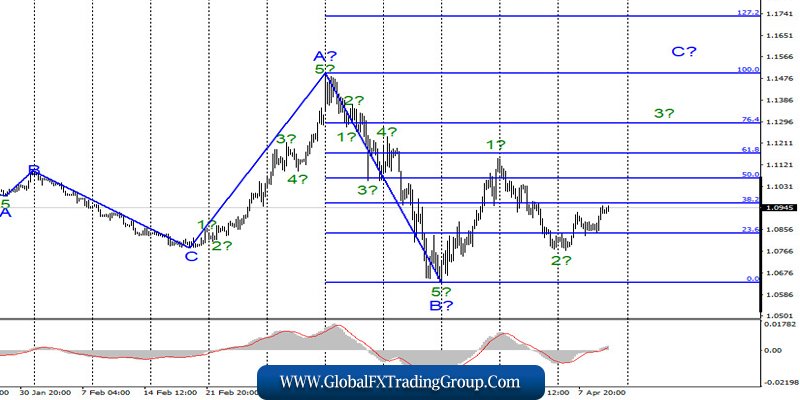

EUR / USD

On April 9, the EUR/USD pair gained about 70 baise points, and thus continued to build the alleged wave 3 in C of a new upward trend section, starting on March 20. If the current wave marking is correct, then the increase in quotes of the instrument will continue with targets above the 11th figure. Wave 3 in C, like all C, can turn out to be very long.

Fundamental component:

On Thursday, the news background for the EUR / USD instrument was noticeable again. Perhaps the most important messages were from the Fed and the Eurogroup. Each of the organizations decided on additional measures to support the economy. Firstly, by 2.3 trillion dollars and secondly by 0.5 trillion euros.

The US dollar will be directed to cheap lending to small and medium-sized businesses, as well as to help households. Fed’s President, Jerome Powell, said his organization will continue to act aggressively in response to the COVID-2019 virus epidemic and is ready to continue to provide financial assistance until the situation improves. It is also understood that multi-trillion measures should allow Americans to keep their jobs to support the economy.

However, according to reports on applications for unemployment benefits, these measures of the Fed and Congress are not very effective. In total, about 17 million Americans have become unemployed over the past three weeks. In Europe, they also agreed on a package of assistance to business, citizens and the most affected countries from the epidemic. The money will also be directed to cheap lending.

Today, markets will have to find out how much inflation has changed in March, when the pandemic reached America. If the report is weak, the demand for US currency may decrease even more. In any case, the current wave marking implies a continued increase in quotes.

General conclusions and recommendations:

The euro/dollar pair supposedly continues to build the rising wave C and began its internal wave 3. Thus, I now recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci, since the MACD signal “up” has already announced the completion of the construction of the alleged wave 2. I recommend placing a protective Stop Loss order below the low of wave 2.

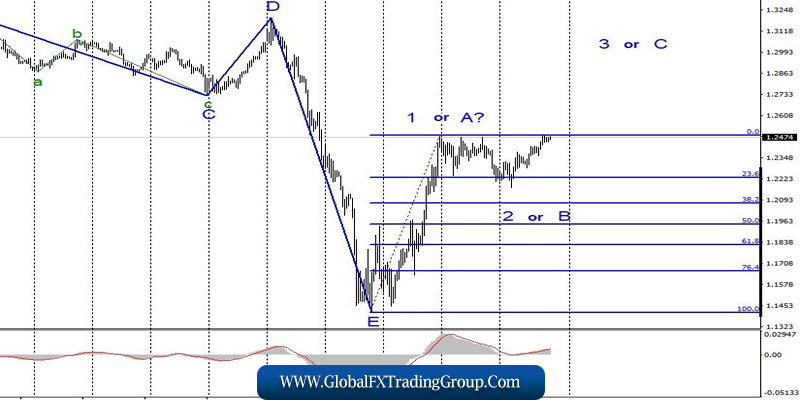

GBP / USD

On April 9, the GBP/USD pair gained about 80 basis points, so wave 2 or B can either be completed or take on a very complex horizontal look. In any case, before a successful attempt to break through the maximum of wave 1 or A, you should not expect a further increase in the quotes of the pair. The wave pattern of the instrument is now completely ambiguous and may require adjustments and additions.

Fundamental component:

There was almost no news background for the GBP / USD pair on April 9. Now, there are no new interesting events in the UK. The whole life seems to be put on pause. Today, Good Friday is celebrated throughout Europe, so there are no events at all.

The British pound is in demand from the markets, but it is unlikely that this will continue for long, although the wave marking suggests the continuation of formation of a new upward part of the trend. On the other hand, Prime Minister Boris Johnson, who was infected with a coronavirus, was transferred to a regular ward, however, according to doctors, he will not be able to start performing his duties until a month later.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first rising wave. Thus, I now recommend selling the pound in the calculation of building wave 2 or B with targets located near the calculated levels of 1.2072 and 1.1944, which corresponds to 38.2% and 50.0% Fibonacci, but this requires a successful attempt to break through the 23.6% Fibonacci level.

An alternative is to wait for the completion of the construction of wave 2 or B and enter the market with purchases at the beginning of the construction of wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom