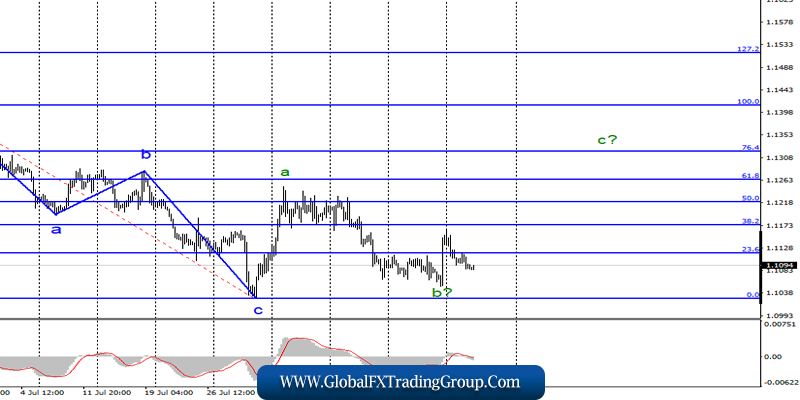

EUR/USD

On Tuesday, August 27, the EUR/USD pair ended with a decrease of only a few base points. The wave pattern remains the same, has not changed yesterday and, most likely, will not change today. The only news of yesterday was the consumer confidence index in America, which could hardly have a strong impact on the movement of the euro/dollar pair.

Today, no economic reports are expected in the foreign exchange market from either America or Europe. Based on this, the market can only wait for new data and hope that they will not be in favor of the dollar, as the current wave marking implies the construction of an upward wave with targets located around 13 figures. But even with such a simple task (growth of 200 basis points), buyers are now unable to cope.

The news background, as I said, is absent in recent days, but in general, it remains permanently in favor of the US currency. Therefore, many traders are frankly afraid of buying the euro. Perhaps the situation will change tomorrow or the day after tomorrow when America and the EU will release some really important and interesting economic reports.

Purchase targets:

1.1264 – 61.8% according to Fibonacci

1.1322 – 76.4% according to Fibonacci

Sale targets:

1.1027 – 0.0% according to Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair has supposedly completed the construction of wave b. I recommend buying a pair with targets located above the mark of 1.1250. I recommend selling the instrument not before receiving confirmation of the readiness of the market to build a new downward set of waves, that is, after a successful attempt to break the minimum of the wave C.

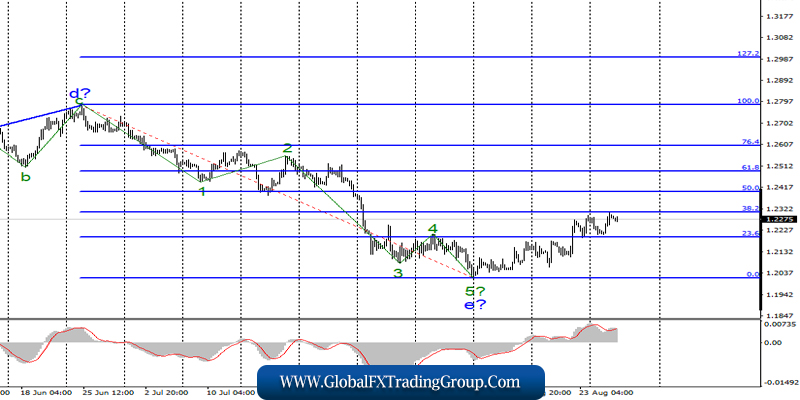

GBP/USD

On August 27, the GBP/USD pair gained 70 bp, thus offsetting the loss of the previous day, but today, it fell after it became known about Boris Johnson’s intention to appeal to Queen Elizabeth II with a request to suspend the parliament until October 14. Naturally, Mr. Johnson must implement Brexit without hindrance until October 31. It is also reported that Johnson wants to suspend Parliament from mid-September.

Now the opposition, led by Jeremy Corbyn, has very little time to oppose anything to Johnson’s ploy. Well, what will happen to the pound if Mr. Johnson implements his plan, you can see in the first minutes of the market’s reaction to the message about the suspension of parliamentarians.

An unsuccessful attempt to break the Fibonacci mark of 38.2% also played a role. The downward section of the trend threatens to take an even more complex and extended form, however, until the breakthrough of its current minimum, the construction of at least three waves up is still more promising.

Sale targets:

1.2016 – 0.0% according to Fibonacci

Purchase targets:

1.2306 – 38.2% according to Fibonacci

1.2401 – 50.0% according to Fibonacci

General conclusions and trading recommendations:

The downward section of the trend is previously considered completed. Thus, the anticipated creation of the upward correctional channel with the first order placed near the settlement marks of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% of Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom