The euro managed to overcome the strong technical preconditions for a downward reversal. Yesterday, it grew by 50 points. But the euro is still under pressure. Thus, the Marlin oscillator is not even going to turn up on the daily chart.

And there are three plausible scenarios: the price overcomes the April 4 high at 1.0974, but the Marlin rises just a bit and a divergence appears; the price turns on the MACD line, creating a wide range consolidation; the price, having exhausted all forces, but still reaches the target level of 1.1033.

There is also a fourth option, which is pushed by today’s US inflation report. It is when the price returns and consolidates below the MACD line (1.0877) and falls in the target range of 1.0758/87. Core CPI for March is forecast to rise from 5.5% y/y to 5.6% y/y and with a monthly gain of 0.4%. Overall CPI is expected to decline from 6.0% y/y to 5.2% y/y, but with a monthly gain of 0.2%.

In general, the overall CPI has been increasing for 7 straight months, although last July it remained unchanged and created a weak base six months ago, so inflation at an annual rate does not inspire optimism in any way, and even today’s forecast could turn out to be worse (that is, above the expected 5.2% y/y). If the data turns out to be neutral, then our second scenario, i.e. a price spike on the MACD line, could materialize.

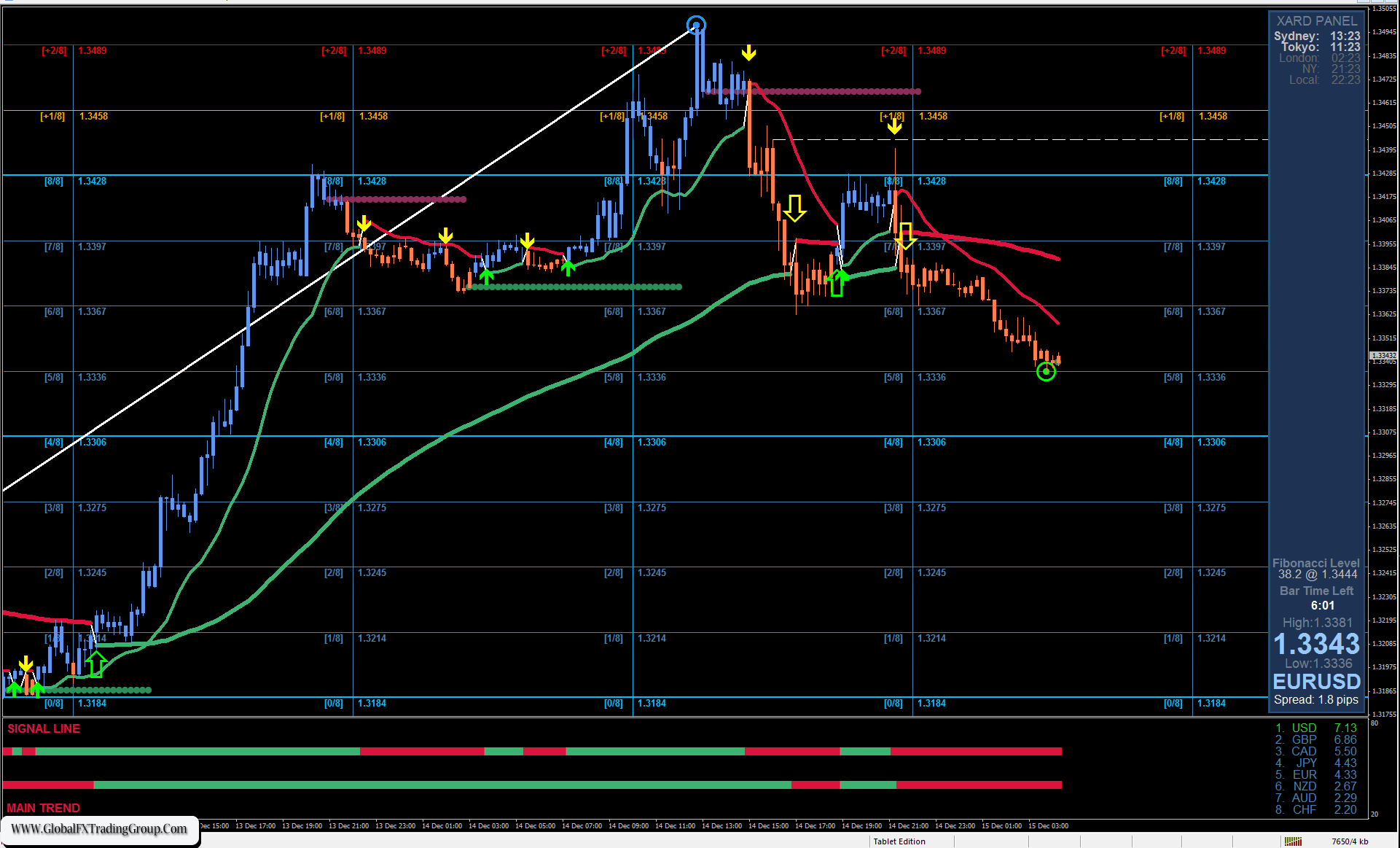

On the four-hour chart, price has once again stalled at the MACD line. But the Marlin has settled in the positive area, so the mood for growth prevails among speculators. Even the Asia-Pacific stock market is showing solid gains this morning. The main events will unfold in the evening, so let’s wait.

Considering that the pair could also move sideways, the benchmark level for the decline in the mid-term is shifted to Monday’s low at 1.0832.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom