Analysis of transactions in the EUR / USD pair

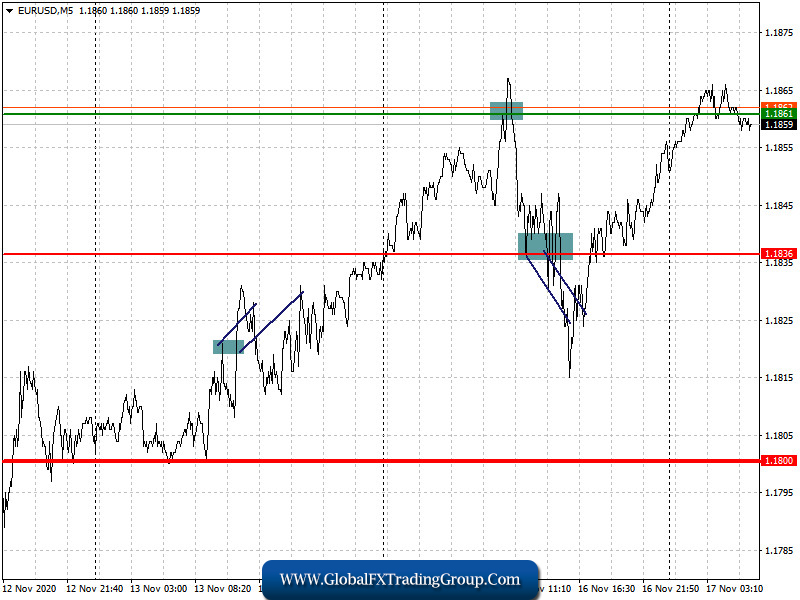

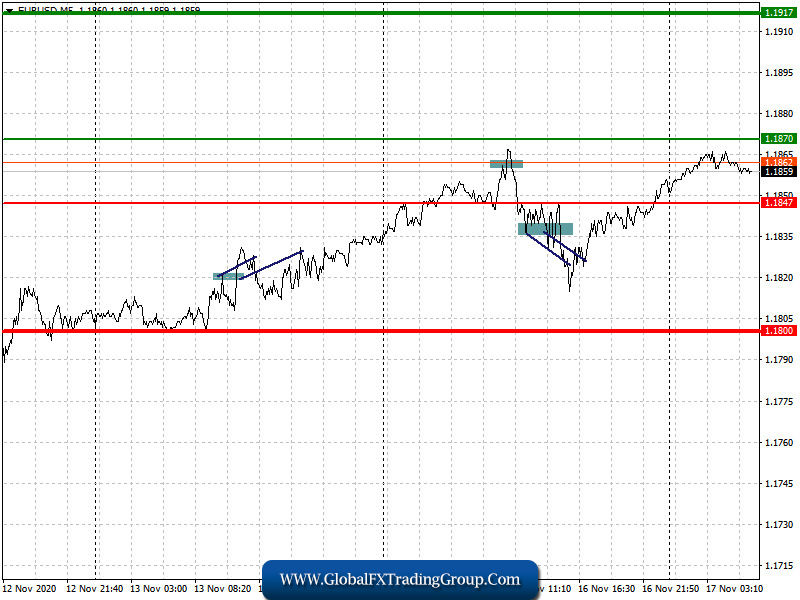

The euro failed to grow actively yesterday, mainly due to the absence of economic data, except for Italy’s CPI, which did not show anything new. The statements from the European Central Bank were also not noteworthy, so long positions in the EUR / USD pair saw only losses. Short positions from the level of 1.1836 also did not bring plenty of profit, as the quote only moved 15 pips down. This suggests that the EUR / USD pair is in a side channel, and is likely to remain there today.

Trading recommendations for November 17

Data on US retail sales is scheduled to be published today, and if the report indicates a decline in the index, the euro will rise with renewed vigor, which will lead to new monthly highs in the EUR / USD pair. But if the data turns out disappointing, the pair will remain in a sideways channel, which it has been in since the beginning of this week. In any case, euro bulls are still dominating the market, so it is better to bet on the further strengthening of the pair.

Open a long position when the euro reaches a quote of 1.1870 (green line on the chart) and then take profit at the level of 1.1915. However, growth will occur only in the event of bad data on the US economy. Open a short position when the euro reaches a quote of 1.1847 (red line on the chart) and then take profit around the level of 1.1800. Sell the euro only if economic reports from the US come out better than the forecasts.

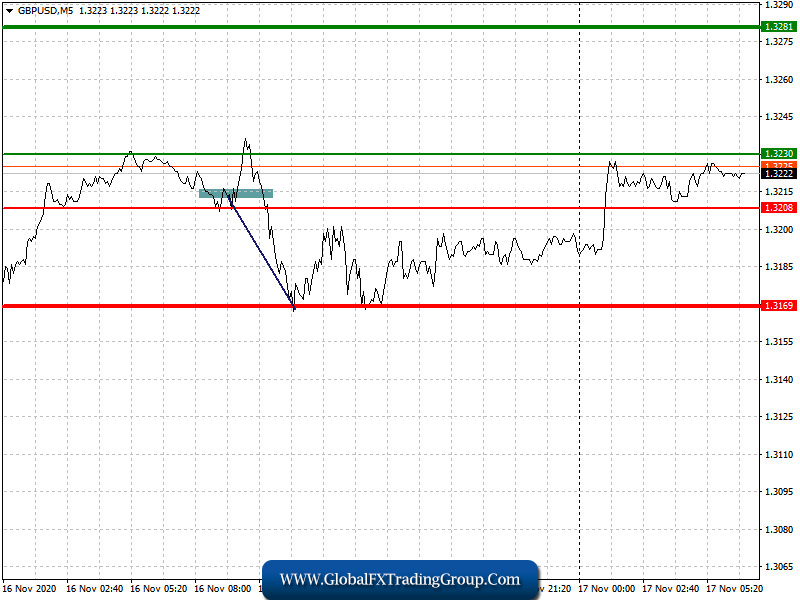

Analysis of transactions in the GBP / USD pair

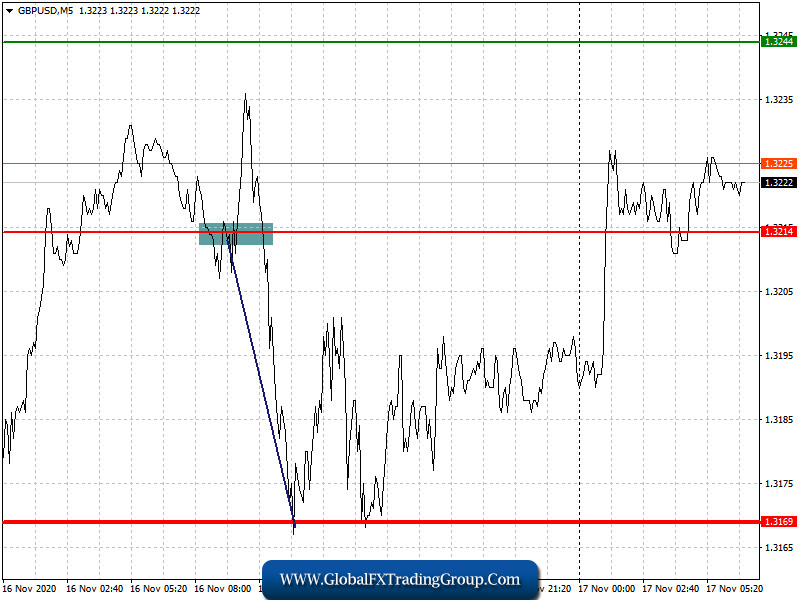

Demand for the pound rose in the market yesterday, so as a result, the GBP / USD pair moved 40 pips upward. However, afterwards, short positions from 1.3214 dragged the quote down to 1.3169. It seems that the lack of economic data and unimproved outlook for the UK economy is a deterrent factor even for speculative players. The pound needs good news to maintain the upward trend.

Trading recommendations for November 17

The position of the pound shall rely today on the statements from the Bank of England. If its governor, Andrew Bailey, leaves key rates unchanged, the British pound will continue to rise. But if he resorts to negative rates, the pound may come under pressure.

Open a long position when the quote reaches the level of 1.3230 (green line on the chart) and then take profit around the level of 1.3281 (thicker green line on the chart). If the Bank of England leaves key rates unchanged, or if there’s good news over Brexit, demand for the British pound may increase. Open a short position when the quote reaches the level of 1.3208 (red line on the chart). A breakout of this range will bring pressure back to the pair, which will push the pound towards the level of 1.3169.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom