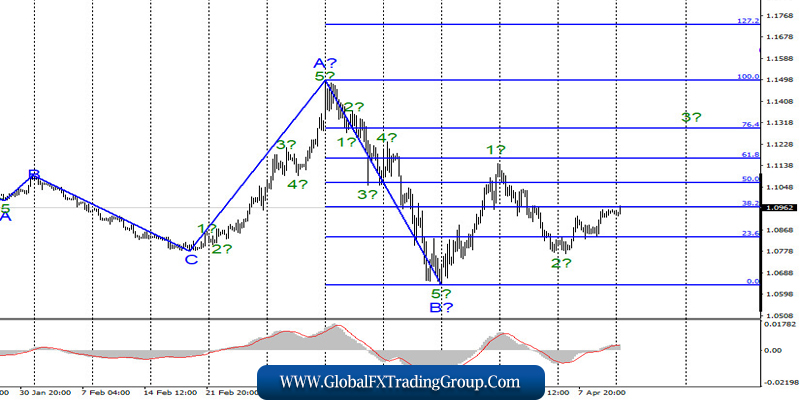

EUR / USD

On April 10, the EUR/USD pair literally gained several basis points and thus, continued to build the expected wave 3 in C of a new upward trend section. On Monday morning, market activity increased and the instrument added another 25 basis points despite the celebration of Catholic Easter. A successful attempt to break through the 38.2% Fibonacci level will show the readiness of the markets for further purchases of the Euro currency. Meanwhile, the current wave markup implies an increase to 11-15th figures.

Fundamental component:

On Friday, the news background for the EUR / USD instrument was quite absent and only one report deserved the attention of the markets. This is the inflation report for America in the first month of the epidemic. It was not surprising that the consumer price index declined. The main indicator of inflation declined immediately to 1.5% y / y, and the baseline – to 2.1% y / y. However, inflation is far from the most important indicator in the current environment. But much more important news are labor market indicators, unemployment rates and GDP.

Now, inflation is not an issue for any Central Bank and all stimulus packages approved by the US government and the Fed are aimed primarily at stimulating business. After all, the Fed understands perfectly well that the more business leaves the market due to quarantine and epidemic, the more people will lose their jobs. They will need to pay unemployment benefits, and they will not bring any benefit to the economy. Thus, the work is now mainly focused on maintaining the business.

The currency market reacts poorly to everything that happens. It is not often that a particular instrument is traded without the influence of fundamental factors. However, this seems to be the case now. Otherwise, how can we explain, for example, the current increase in the European currency? Or the preceding increase in the US dollar?

General conclusions and recommendations:

The euro/dollar pair continues to build the rising wave C and began its internal wave 3. Thus, it is now recommended to continue to buy the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci, especially in the case of a successful attempt to break down the level of 1.0963. At the same time, it is suggested placing Stop Loss protective orders below wave 2 minimum.

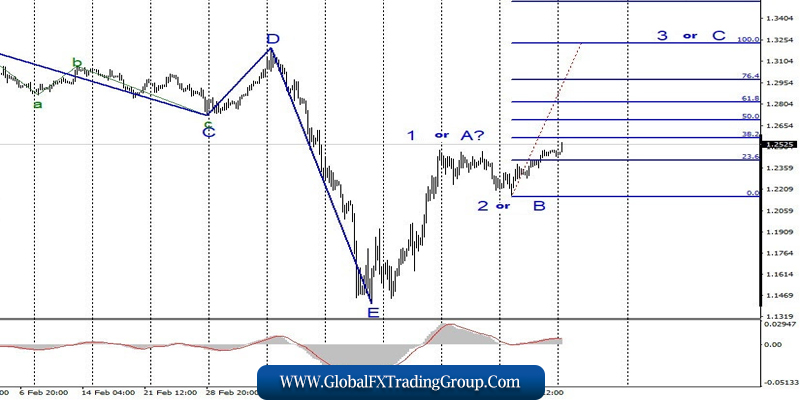

GBP / USD

On April 10, the GBP/USD pair lost several basis points, however it also began to increase this morning. Thus, the maximum wave 1 or A was successfully broken through, which suggests the conclusion that a very shortened corrective wave 2 or B. If this is true, then the increase in quotes will continue with targets located about 32 figures, based on the possible equality of waves 1 and 3.

Fundamental component:

The news background for the GBP / USD pair on April 10 was completely absent. There are no interesting events and news in the UK right now. The only thing that deserves attention is the recovery of Boris Johnson from the COVID-2019. There were no economic reports on Friday. Moreover, not a single report is planned for the whole of the current week in Britain. Thus, the markets will be able to pay attention to only 2-3 reports from the USA in 5 trading days, including reports on industrial production and retail sales.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first and second waves. Thus, it is now recommended to buy the pound with the expectation of building a wave of 3 or C with targets located near the calculated levels of 1.2974 and 1.3234, which corresponds to 76.4% and 100.0% Fibonacci. At the same time, it is suggested placing Stop Loss protective orders below wave 2 or B.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom