Analysis of transactions in the EUR / USD pair

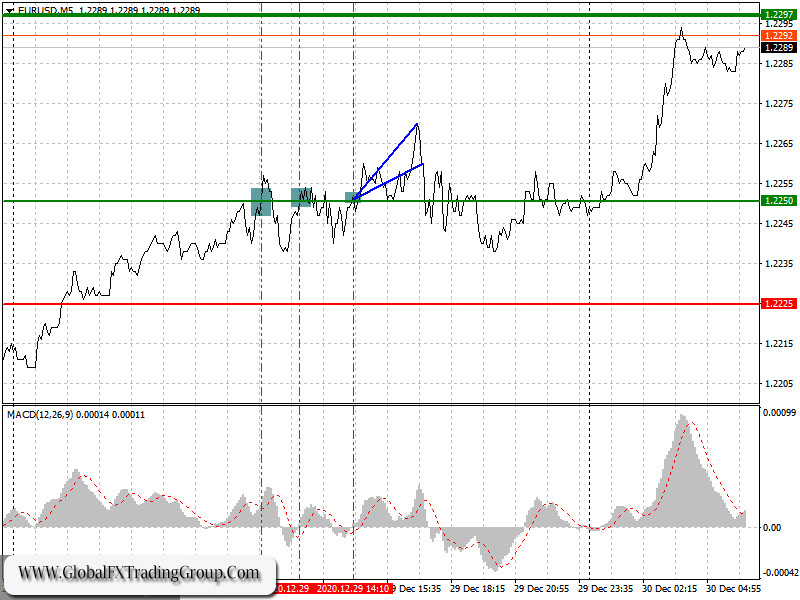

Three buy signals emerged in the market yesterday. The first one is at 1.2250, which appeared after the MACD line moved upwards in the chart, indicating the weak recovery prospects for EUR / USD. Then, afterwards, the MACD line went close to zero, so as a result, the euro climbed 20 pips up from the initial price level. Trading volumes have decreased significantly, as was the overall volatility of the pair.

Trading recommendations for December 30

The euro rose today during the Asian session, and it seems that it would continue doing so for the rest of the day. Economic reports from the US, which are scheduled to be released this afternoon, are unlikely to help the dollar regain its positions against risky assets. However, attention should still be paid to data on foreign trade, Chicago PMI index and the US wholesale price index. Better-than-expected values could limit the upward potential for the euro.

In another note, there are patients diagnosed with the new strain of coronavirus in the EU, but the ongoing vaccinations is retaining hope that the current COVID-19 vaccines will also be effective against the mutated virus.

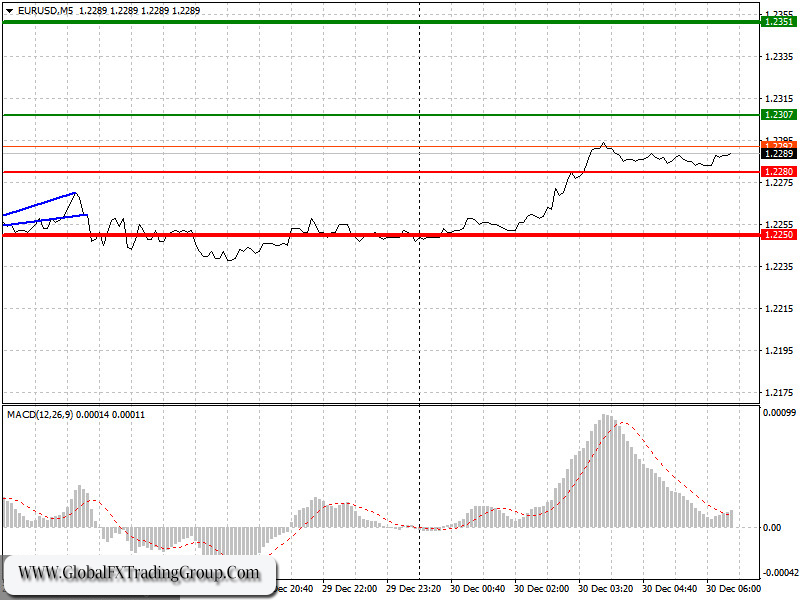

For long positions:

Buy the euro when the quote reaches 1.2307 (green line on the chart), and then take profit around the level of 1.2351. However, growth is rather dubious because 1.2307 is a new yearly high. Also, keep in mind that before buying, make sure that the MACD line is above zero and is starting to rise from it.

For short positions:

Sell the euro after the quote reaches 1.2280 (red line on the chart), and then take profit at the level of 1.2250. Demand for risky assets is expected to decrease because of low trading volume, which will allow speculators to take control of the market. Of course, keep in mind that before selling, make sure that the MACD line is below zero and is starting to move down from it.

What’s on the chart:

- The thin green line is the key level at which you can place long positions in the EUR/USD pair.

- The thick green line is the target price, since the quote is unlikely to move above this level.

- The thin red line is the level at which you can place short positions in the EUR/USD pair.

- The thick red line is the target price, since the quote is unlikely to move below this level.

- MACD line – when entering the market, it is important to be guided by the overbought and oversold zones.

Important:

Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom