Analysis of transactions in the EUR / USD pair

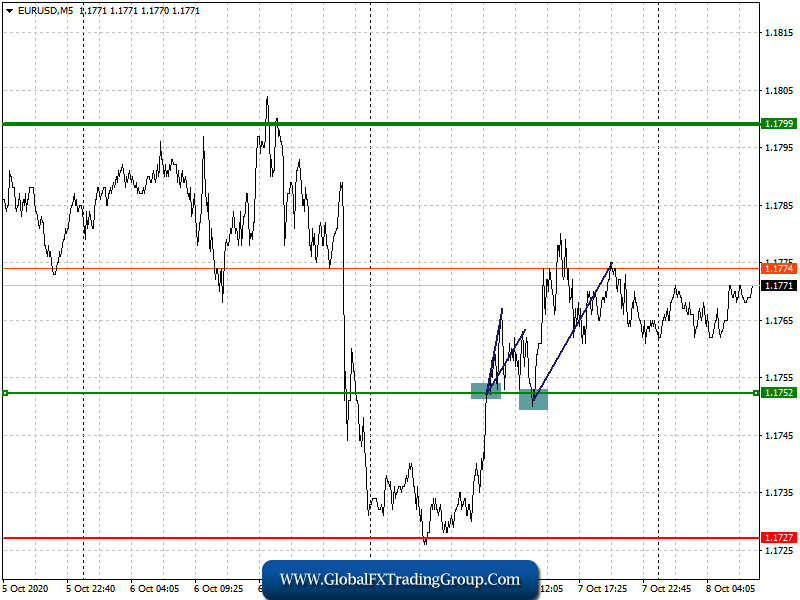

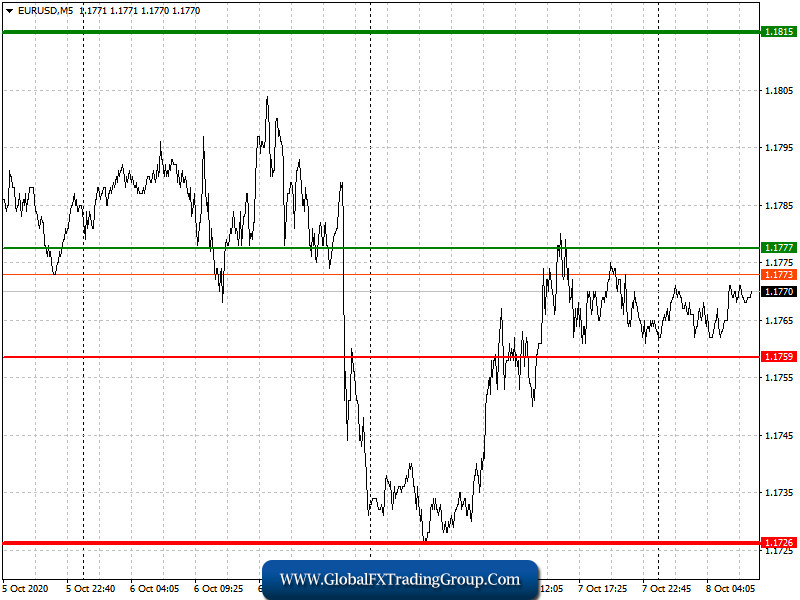

Trump’s change of tone over the long-disputed coronavirus relief bill shifted market demand to the European currency. As a result, a buy signal appeared in the euro from the level of 1.1752, which rose long positions in the market and triggered a 15 to 20-pip movement in the EUR / USD pair.

Trading recommendations for October 8 The European Central Bank will publish its latest protocol today, and from there it will be clear how strongly the Central Bank is inclined to ease its monetary policy. A dovish rhetoric may decrease demand for the European currency.

Set up a long position when the euro reaches a quote of 1.1777 (green line on the chart), and then take profit at the level of 1.1815. However, a bullish move will only occur if the ECB declares that it would maintain interest rates at the current level. Open a short position if the euro moves to a quote of 1.1759 (red line on the chart), and then take profit at the level of 1.1726. Any hints of a possible negative rate will put pressure in the European currency.

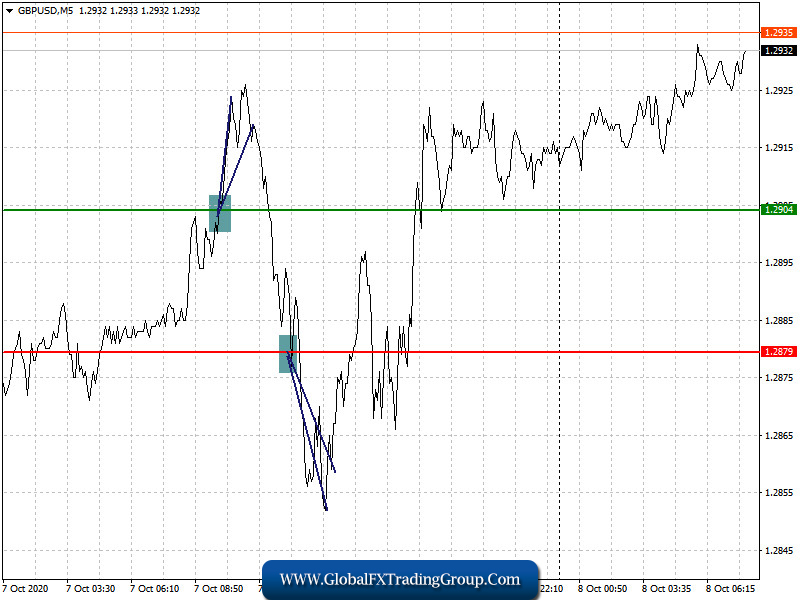

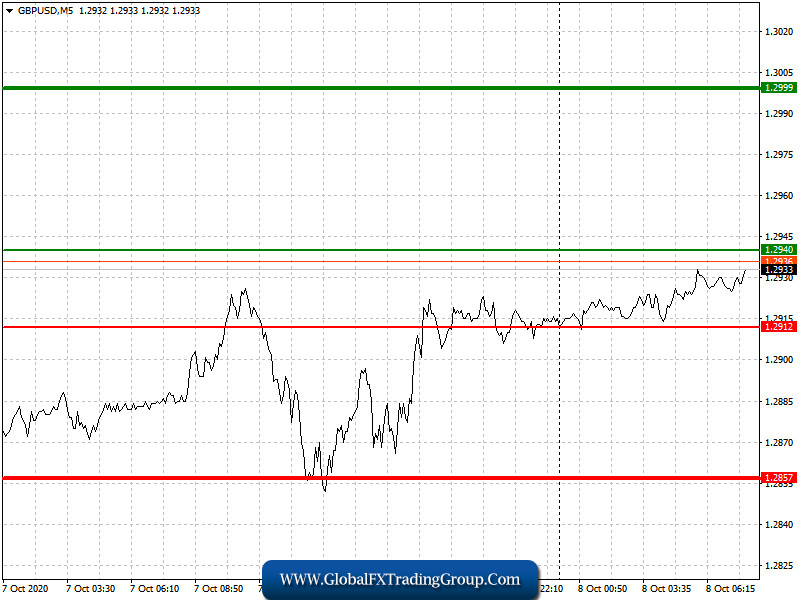

Analysis of transactions in the GBP / USD pair Two signals appeared for the pound yesterday, the first of which is a buy signal from the level of 1.2904. However, it did not lead to a large upward move, as the pound moved downwards instead by about 20 pips. In the afternoon, a wave of short positions from 1.2879 rose in the market, but there was no strong downward movement either. The decline only to about 15-20 pips.

Trading recommendations for October 8

Since there are no important UK statistics scheduled to be published today, the market will be biased towards the upcoming US labor market report, as well as news related to Brexit.

Open a long position when the pound reaches a quote of 1.2940 (green line on the chart), and then take profit around the level of 1.2999 (thicker green line on the chart). Set up short positions after the pound reaches a quote of 1.2912 (red line on the chart), and then take profit at least at the level of 1.2857.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom