Yesterday’s US data showed a weak decline in inflation in April. The overall and core CPI decreased by 0.1% to 4.9% YoY and 5.5% YoY, respectively, while in the monthly assessment, the CPI grew by 0.4% in each index.

What the markets did: Dow Jones -0.09%, S&P 500 +0.45%, almost all European stock markets were in the red, the yield on 5-year US government bonds fell from 3.49% to 3.38%, raw materials and gold became cheaper, whereas it seemed like gold should have risen on the dollar and bond yields falling. This morning, all Asian stock markets are falling. We see a mixed market reaction. The main point is that on Tuesday, the New York Fed’s John Williams stated that there are no plans for the Federal Reserve to end the rate hike cycle.

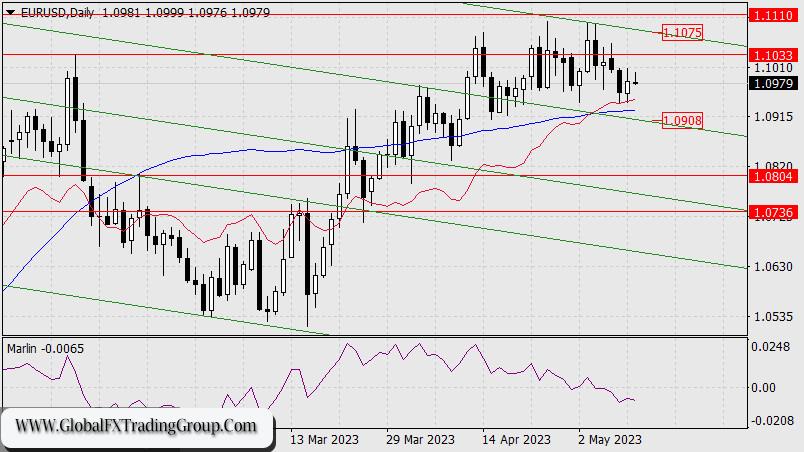

Market confusion is obvious. The euro has spent the last week in the 1.0942-1.1033 range. Technically, on Tuesday and Wednesday, the balance line served as price support on the daily chart – the market did not dare to sell the euro. It is also unclear what will be the sign of euro purchases, as there are immediately three major tactical resistances ahead: 1.1033, 1.1075, 1.1110.

One thing can be said with confidence: if the price goes below 1.0908, where the embedded price channel line and the MACD line are located, the downward medium-term trend will come into play. And, of course, we accept the bearish scenario as the main one.

On the four-hour chart, the price held back from attacking the MACD line. At these moments of indecisiveness, the Marlin oscillator’s signal line turned from the neutral zero line (arrows). The sign is weak, but in favor of the bears. In case it crosses the MACD line (1.1010), the price will continue to grow to the first close target of 1.1033. Overcoming yesterday’s low of 1.0942 will allow the price to reach the range of 1.0908-1.0924 (MACD line on the daily chart).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom