Yesterday, the euro rallied 90 pips without any fundamental or technical reasons, breaking through two target resistances, 1.0595 and 1.0660. The trading volume was the highest since the 16th of February, there was probably a hunt for the bears’ Stop Losses, who were above 1.0650. If that’s the case, then the euro’s further growth looks really strange.

With a great stretch it is possible to assume that market participants expect a higher rate from the European Central Bank than the Federal Reserve, but, first of all, such a version hasn’t drawn much attention in the western press yet, and secondly, the rate difference even in the long term will be in favor of the Fed and the dollar.

What we hear more is the version that risk appetite increased due to upbeat Chinese PMI for February. The manufacturing PMI increased from 50.1 to 52.6 points. But the stock market did not benefit from this as the main indices closed in the red zone. Today, the European CPI for February is expected to decline from 8.6% y/y to 8.2% y/y and the number of initial jobless claims in the US might stay at a relatively low level for the last 6 weeks – the forecast is 195,000.

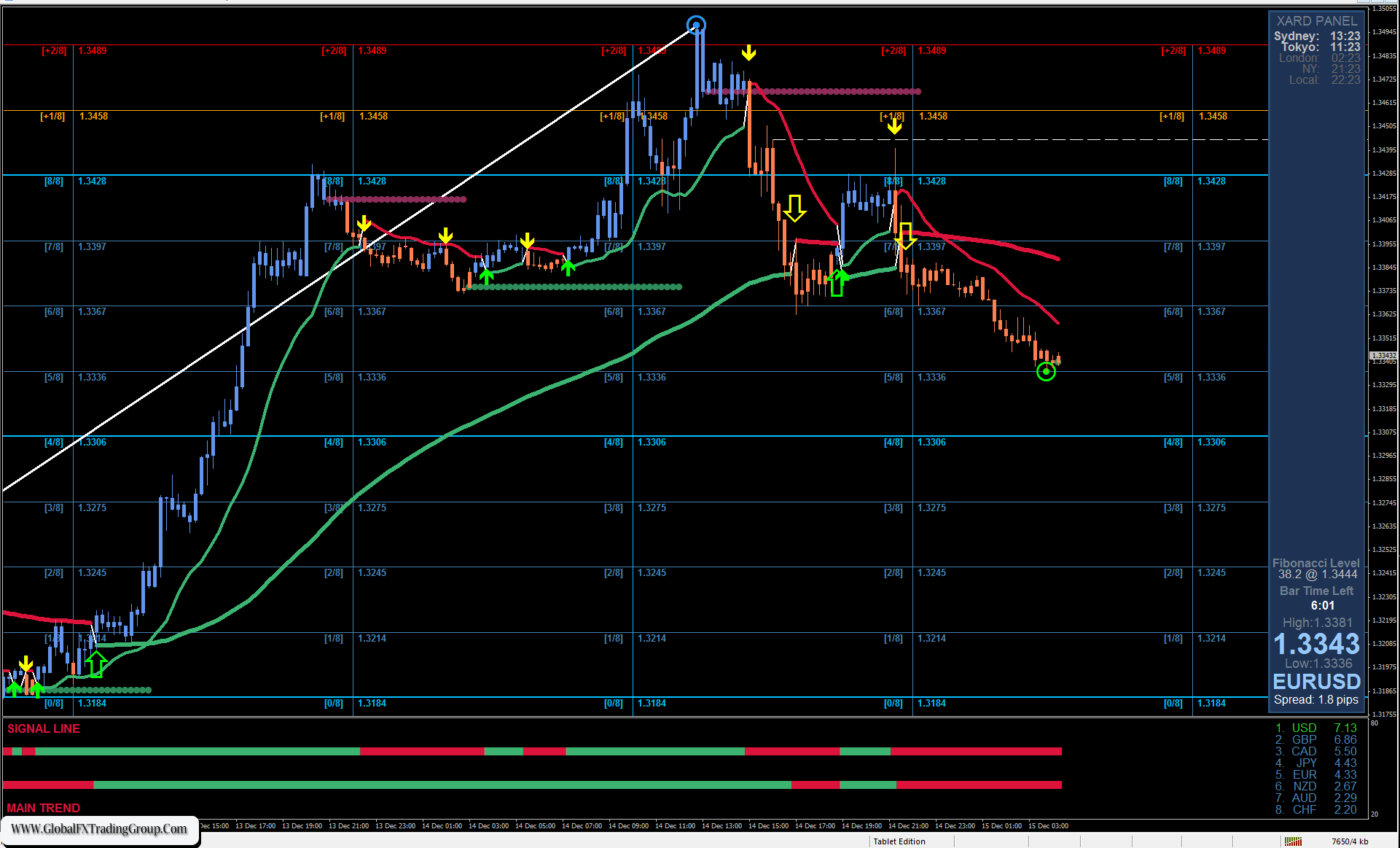

The signal line of the Marlin oscillator on the daily chart is in the negative area and shows the first sign of a downward reversal. If the price closes today below 1.0660, then further fall to 1.0595 will resume and, what we expect according to the main scenario, further advance to the target range of 1.0443/70.

An alternative scenario, the probability of which, however, has increased, suggests that the price settles above 1.0660 (i.e. closing the day with a white candlestick), Marlin’s transition into the positive zone and further growth to the target range of 1.0758/87.

On the four-hour chart, the price has consolidated above the balance and MACD indicator lines, it is still trying to overcome the support at 1.0660, the Marlin oscillator turns down sharply, which is an early sign of price reversal.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom