Following the outcome of yesterday’s FOMC meeting, the Federal Reserve left the current interest rate unchanged (5.25%), but the dot plot projections showed Committee members leaning towards two more rate hikes by the end of the year. The next rate hike will likely happen at the July meeting. Investors reacted accordingly, increasing the probability of a July rate hike to 64.5%. Yesterday’s trading volume was not particularly high, but is considered above average.

On the reversal candle on June 1st, the volume was higher. Therefore, yesterday’s short-term decline in the euro was merely due to partial closing of long positions, not due to selling. The day itself ended as a doji candle. If the European Central Bank appears moderately hawkish to investors today and the price surpasses yesterday’s high at 1.0865, the upward movement will continue towards the target range of 1.0910/30, determined by local highs in March and April.

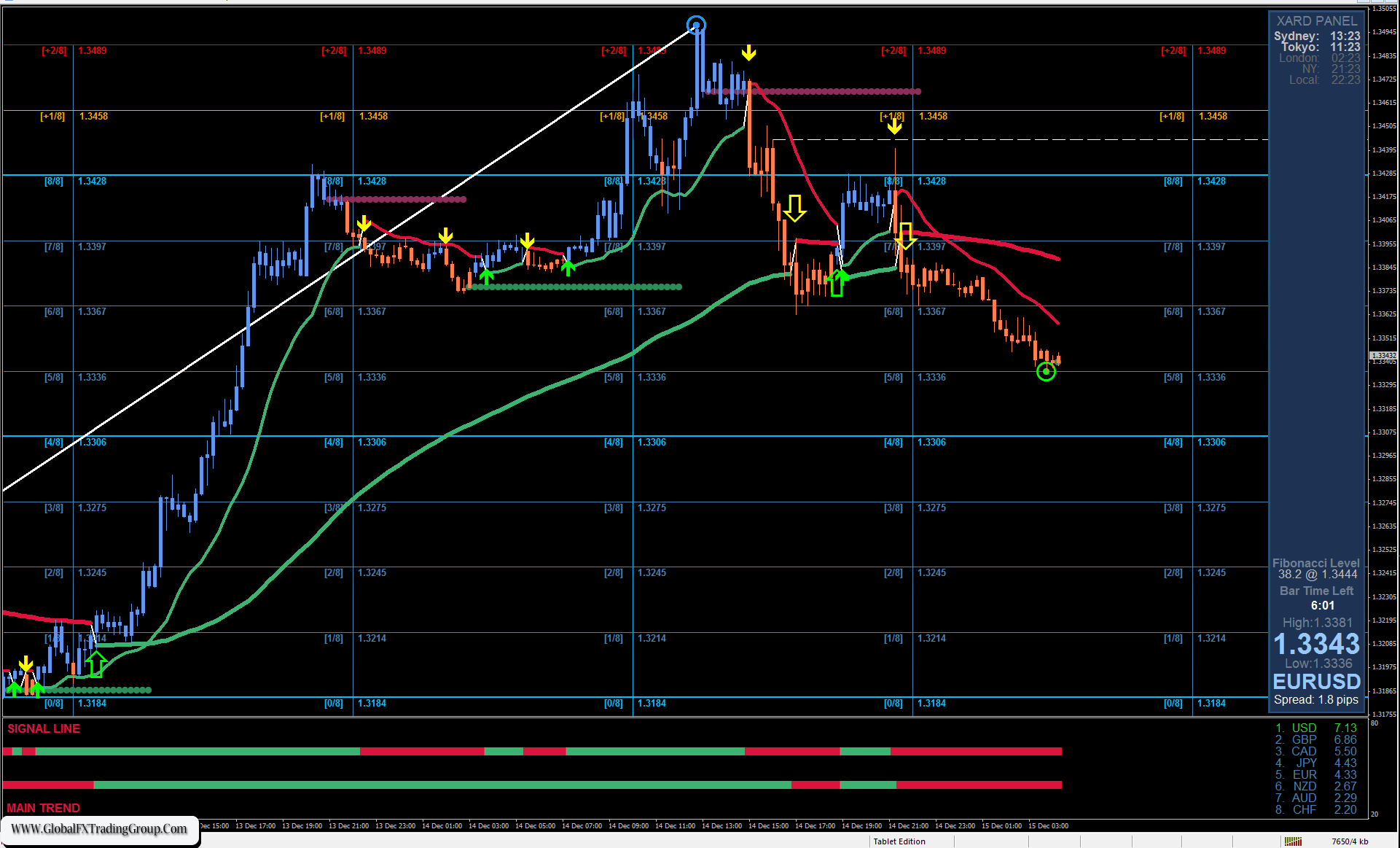

From a technical perspective, the price stopped rising by the nearest line of the global descending price channel and the balance indicator line. At the moment, the price is above the MACD indicator line, and if today’s close is above it, even without surpassing 1.0865, the euro may launch an attack as early as tomorrow.

To relieve tension, the price needs to drop below the nearest support at 1.0804 (thus also below the MACD line). In that case, the bears could extend their success towards 1.0738 in the coming days.

The outcome of yesterday’s session indicates that market participants will make a decision on the near-term outlook today. On the 4-hour chart, the situation is upward, but in the context of awaiting the ECB meeting, it appears neutral, with the only difference being that the waiting is happening above the 1.0804 level, rather than below it as it was yesterday.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom