EUR/USD

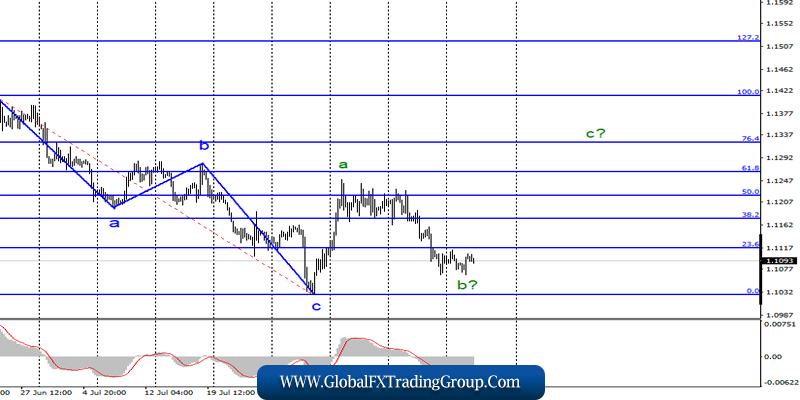

On Tuesday, August 20, the EUR/USD pair ended with an increase of 20 bps. Thus, there are new grounds to assume the completion of the construction of the wave b and the transition of the instrument to the wave c with targets located near the 13 figures. If this assumption is correct, the pair will continue to rise from its current position.

As before, the main problem for the growth of the euro remains the news background. This week, the FOMC protocol may hinder the rise of the instrument tomorrow night, the US and European indexes of business activity on Thursday and Jerome Powell’s performance on Friday. As for Powell and the FOMC protocol, it’s simple.

The more “dovish” signals the currency market will receive, the more chances for the growth of the euro/dollar pair in accordance with the wave pattern. If unexpected “hawkish” signals follow, which is unlikely, it can lead to a breakthrough of the minimum from August 1. The most likely option is a neutral speech by Jerome Powell, which will leave room for the Fed to maneuver at the next meeting in September.

Purchasing goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales targets:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair continues to build a section of the trend, which is now interpreted as corrective. Given the proximity to the minimum of the wave c, now is a good time to buy the instrument based on the construction of the wave c with targets located above the mark of 1.1250. I recommend placing restrictive orders under the minimum of August 1.

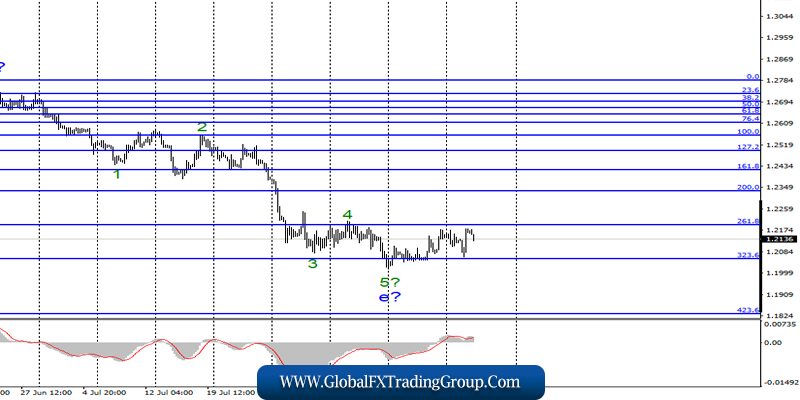

GBP/USD

The GBP/USD pair increased by 40 basis points on August 20 and continues to move away from the previously reached lows. At the moment, the wave e is still interpreted as completed, but the news background still allows for a new complication of the downward trend.

A successful attempt to break the low of August 12 will indicate the readiness of the markets for new sales of the pound sterling. Meanwhile, British Prime Minister Boris Johnson received a refusal from Donald Tusk, President of the European Council, to revise the existing agreement on Brexit and to exclude from it the point defining the “backstop” regime for the Northern Ireland border.

For the pound, this is certainly bad news, as once again it becomes clear that there will be no new negotiations between the UK and the EU. This means a “hard” scenario or a new transfer of the Brexit date. Both are bad for the pound.

Sales targets:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchasing goals:

1.2334 – 200.0% Fibonacci

General conclusions and trading recommendations:

The downward part of the trend may become even more complicated. Despite the fact that the wave e appears to be complete, it may take more complicated form. Thus, on the break of the minimum of August 12, I recommend considering the pair’s sales with targets near the level of 1.1830, which corresponds to 423.6% of Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom