At yesterday’s meeting, the European Central Bank raised the rate by 0.75% – as expected by the optimistic part of economists. The moderate part assumed an increase of 0.50%. ECB President Christine Lagarde’s subsequent speech made it clear that further growth would slow down. The next increase will be 0.50% followed by 0.25% until the target level of 2.00% is reached.

Such a plan clearly shows that the ECB’s policy will be softer than the Federal Reserve, which is more than obvious in the current political and economic realities. We will not be surprised that a further European crisis will force the ECB to carry out the next increase only for the form – by 0.25%. Note that Lagarde did not commit to raise the rate at the next meeting by 0.50%.

The euro closed the day down 20 points.

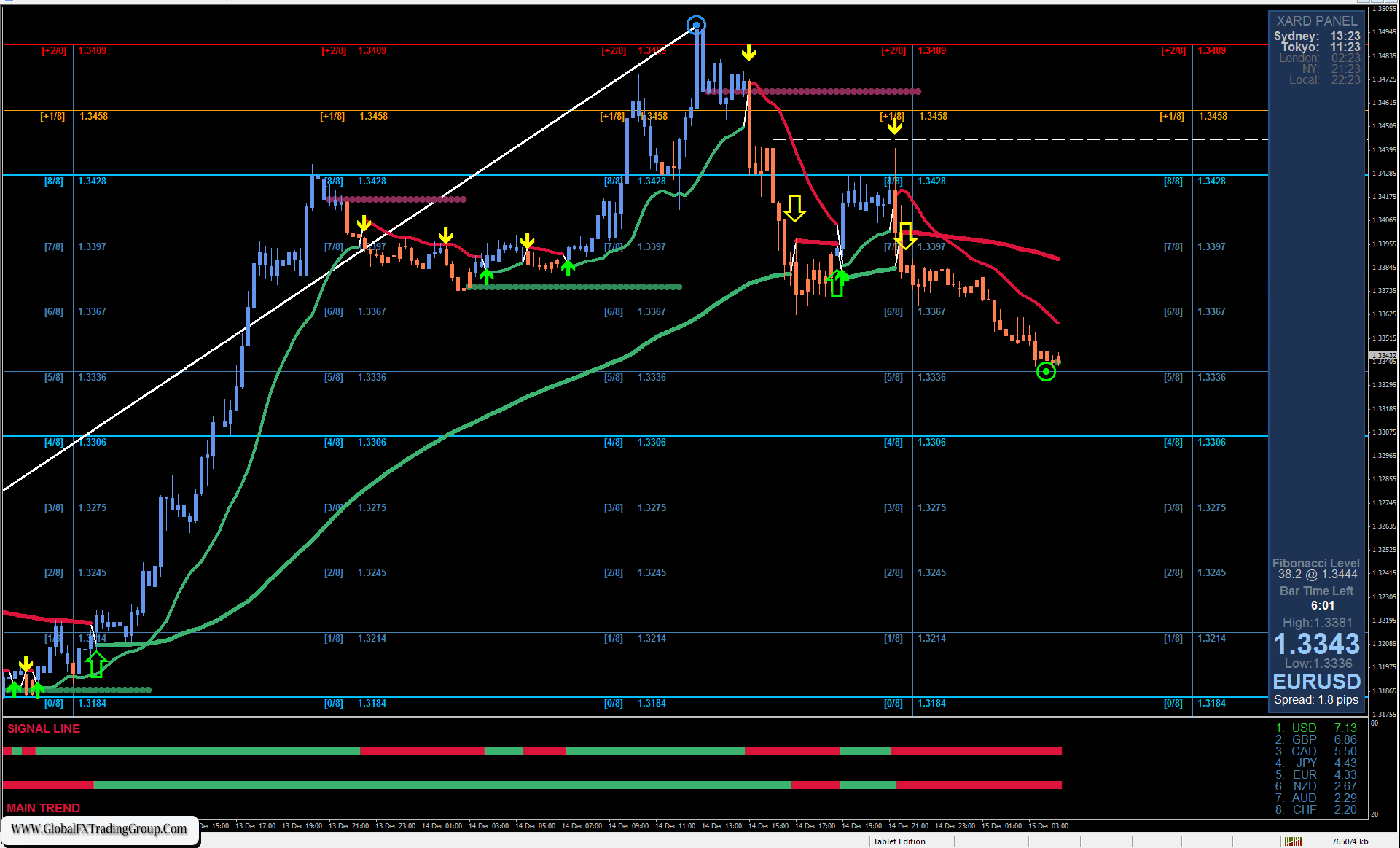

Today the euro began with growth. The price returned above the target level of 1.0020 and entered the struggle with the MACD line (1.0065). Consolidating above the level will allow the price to continue rising to the target level of 1.0150. The Marlin Oscillator has already moved into the growth zone and supports the price’s bold intention.

If the level of 1.0150 is overcome, then the euro will fall into a strong speculative game up to 1.0360, after which a strong collapse below 0.9850 may follow. Yesterday’s trading volumes were the highest since August 2nd.

On the four-hour chart, the price is in an upward trend for all indicators. We do not rule out that the market is now being bought out on the occasion of the death of the English Queen Elizabeth II in order to avoid a fall in values, but the markets seem to have calmed down and they can be released into further free development, that is, downward.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom