Here are the details of the economic calendar for December 15, 2021

A lot of statistics were published yesterday: UK inflation, which accelerated to 5.1%, US retail sales, which rose to 18.2%, but this was just a warm-up. So, the Fed meeting was considered the key event of the day and month.

The main points of the FOMC:

• The decision on the US interest rate is the actual 0.25% (forecast 0.25%, previous 0.25%).

• The Fed’s average forecast shows three increases in 2022 (three increases in 2023 were announced during the previous meeting).

• By the end of 2024, 5 out of 18 Fed members expect the federal funds rate to be at or above the neutral rate of 2.5%.

• FOMC will cut the monthly purchase rate of Treasury bonds by $ 20 billion.

• FOMC will reduce the monthly purchase rate by $10 billion.

• The Fed expects PCE inflation to be 2.6% in 2022 (previous 2.2%), 2.3% in 2023, 2.1% in 2024.

• PCE core inflation is expected to be 2.7% in 2022 (previous 2.3%), 2.3% in 2023, and 2.1% in 2024, according to the Fed.

• Ten Fed officials expect three rate hikes in 2022; five officials expect two hikes in 2022.

Based on expectations, the regulator plans to tightly tackle the inflation that is growing by leaps and bounds, but it is worth noting that the market behaves in a mirror way. Stock indexes and the currency market are growing against the US dollar, which indicates a high speculative hype. To put it simply, the market denies reality and wants a continuation of the banquet.

Analysis of trading charts from December 15:

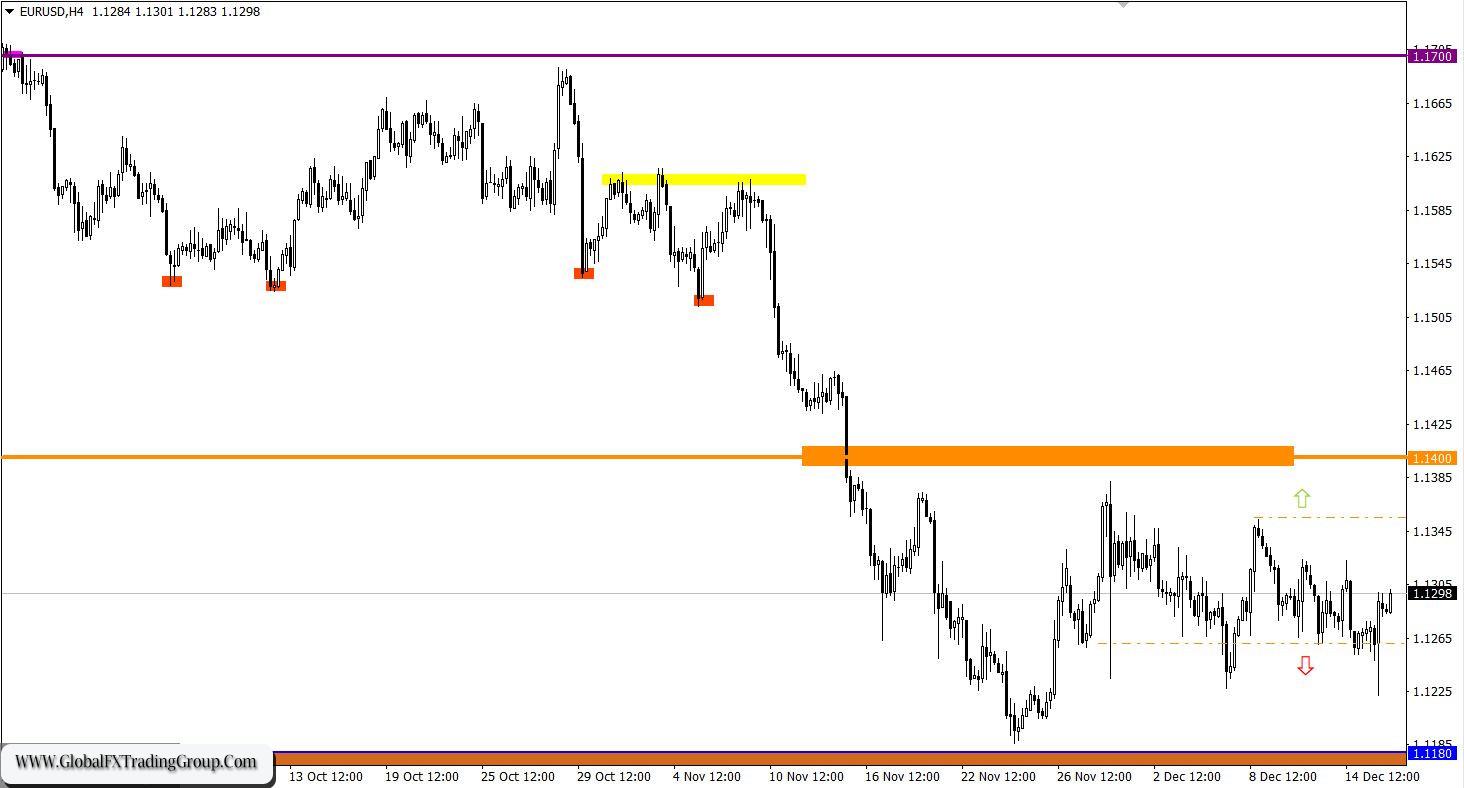

Despite market speculation, the EUR/USD pair is still above the level of 1.1260. This indicates a characteristic uncertainty among traders, where the 1.1265/1.1355 side channel serves as an area of equilibrium of trading forces. The longer the quotes follow within the borders of the flat, the stronger and more purposeful the subsequent move will be.

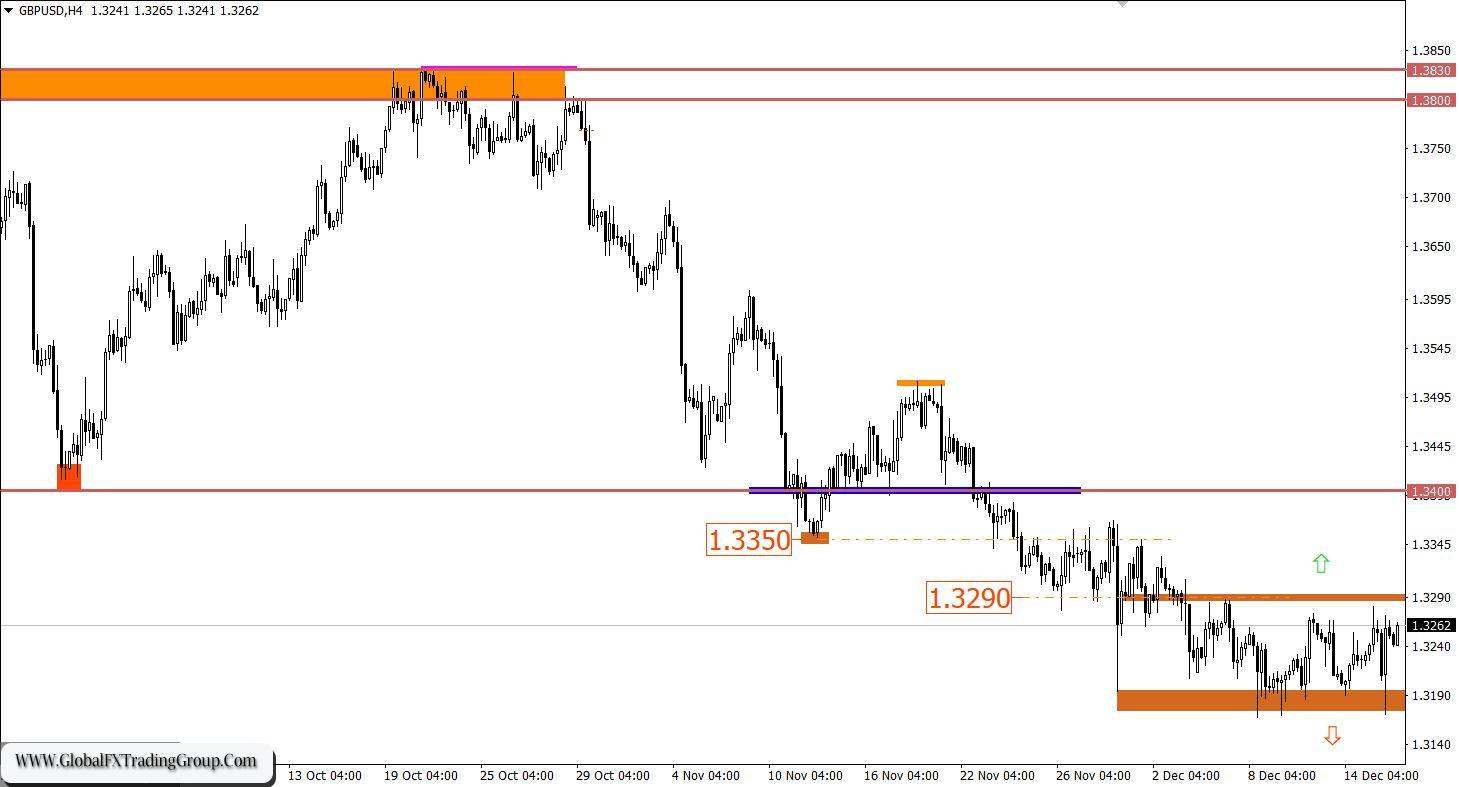

The GBP/USD pair, after a short burst of activity, resumed movement within the 1.3200/1.3290 flat, consistently working out the set borders. In this situation, the flat only aggravates speculators to possible price increases.

December 16 economic calendar:

It will not be possible to relax today, as there are two meetings on the agenda. The Bank of England will be the first to report, which is unlikely to bring at least something new, despite the rapidly growing inflation in the country. The regulator, following the results of the last meeting, clearly outlined its plans for the next two years and the probability that the Bank of England will make the next changes in just a month and a half is unlikely. Therefore, one can listen, but it will not have any impact on the market.

The ECB board meeting may well end without changes, as representatives of the European regulator have hinted several times over the past week that no changes are planned yet. In this scenario, all hope is for speculators, who may well seize on some comments or rumors. Yesterday, the well-known financial media began to publish news that the ECB may well begin to raise the rate intensively. This provoked a lot of discussion and speculation. There are no specifics in terms of sources of information, but this is enough for speculators.

Now, we are monitoring the results of the ECB meeting and possible information outliers. In terms of statistical data, weekly figures on applications for unemployment benefits in the US will be published today, where a reduction in the total volume is predicted.

Details of statistics: The volume of initial applications for benefits may leave from 184 thousand to 215 thousand. The volume of repeated applications for benefits may be reduced from 1,992 thousand to 1,915 thousand. Statistical data overlap in time with the ECB press conference and so, it will remain without attention.

Time details:

Bank of England meeting results – 12:00 Universal time

ECB meeting results – 12:45 Universal time

ECB Press Conference – 13:30 Universal time

U.S. Unemployment Insurance Claims – 13:30 Universal time

Trading plan for EUR/USD on December 16:

There is still stagnation in the market in the form of a flat 1.1265/1.1355, which plays the role of a catalyst for trading forces. It will be completed soon and this will lead to a sharp acceleration in the market at the moment of the breakdown of one or another stagnation border. Traders consider the levels of 1.1260 and 1.1360 as control levels, confirming the signal by holding the price in a four-hour period.

Trading plan for GBP/USD on December 16:

Based on the long-term formation of the 1.3200/1.3290 side channel, it can be assumed that the flow of speculation will complete it soon. In this situation, the most appropriate trading tactic is considered to be the method of breaking one or another border of the established range, focusing on signal levels.

Buy positions should be considered after holding the price above 1.3300 in a four-hour period.

Sell positions should be considered after holding the price below 1.3165 in a four-hour period.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future. The up/down arrows are the reference points of the possible price direction in the future.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom