EUR/USD

On Friday, September 6, the EUR/USD pair ended with a decrease of 5 basis points, which did not affect the current wave pattern, suggesting the construction of a downward wave 5 in the expected 3. Thus, an unsuccessful attempt to break through the 76.4% of the Fibonacci level – still sends the euro/dollar instrument down to 9 and 8 figures.

Most of Friday’s economic reports in America were not received by the foreign exchange market. Neither Nonfarm, nor unemployment, nor salary data entailed serious exchange rate fluctuations. This is odd. Today, tomorrow and the day after tomorrow, there will be no interesting reports in the EU and the US. Monday, thus, could be used by the market to “close” Friday’s events.

But, as we can see, today the activity of the currency market leaves much to be desired. Hence the conclusion: the markets are focused on the ECB meeting, which will be held on Thursday, and until the moment when its results will be known, they do not want to open new deals. To build wave 5, it will be very helpful if the ECB lowers its key rate.

However, in the last months of the presidency, anything can be expected from Mario Draghi. By and large, he does not care whether to lower the rate or not. Over the past two months, it is unlikely that the dramatically deteriorating economic situation of the eurozone can be corrected. It would even be better if there were no changes in monetary policy in recent months, so that Christine Lagarde, who is likely to take Draghi’s place, could begin to implement her plans, not with ultra-low rates.

Purchase targets:

1.1248 – 0.0% according to Fibonacci

Sales targets:

1.0893 – 161.8% according to Fibonacci

1.0807 – 200.0% according to Fibonacci

General conclusions and recommendations:

The euro/dollar pair continues to build a downward wave 3 and presumably completed the construction of an internal corrective wave 4. I recommend selling the pair with the targets located near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% of Fibonacci, the MACD signal “down” (already available) in the calculation of the construction of the wave 5.

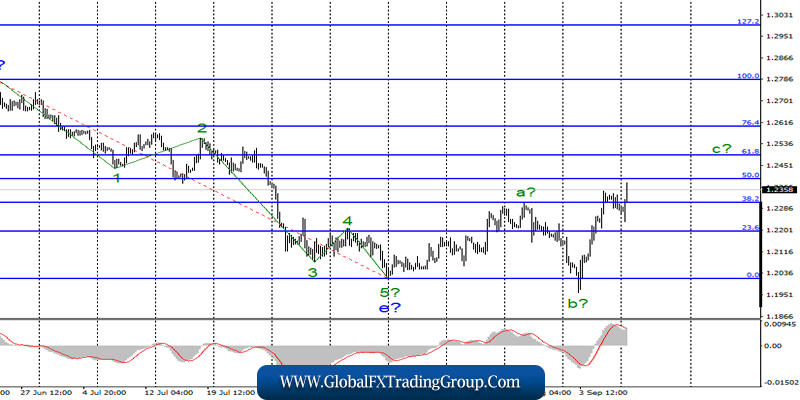

GBP/USD

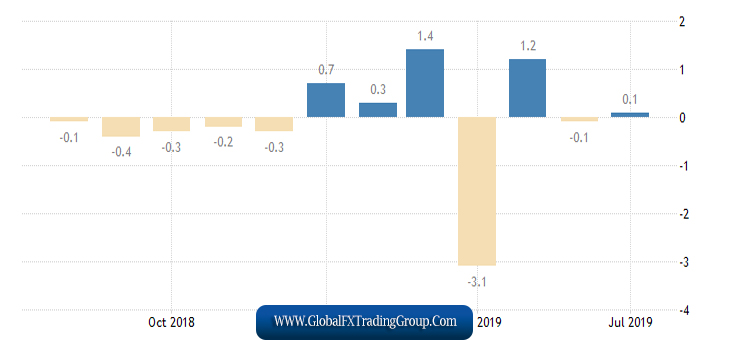

The GBP/USD pair lost about 50 base points on September 6, but today it resumed the increase and thus continues to build the expected wave C as part of the upward correction section of the trend. Today in the UK, reports on GDP and industrial production came out.

Against the background of all that is happening in the United Kingdom, meaning Brexit and the political crisis associated with it, it is very strange to see a GDP growth in July of 0.3%, instead of the projected + 0.1%, and an increase of 0.1% in industrial production in July, instead of a projected decline.

Against the background of recent months, the increase of + 0.1% looks weak and unconvincing, and in annual terms, production fell by 0.9%, which is still higher than forecasts. Despite the contradictory and unexpected statistics, the pound takes advantage of the given chances and continues to rise.

Today, there will be no interesting publications, but wave c takes on a 5-wave form and threatens to turn out to be very long. Will he be hindered by any new developments around Brexit?

After all, the latest data suggests that Boris Johnson is not going to give up after the defeat in Parliament. Today, by the way, there will be a vote on the issue of early elections or rather re-elections. Thus, the evening for GBP/USD can be very interesting.

Sales targets:

1.2016 – 0.0% according to Fibonacci

Purchase targets:

1.2401 – 50.0% according to Fibonacci

1.2489 – 61.8% according to Fibonacci

General conclusions and recommendations:

The downward trend is still considered complete. Thus, it is expected to continue the construction of the upward wave with targets located near the calculated marks of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% of Fibonacci. You can buy a pound now when the news tension has subsided a bit, but I still do not recommend doing so in large volumes.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom