Our previous assumption of CPI manipulation as a signal for a Fed rate hike did not materialize. Inflation turned out to be even better than expected: the overall CPI for May decreased from 4.9% YoY to 4.0% YoY, while the consensus forecast was 4.1% YoY. The core CPI decreased from 5.3% YoY to 5.3% YoY.

The data completely nullified all previous signs of a possible rate hike and confused the markets. Investors have lowered the chances of a rate hike today from 23% to 4.6%. Now, at best, the rate will be hiked in July, and if inflation decreases, the rate hike cycle will be completed.

In the medium and long term, our forecasts for the dollar remain unchanged: divergences in interest rates between the Federal Reserve and the European Central Bank remain in favor of the dollar, the Treasury is rapidly issuing government debt (now at $31.926 trillion, with a weekly increase of $71 billion), balance of payments comparisons between the eurozone and the US remain in favor of the US, and inflation in the eurozone is higher. The current situation is a complex issue – the market’s reaction to today’s neutral Fed meeting and tomorrow’s ECB rate hike.

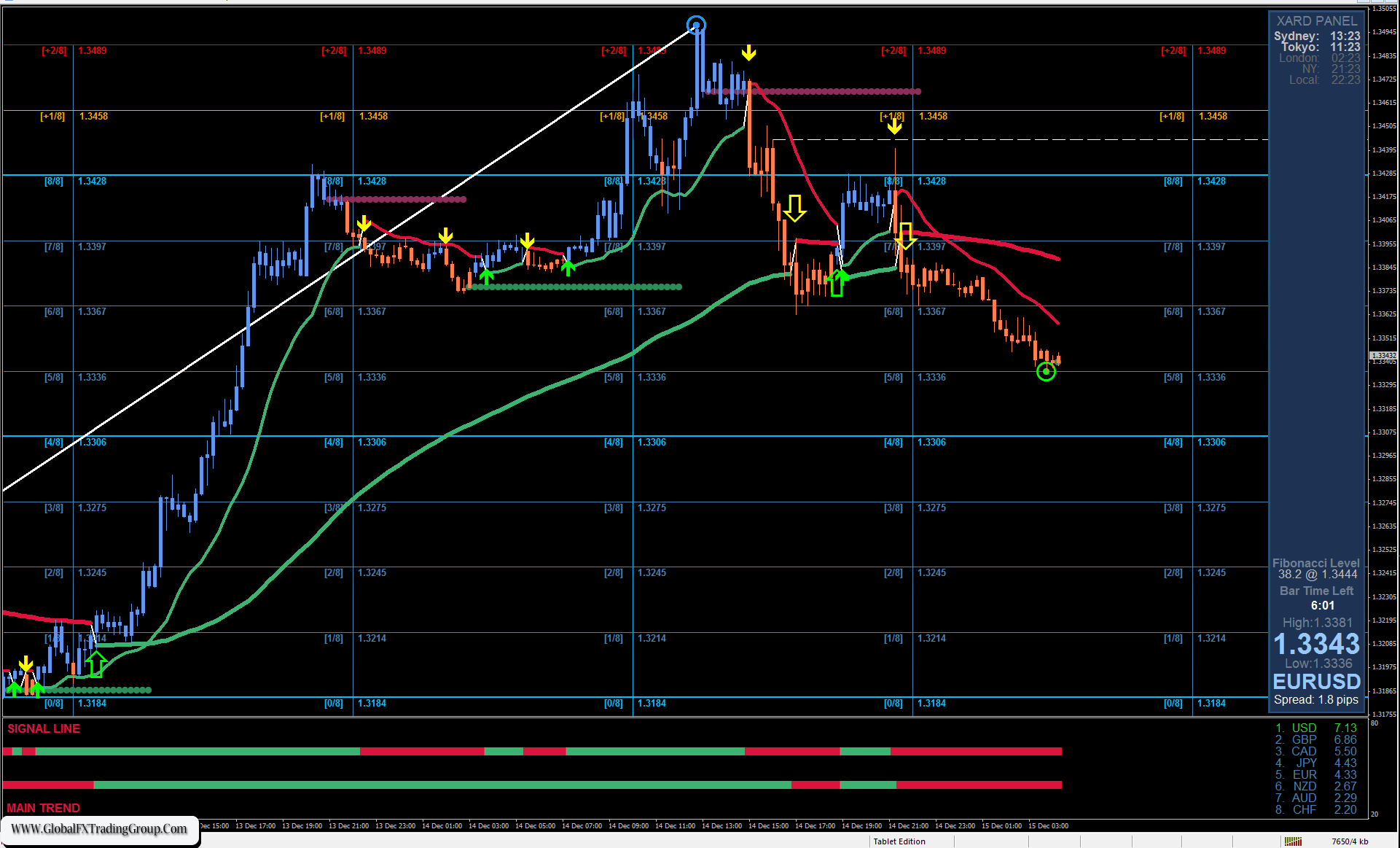

From a technical standpoint, the euro has completed its possible corrective growth – yesterday it stopped rising at the MACD indicator line on the daily chart. Staying above it will be the primary condition for medium-term growth. The signal line of the Marlin oscillator has entered the positive territory, but this movement may be similar to the price surpassing the target level of 1.0804. The second sign of a price reversal would be falling below the support level at 1.0738.

On the four-hour chart, the price is consolidating below the level of 1.0804. The Marlin oscillator is under pressure (divergence), but it is still in the positive area. We’ll find out what the market’s short term direction is late tonight.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom