Yesterday, the euro failed to move towards the 1.0990 target and rolled back to Wednesday’s initial positions. If today’s U.S. consumer income/expenditure data is close to the forecast, the 1.0990 target will be much closer for the pair.

Consumer spending for December is expected to be down 0.1%, while income is expected to be up 0.2% after a 0.4% gain in November. As before, the probability of forming a divergence between the price and the Marlin oscillator with the consequent reversal of the price into a medium-term decline remains.

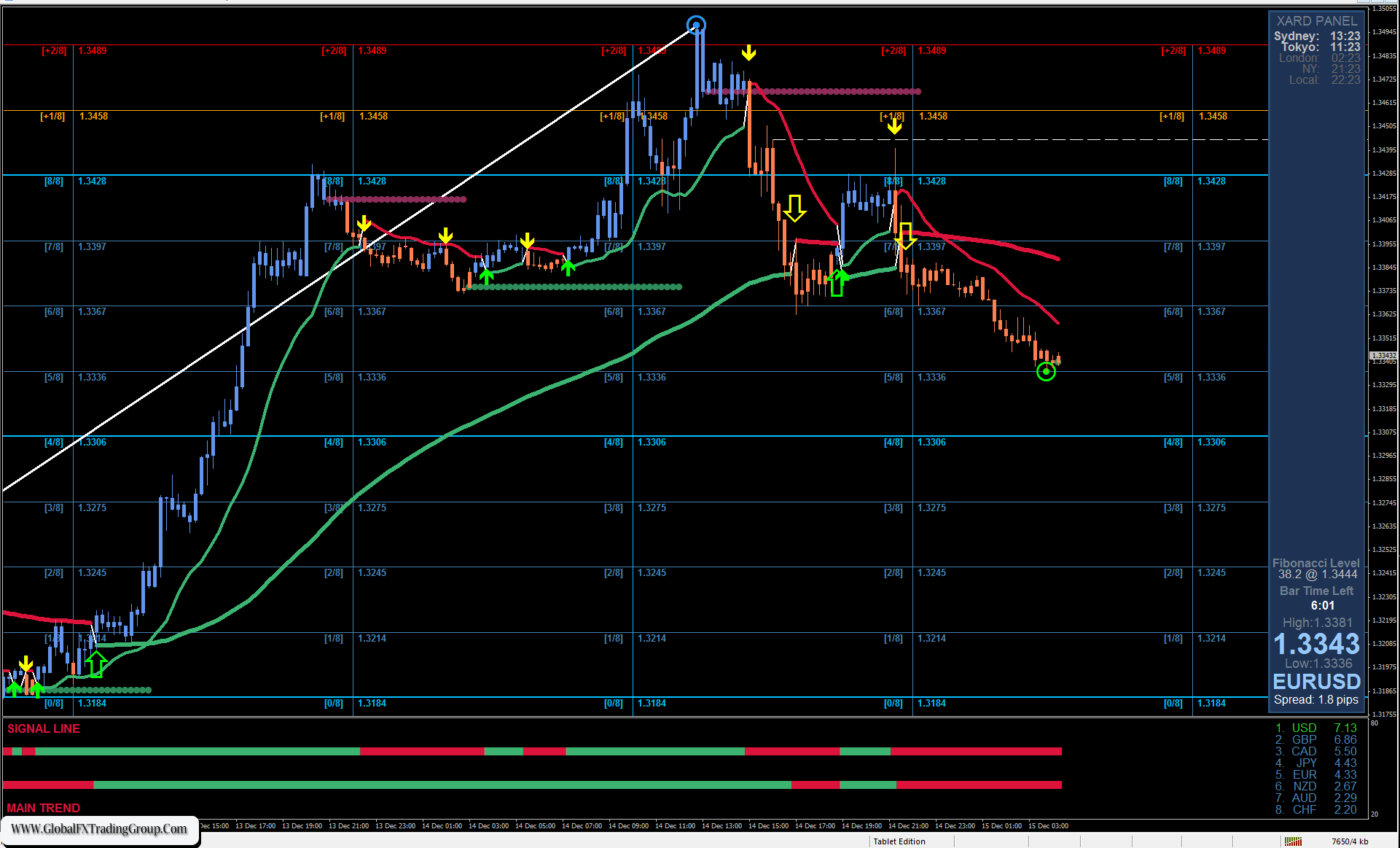

On the four-hour chart, the price returned above the MACD indicator line after a brief (and false) move below it. The same false movement was made by the Marlin oscillator yesterday. Currently, there is growth. Expect the day to close above Wednesday’s closing level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom