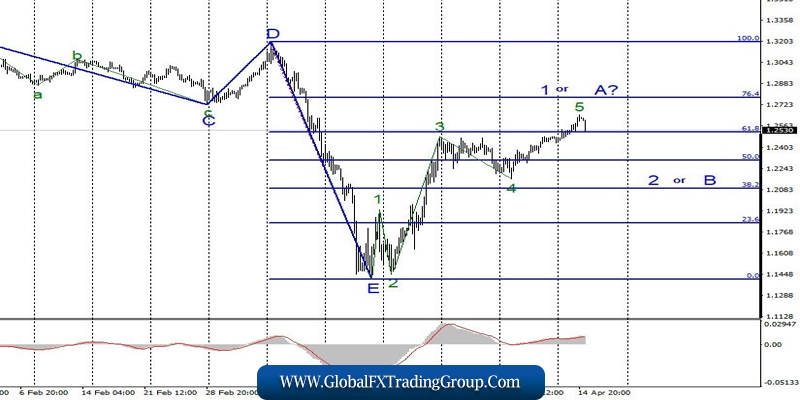

GBP/USD

On April 14, the GBP/USD pair gained about 120 basis points, but this morning, it has lost almost the same amount as the euro. However, in the case of the pound, the alleged wave 1 or A may be completed. Thus, the instrument could already proceed to the construction of wave 2 or B with targets located close to the 21th figure. As a result, the decrease in the quotes of the instrument corresponds to the wave markup. A successful attempt to break through the 61.8% Fibonacci level will indicate the willingness of the markets to further decline.

Fundamental component:

The news background for the GBP / USD pair was similar to yesterday. The British currency was in demand from the markets, but it fell sharply this morning. The prospects of the pound, like the dollar, are now extremely difficult to say. The markets have just recovered from the shock state in which they were one and a half months. Thus, we can say that the recovery process is ongoing.

In the UK, the epidemic continues to rage. There are no reports of a possible peak of the disease. On the other hand, Boris Johnson was discharged from the hospital, but he will not be able to rule the country for about a month. As a result, the negotiations with the European Union under the terms of Brexit are paused.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals that are about 21th figures in the calculation of the construction of the correctional wave, or wait for the completion of this wave, so that buying can be considered at the beginning of the upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom