Trading recommendations for EUR/USD on September 8

Analysis of transactions

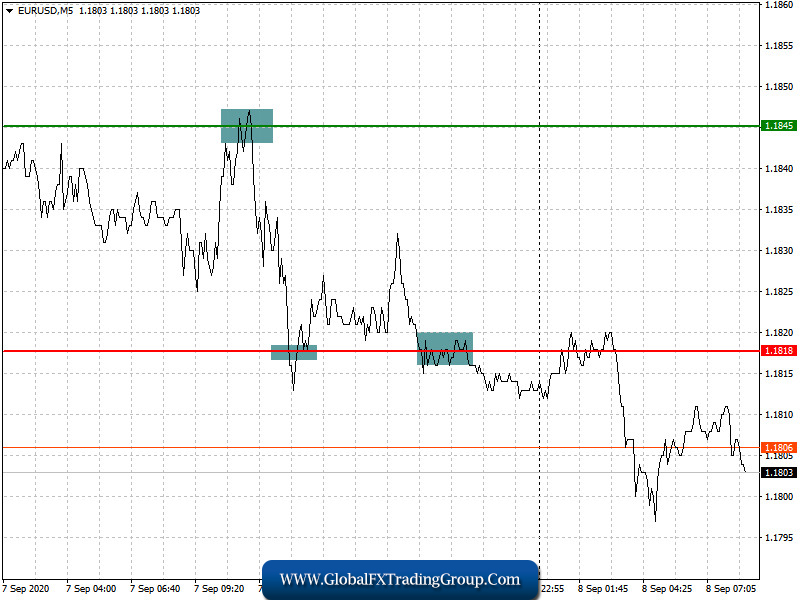

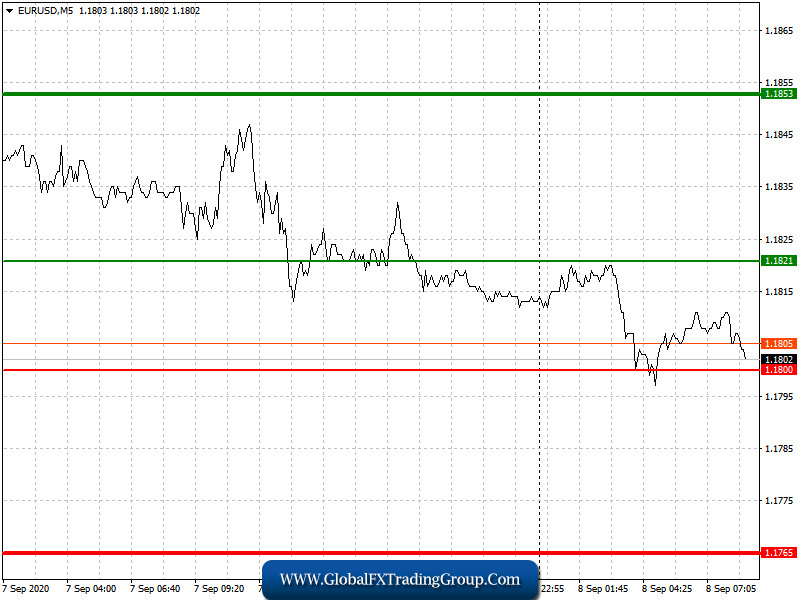

Euro stopped its rally after reaching 1.1845, which brought losses to long positions in the EUR/USD market. Meanwhile, shorts were not actually profitable either, since activity and volatility were low, it being a weekend and holiday in the United States yesterday.

Today, a series of reports for the eurozone are scheduled to be published, among which is the data on EU GDP for the 2nd quarter. If the report is revised for the worse, demand for the euro will decrease, which will lead to a further decline of EUR/USD in the market.

Set long positions from 1.1821 (green line on the chart) to 1.1853, and take profit at the level of 1.1853. Set shorts from 1.1800 (red line on the chart) to 1.1765, as a breakout from which will lead to a quick return of the quotes to last week’s low. Then, take profit at the level of 1.1765.

Trading recommendations for GBP/USD on September 8

Analysis of transactions

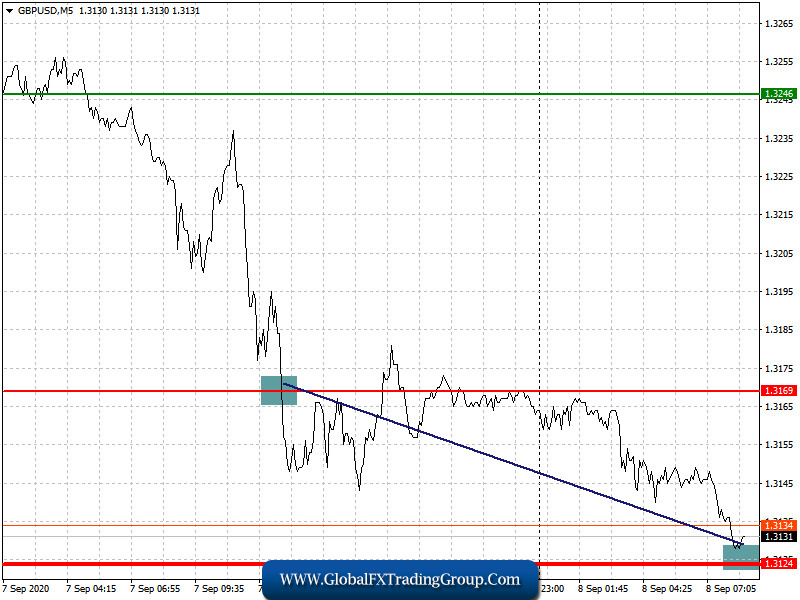

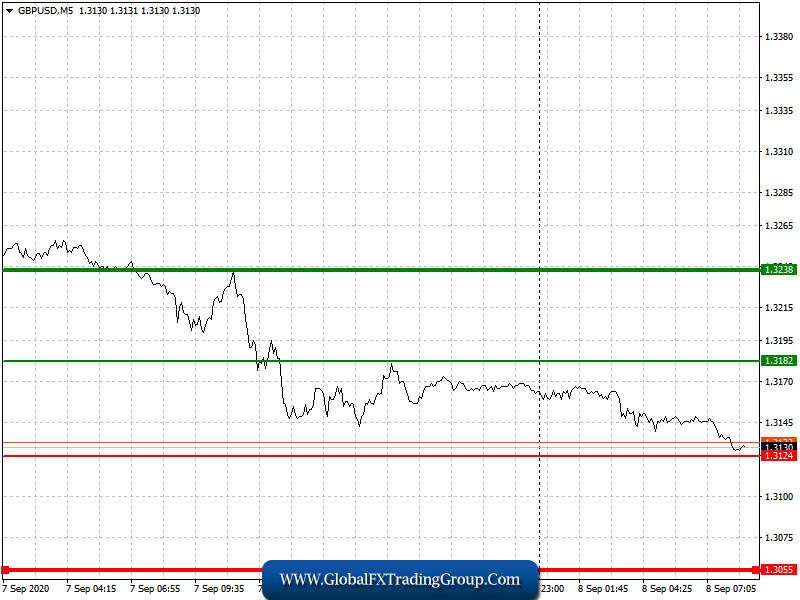

Although it took quite a long time, GBP/USD moved down from 1.3169 to 1.3124, bringing profit to short positions in the market.

No important statistics are scheduled for release today, so the movement of the pound promises to be quite calm. However, the downward trend will most likely continue, so it is best to trade short positions to gain profit. In addition, uncertainty over Brexit and the trade agreement will continue to put pressure on the GBP/USD pair.

Be very careful when setting up trades. For example, open long positions from 1.3182 (green line on the chart) to 1.3238 (thicker green line on the chart), and take profit at the level of 1.3238. Meanwhile, sell shorts from 1.3124 (red line on the chart), and take profit at the level of 1.3055.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom