At the end of yesterday’s FOMC meeting, the Federal Reserve raised the rate by the expected 0.25%, but the rhetoric, contrary to our expectation, was not firm, as the Committee announced a pause in the rate hike cycle. Nevertheless, yesterday’s euro growth by 59 points might not have happened because for this reason (the Australian and Canadian dollars are falling), as it was helped by additional news: PacWest Bancorp is on the verge of bankruptcy, and Congress has not made progress in raising the debt ceiling.

Today, the European Central Bank is also raising the rate by 0.25%, but the central bank’s sentiment may be softer than that of the FOMC, as yesterday’s inflation data in the eurozone were not optimistic. Tomorrow, the US labor data for April, according to forecasts, may turn out to be worse than March’s. This will weigh on stock prices, and yesterday, the S&P 500 lost 0.70%, which will completely eliminate any desire for investors to take risks. As a result, investors will again strengthen long positions on the dollar.

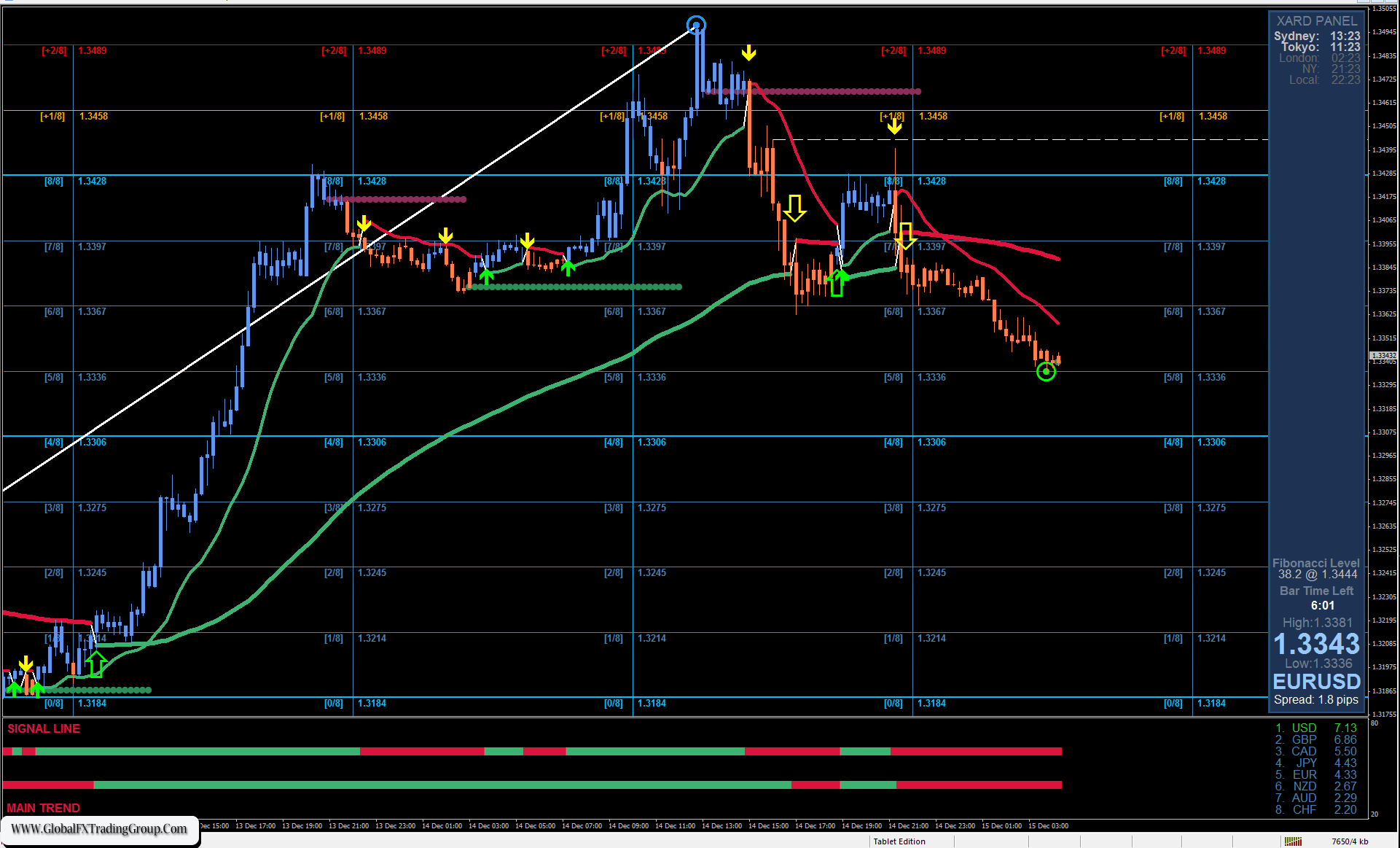

On the daily chart, the price crossed the upper limit of the descending price channel, which will be modified later, and for now, consolidating above yesterday’s high of 1.1092 will allow the euro to climb to 1.1185. If today closes with a black candlestick, the euro reversal will be out of the question. The target will be the MACD line in the area of the 1.0935 mark, followed by 1.0804.

On the four-hour chart, the euro doesn’t even try to reverse. The current levels can hardly be considered convenient, and the position (above the indicator lines) obliges to somehow continue the growth, so the market will prefer to maintain neutrality at local highs until the ECB’s decision on monetary policy is announced.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom