Trading recommendations for the EUR / USD pair on September 23

Analysis of transactions

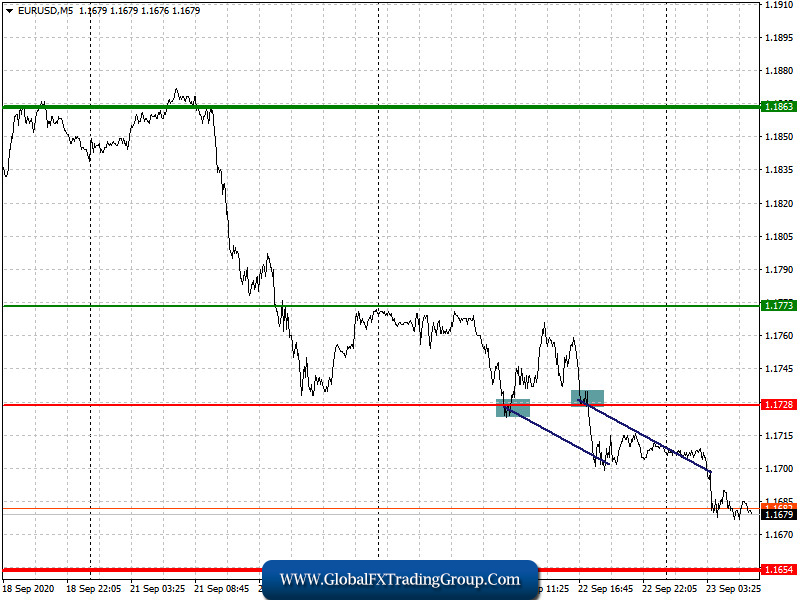

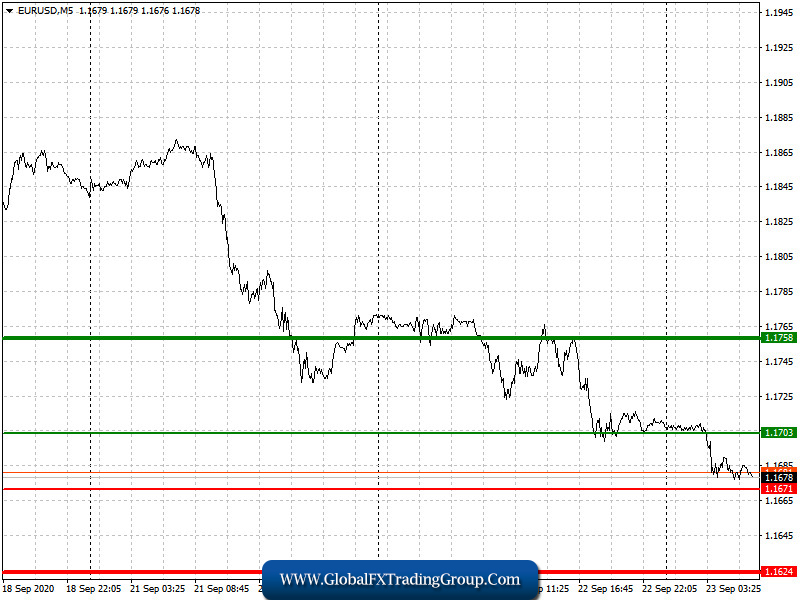

Another surge in coronavirus incidence, together with good reports on the US economy, led to a sharp decline in the euro yesterday. As a result, EUR / USD moved down 30 pips from the level of 1.1728, following a bearish trend.

Upcoming reports on the euro area’s PMI may help the euro regain its position in the market, provided that data turns out to be better than the forecasts. But if the reports indicate a slowdown in activity in late summer and early autumn of this year, the decline in EUR / USD will continue.

Buy positions only when the quote reaches a level of 1.1703 (green line on the chart). However, large movements will only be seen if data on the PMI reports come out good. Take profit around the level of 1.1758. Sell positions starting from the level of 1.1671 (red line on the chart). A breakout from which will lead to another strong drop in EUR / USD, especially if the situation with coronavirus intensifies in Europe. Take profit around the level of 1.1624.

Trading recommendations for the GBP / USD pair on September 23

Analysis of transactions

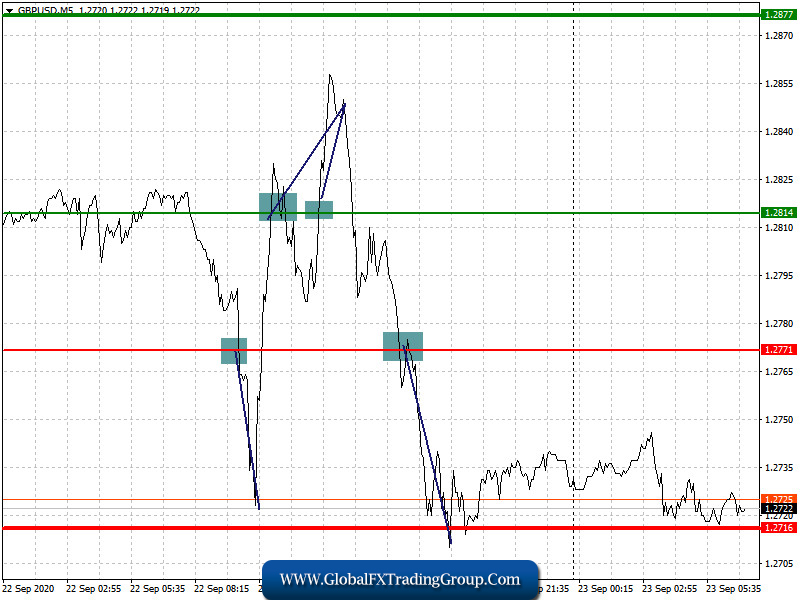

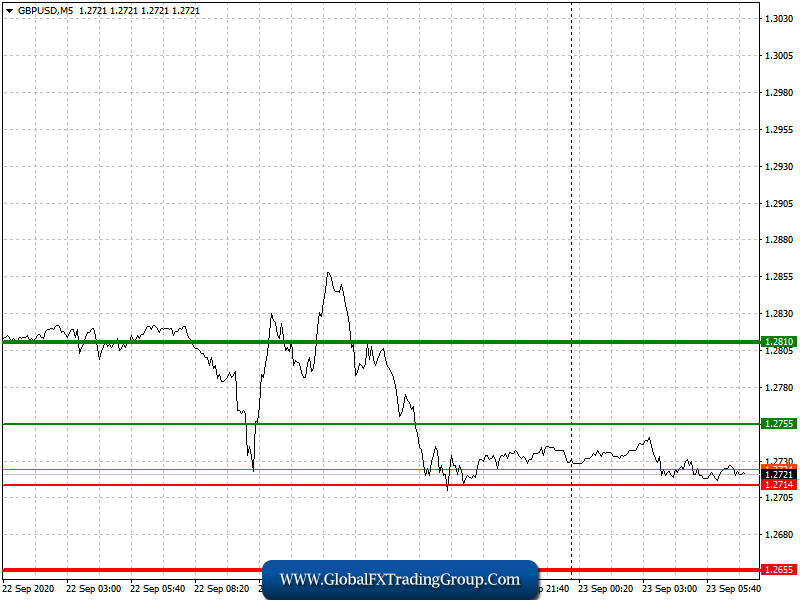

The statements of the Bank of England regarding negative interest rates led to a sharp surge in volatility in the pound. As a result, short positions from the level of 1.2771 brought about 40 points of profit., While long positions from the level of 1.2814 gave about 30 points of profit. Now, the GBP / USD pair is trading around the target price level of 1.2716.

The decline in the pound may continue, especially if data on UK PMI comes out today as weaker than forecasts. Bad data will lead to a new wave of sales in the market.

Buy positions when the quote reaches the level of 1.2755 (green line on the chart). However, large upward moves are not expected, since there is not much impetus for growth in the GBP/USD pair. Take profit around the level of 1.2810. Sell positions after the quote reaches a price level of 1.2714 (red line on the chart), and take profit at least at the level of 1.2655. However, weaker PMI data will quickly derail the pair towards its intended target.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom