EUR / USD

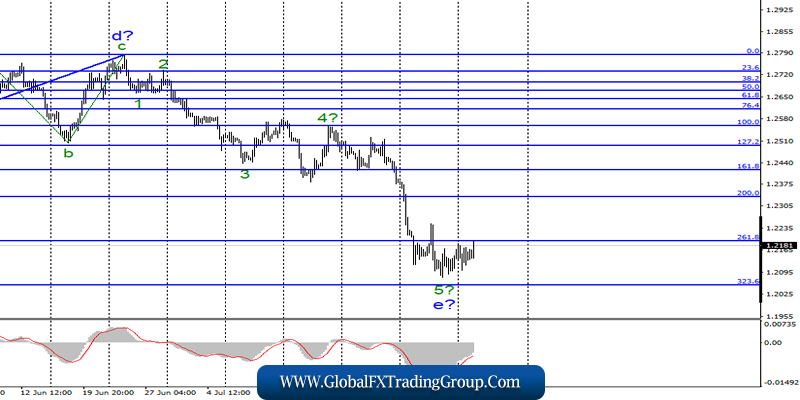

On Monday, August 5, the EUR/USD pair ended with an increase of 95 basis points. Such unexpected strong growth of the European currency gave reason to assume the completion of the construction of the bearish 3-wave section of the trend.

If this is true, then the construction of a new upward section of the trend from the minimum of the wave has begun. It is also likely to take a 3-waveform given the news background for the euro-dollar pair, despite the fact that foreign exchange markets have been discussing the collapse of stock markets caused by the aggravation of the conflict between Xi Jinping and Donald Trump in recent days.

This means that it significantly reduces the likelihood of signing a trade agreement between Beijing and Washington not only in the near future, but it is unlikely that the euro will increase generally. It is connected with this factor. More likely, the desire of sellers to take a break for a certain period of time, after all, no currency can fall or grow forever.

It seems that just such a period of rest for the bears has now come. Forex market participants do not expect any economic reports from America or the European Union today.

Purchase targets:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales targets:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair has moved to the formation of the upward trend section. Thus, I recommend buying the pair with targets near the 1.1264 and 1.1322 marks, which equates to 61.8% and 76.4% Fibonacci on every upward signal of MACD, calculated on the construction of three upward waves.

GBP / USD

On August 5, the GBP/USD pair lost about 15 basis points but it still can’t move far from the previously reached lows, which suggests a complication of the downward trend section. If this is true, then the MACD signal down will indicate the start of new sales of the pound-dollar pair.

Unfortunately, the news background does not allow the pound to count on strong growth. Although, as in the case of the euro, the currency cannot forever go down. However, most likely, everything will cost to build a weak 3-wave section of the trend.

There are no advances in the Brexit procedure, no progress and no hopes for a deal with the European Union either. There are not many hopes that the British Parliament will accept Johnson’s vivid desire to leave the EU in a tough way. Britain remains in an absolutely stalemate situation, from which it simply has nowhere to go.

Sales targets:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase targets:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound/dollar instrument suggests the continuation of the construction of the downward trend section. Thus, I recommend selling the pair on two options. One is the new downward signal of MACD with targets located near the calculated mark of 1.2056. Another option is in case of a successful attempt of a breakthrough with targets located about 1.1830, which corresponds to 423.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom