Analysis of transactions in the EUR/USD pair

Two sell signals appeared in the market last Friday. However, the first one had to be ignored because the MACD line, during that time, was in the oversold zone. Fortunately, in the afternoon, the MACD line moved to a profitable zone, so EUR/USD was able to go down by 20 pips.

Trading recommendations for March 22

German PPI left the market calm last Friday morning, but the sharp rise in Treasury yields set off another rise in USD in the afternoon. Plausibly, this trend will continue today since the upcoming statements from the Federal Reserve will most likely strengthen the position of the US dollar. That being said, short positions in EUR/USD are the most ideal transactions for today. A report on ECB’s account balance should also be released within the day, so traders should pay attention to it as well.

For long positions:

Buy the euro when the quote reaches 1.1917 (green line on the chart), and then take profit around the level of 1.1986. However, it is unlikely that the price will grow today because almost all indicators are pointing to a further downwards move.

Keep in mind that before buying, the MACD line should be above zero and is starting to rise from it.

For short positions:

Sell the euro after the quote reaches 1.1871 (red line on the chart), and then take profit at the level of 1.1815. Pressure on EUR/USD should continue because US Treasury yields have grown again. Aside from that, Europe is still suffering from the COVID-19 crisis, especially now that cItizens are refusing AstraZeneca’s vaccine. Such complicates the overall process of vaccination and delays the lifting of quarantine measures.

Before selling, be sure that the MACD line is below zero and is starting to move down from it.

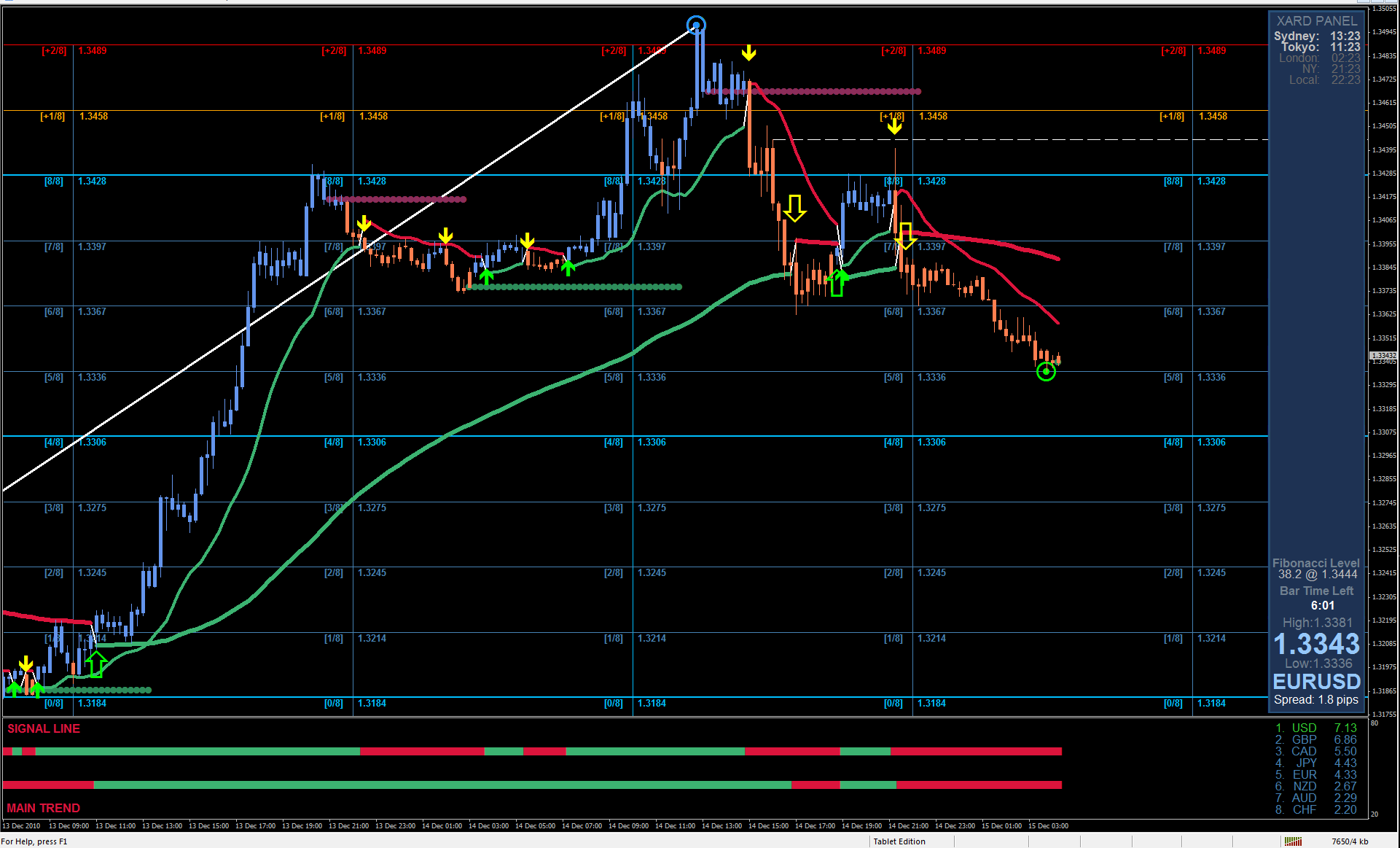

What’s on the chart:

- The thin green line is the key level at which you can place long positions in the EUR/USD pair.

- The thick green line is the target price, since the quote is unlikely to move above this level.

- The thin red line is the level at which you can place short positions in the EUR/USD pair.

- The thick red line is the target price, since the quote is unlikely to move below this level.

- MACD line – when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

Analysis of transactions in the GBP/USD pair

Two signals appeared in the market last Friday, however, all of them had to be ignored. This is because when the pound reached 1.3935, the MACD line, although in a buy zone, was not that far from zero. So even if the volume of longs increased in the market, the movement will never be more than 20 pips. As for the second signal which is to sell at 1.3899, it was also unsuccessful because the MACD line, by that time, was in the oversold zone.

Trading recommendations for March 22

Last Friday, the speech of Bank of England Deputy Governor Jon Cunliffe shook GBP/USD a bit, but it did not lead to a directional movement. Today though, the price will most likely drop vigorously due to statements from the Federal Reserve. Plausibly, the speech of Fed Chairman Jerome Powell will strengthen the US dollar, accordingly weakening GBP/USD.

For long positions:

Buy the pound when the quote reaches 1.3890 (green line on the chart), and then take profit at the level of 1.3955 (thicker green line on the chart). But the price will increase only after a break above 1.3890.

Make sure that when you open a buy position, the MACD line is above zero and is starting to rise from it.

For short positions:

Sell the pound after the quote reaches 1.3833 (red line on the chart), and then take profit at the level of 1.3767. Aside from the fact that statements from the Federal Reserve will strengthen the US dollar, a break below 1.3833 will automatically set off a decline in the pair.

When selling, make sure that the MACD line is below zero and is starting to move down from it.

What’s on the chart:

- The thin green line is the key level at which you can place long positions in the GBP/USD pair.

- The thick green line is the target price, since the quote is unlikely to move above this level.

- The thin red line is the level at which you can place short positions in the GBP/USD pair.

- The thick red line is the target price, since the quote is unlikely to move below this level.

- MACD line – when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom