EUR/USD

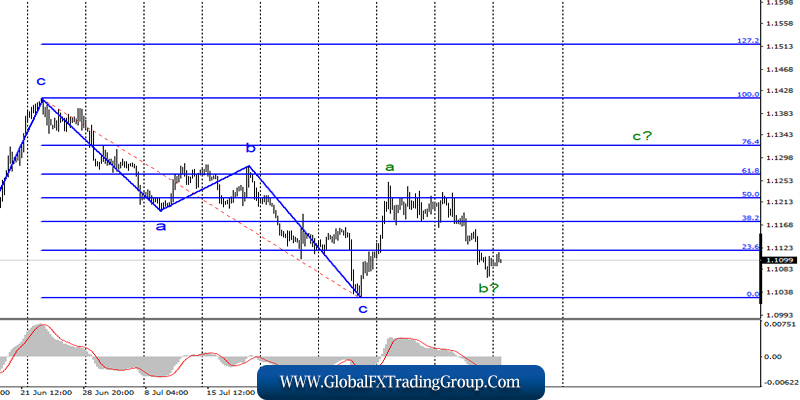

On Friday, August 16, the EUR/USD pair declined by 20 basis points. Thus, the estimated wave b continues its formation and threatens to go beyond the minimum of wave c. If that happens, then the wave pattern will require adjustments, and the downward trend can be very complicated.

On Monday, August 19, is held in quiet trading, although they had every chance to be restless and negative for the euro. The only but very important report of the day – inflation in the eurozone – was significantly worse than the expectations of the foreign exchange market. Inflation slowed to 1.0% y/y in the European Union and lost 0.5% monthly.

The core consumer price index fell to 0.9% y/y and lost 0.6% monthly. Thus, this would be enough for the bears to start putting pressure on the euro/dollar pair again. However, this did not happen, perhaps because wave b still needs to be completed. In general, as long as the instrument does not go beyond the minimum of the wave c, there are good chances of building a third wave of the upward trend with targets located above the mark of 1.1250. Before the ECB lowers the rate, the pair needs to build a wave up.

Purchasing goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales targets:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair continues building the upward trend channel. Given the proximity to the minimum of the wave c, now is a good time to buy a tool based on the construction of the wave c with targets located above 1.1250. I recommend placing restrictive orders under the minimum of August 1.

GBP/USD

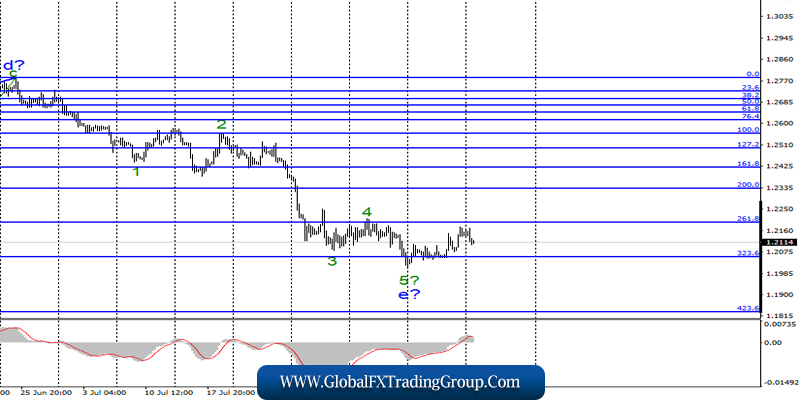

On August 15, the GBP/USD pair gained about 50 base points and continues a sluggish retreat from the previously achieved lows. At the moment, the fifth wave is still considered as completed, but the news background is still not on the side of the pound.

However, in early September, when the Parliament will come out of holidays and start working sessions, there may be events that will not only affect the course of the instrument but also change the mood in the market for several months. In recent months, the pound has been falling non-stop, because the market expects disordered Brexit and there was not a single hint that Boris Johnson will find a way to negotiate with the EU and avoid a tough scenario.

Now, a vote of no confidence can be announced to Boris Johnson, and he can resign. And in this case, the probability of a hard Brexit will significantly decrease, and the British pound may become enthusiastic and rush up due to this news, as it is greatly oversold, and the bears will begin to close sales.

Sales targets:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchasing goals:

1.2334 – 200.0% Fibonacci

General conclusions and trading recommendations:

The downward part of the trend may become even more complicated. Although the wave e appears to be complete, it may take a more complicated form. Thus, on the break of the minimum of August 12, I recommend considering the pair’s sales with targets near the level of 1.1830, which corresponds to 423.6% of Fibonacci. There are certain chances for the pound to grow now, the main thing is that the news background does not cause new sales until early September.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom