Analysis of transactions in the EUR / USD pair

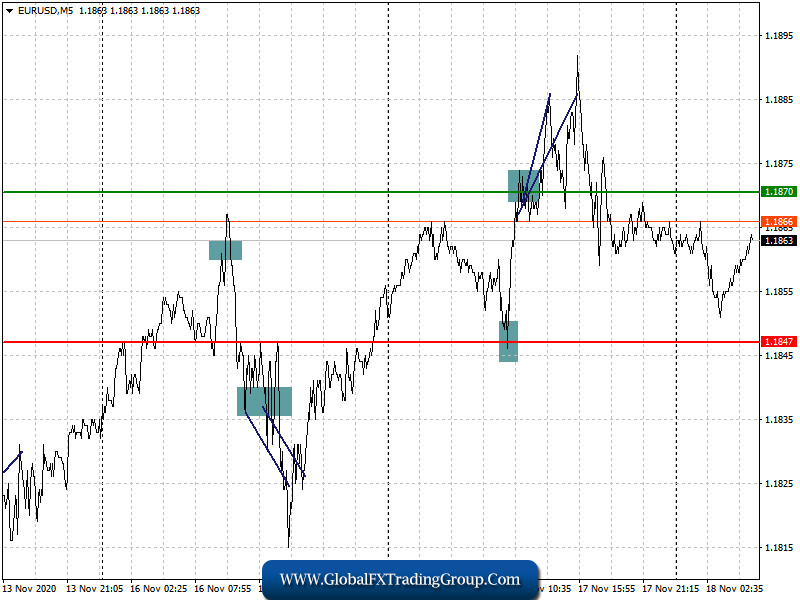

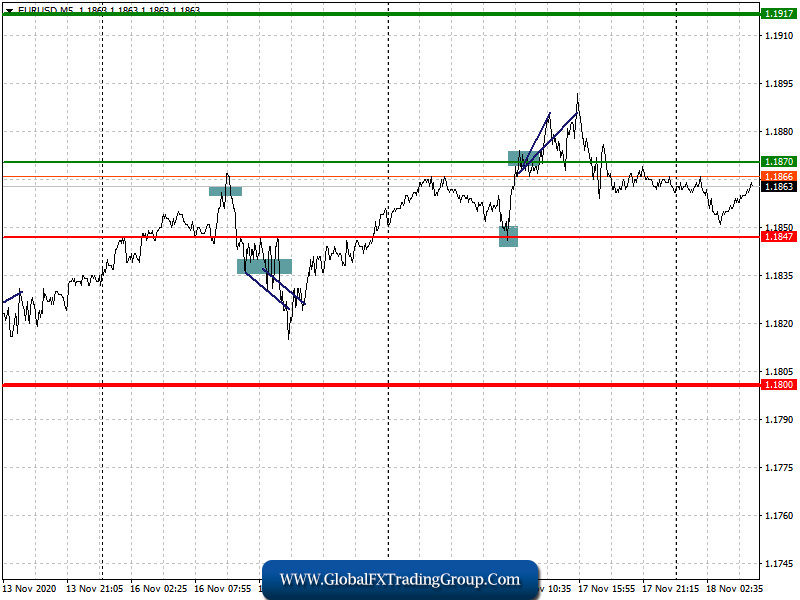

Yesterday, the European currency disappointed with its wrong sell signal at 1.1847, which led to a loss, but was thankfully compensated by the buy signal at 1.1870. Then, after reaching a new local high, demand for the euro dropped sharply, and this is mainly due to the negative news in Europe.

According to reports, Poland and Hungary suddenly decided to block the approval of the EU budget and the stabilization fund, which will be discussed further at the EU summit tomorrow. To add to that, the persistent rise of COVID-19 infections around the world adds pressure on the euro, even despite the fact that there are positive reports about a vaccine.

Trading recommendations for November 18

Today, particular attention will be drawn to the report on EU inflation, where the consumer price index is expected to decline in October this year, which is rather bad news for the European Central Bank. But if the data turns out better than the forecasts, the euro will continue to grow with renewed vigor, which will lead to new monthly highs in the EUR / USD pair. If the data is disappointing, the pair will remain in a sideways channel, and it is quite possible that the pressure on the euro will increase, depending on how the report diverges from the expectations of economists.

Open a long position when the euro reaches a quote of 1.1870 (green line on the chart) and then take profit at the level of 1.1915. However, growth will occur only in the event of good data on the EU economy. Open a short position when the euro reaches a quote of 1.1847 (red line on the chart) and then take profit around the level of 1.1800. Sell the euro only if the data on inflation comes out weaker than expected.

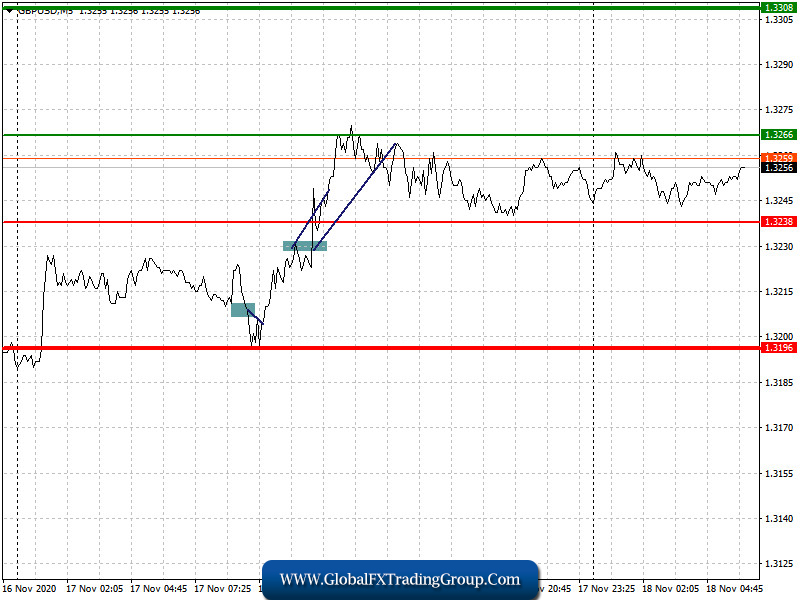

Analysis of transactions in the GBP / USD pair

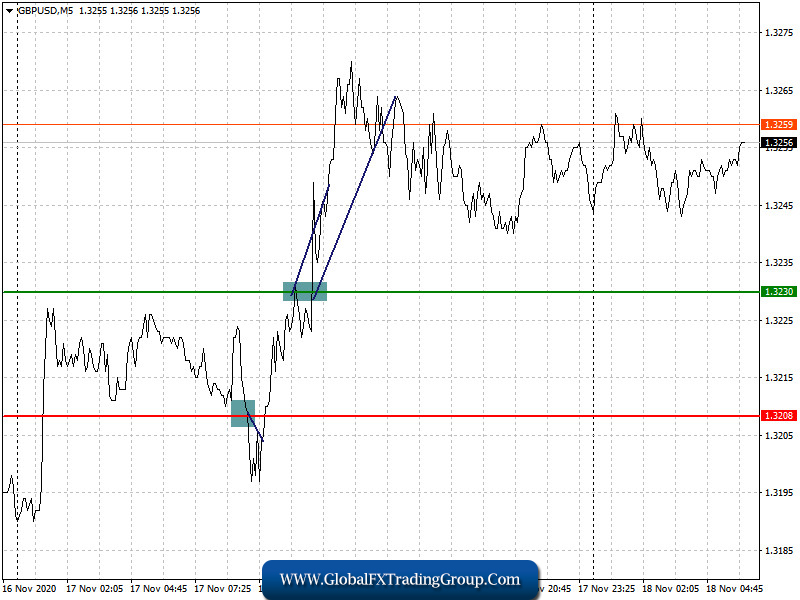

Attempts to sell the pound at 1.3208 did not lead to much success, so most short positions yesterday saw losses. Meanwhile, long positions from 1.3230 were highly profitable. The total growth to more than 65 pips, of which it was actually possible to take half. The first upward move was about 25 pips, and the second was 35 pips. However, demand for the pound remains subdued due to uncertainty over the direction of the Brexit trade agreement.

Trading recommendations for November 18

The position of the pound shall rely today on the statements from the Bank of England. If its governor, Andrew Bailey, leaves key rates unchanged, the British pound will continue to rise. But if he resorts to negative rates, the pound may come under pressure. A report on UK inflation will also be published, where the data on CPI comes out better than the forecasts, a new upward wave emerge in the GBP / USD pair. But if the data turns out weaker than expected, a downward correction will begin.

Open a long position when the quote reaches the level of 1.3266 (green line on the chart) and then take profit around the level of 1.3308 (thicker green line on the chart). The position of the pound can be strengthened by good inflation data on the UK, as well as statements from the Bank of England about keeping interest rates at the same level. Progress on Brexit negotiations will also bring growth incentives to the pair. Open a short position when the quote reaches the level of 1.3238 (red line on the chart) and then take profit around the level of 1.3196. A weak inflation report in the United Kingdom will add pressure on the British pound.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom