Here are the details of the economic calendar for Sept 9:

The focus of everyone’s attention yesterday was the results of the European Central Bank (ECB) meeting, where nothing extraordinary happened. The regulator left the key rate at the previous levels with a warning that it will keep this policy until inflation reaches 2% and the progress in core inflation is not high enough to match inflation stabilization at 2% in the medium term.

During the press conference, Christine Lagarde noted that the economic recovery is becoming more noticeable. According to her, the increase in inflation is considered a local manifestation.

The market reacted to such an important economic event with a price stagnation due to the lack of specifics on the part of the ECB. The only thing that stopped the euro from a big decline was the regulator’s statement that they cut the volume of the quantitative easing program from 80 to 60 billion euros per month. Together with the press conference, unemployment benefits data in the United States were published, where they recorded a decrease in their volume.

Details of statistics:

The volume of initial applications for benefits fell from 345 thousand to 310 thousand. The volume of repeated applications for benefits fell from 2 805 thousand to 2 783 thousand. It should be noted that the previous figure for repeated applications was revised in favor of growth from 2,748 thousand to 2,805 thousand.

* Applications for unemployment benefits reflect the number of currently unemployed citizens and those receiving unemployment benefits. This indicator is considered to be the state of the labor market, where the growth of the indicator negatively affects the level of consumption and economic growth. The reduction of applications for benefits has a positive effect on the labor market.

Analysis of trading charts from September 9:

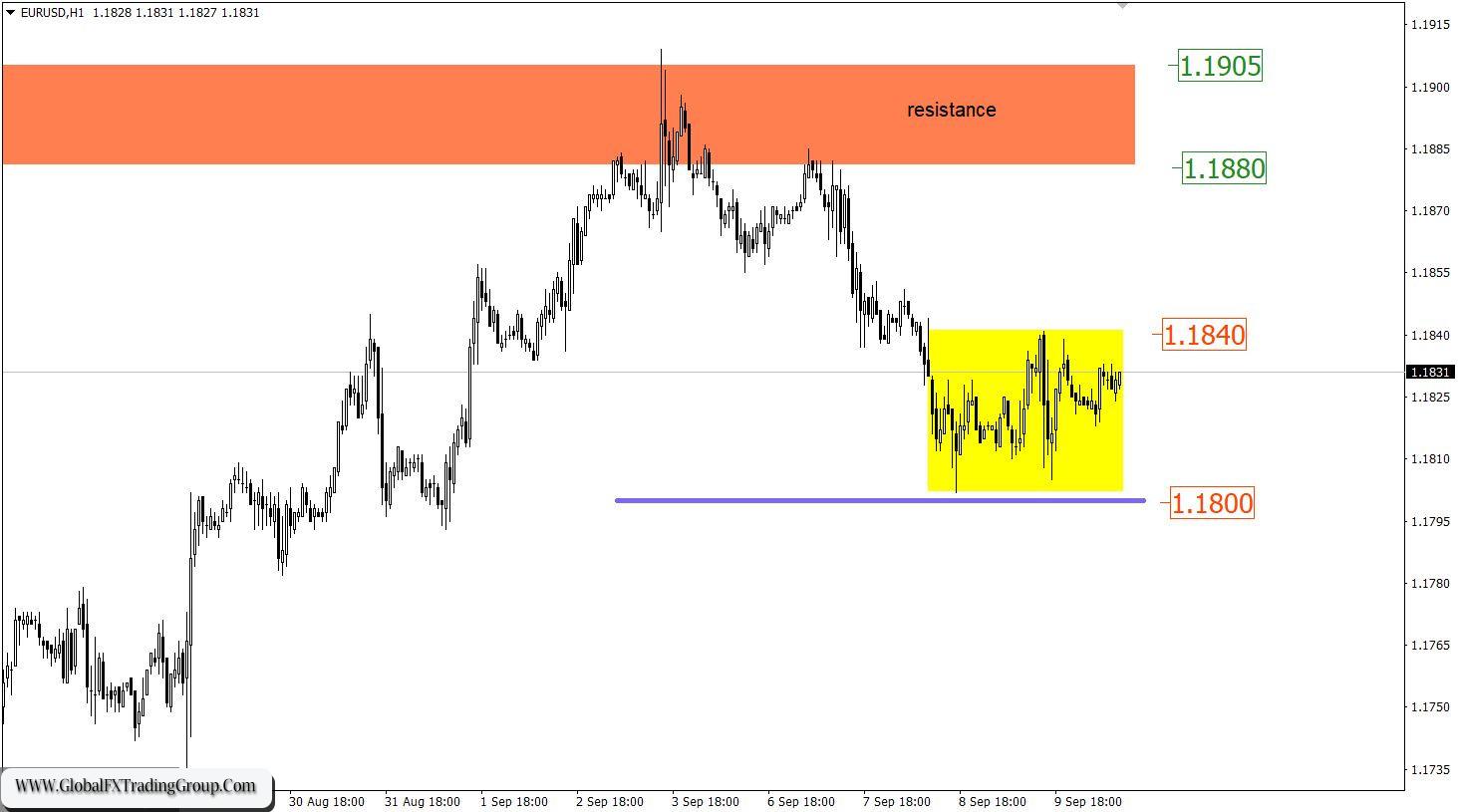

The price rebound from the resistance area of 1.1880/1.1905 returned the quote to the support level of 1.1800, where a 40-hour stagnation occurred within the borders of 1.1800/1.1840. A looped move in a sideways range is considered to be the process of accumulation of trading forces, where acceleration will most likely occur in the market. Our trading plan indicated the superiority of short positions for the fourth day in a row. This strategy has brought us income, but considering the price stagnation, plans will be revised.

The GBP/USD pair rebounded from the support area of 1.3730/1.3750, returning the quote to the resistance level of 1.3880. In this situation, there was an increased speculative interest among market participants. This resulted in sharp price changes and an overbought status of the pound.

Trading recommendations on September 9 indicated the possibility of a price rebound from the support area, with a pivot point in the form of the level of 1.3800. This movement is considered local. The process of accumulation of trading forces is price fluctuations in a closed amplitude, where at the moment of the breakdown of a particular stagnation border, a local acceleration in the direction of breakdown often occurs.

* The resistance level is the so-called price level, from which the quote can slow down or stop the upward movement. The principle of constructing this level is to reduce the price stop points on the history of the chart, where the price reversal in the market has already occurred earlier.

* The support level is the so-called price level, from which the quote can slow down or stop the downward course. The principle of constructing this level is to reduce the points of support on the history of the chart, where the price reversal in the market has already occurred earlier.

* Overbought market – a situation that occurs after prices have risen too high and quickly, and prices are expected to fall soon. In our situation, we are talking about the pound sterling.

September 10 economic calendar:

Today, the United Kingdom published its better-than-expected data on industrial production. The slowdown in growth rates was from 8.3% to 3.8% with the forecast of a decline to 3.2%. The divergence of expectations is positive in favor of the British currency, but given the recent price surges, the pound has nowhere to grow. As for the United States, data on producer prices are to be published. It is expected to accelerate from 7.8% to 8.3%. Consequently, there is a risk of further growth in inflation, which is already at a record high.

Trading plan for EUR/USD on September 10:

In this case, it can be assumed that the amplitude movement within the borders of 1.1800/1.1840 will end soon. Now, it is worth preparing for the upcoming acceleration by using the method of breaking one or another border of the side range. Buy positions will be considered if the price is held above the level of 1.1850. Sell positions will be considered if the price is held below the level of 1.1790.

Trading plan for GBP/USD on September 10:

The resistance level of 1.3880 is hanging over the market participants, which puts pressure on long positions. In this situation, traders consider two possible scenarios. The first scenario is based on the previous logical basis, associated with the resistance level of 1.3880. Within its area, there may be a reduction in the volume of buy positions. This will lead to a slowdown in the upward movement and, as a result, a price rebound along a downward course.

The second scenario considers the preservation of speculative interest in the market, where if the price holds above the level of 1.3910 on a four-hour period, a path will open towards the psychological level of 1.4000. Long positions or Long means buy positions. Psychological levels are round values (1.2000, 1.3000, 1.4000,1.5000, etc.) that serve as key coordinates in the market, which traders pay special attention to. These levels are often used as support or resistance.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices. Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market. Circles and rectangles are highlighted examples where the price of the story unfolded.

This color selection indicates horizontal lines that may put pressure on the quote in the future. The up/down arrows are the reference points of the possible price direction in the future. Golden Rule: It is necessary to figure out what you are dealing with before starting to trade with real money. Learning to trade is so important for a novice trader because the market is constantly dynamic and it is important to understand what is happening.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom