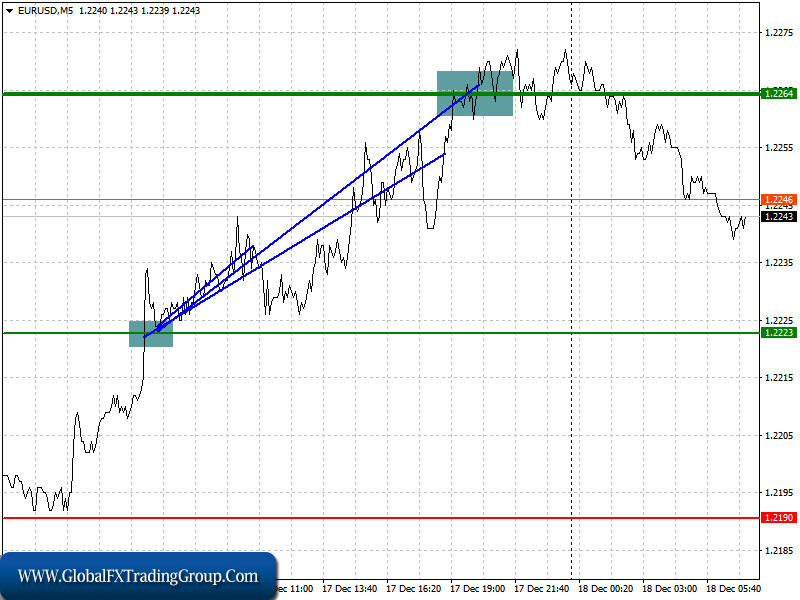

Analysis of transactions in the EUR / USD pair

Weak data on the US labor market put pressure on the dollar yesterday, so as a result, EUR / USD reached a new yearly high, managing to rise up to the target value of 1.3364. All in all, the quote moved 40 pips up from 1.2223.

However, during today’s Asian session, the pressure on the dollar eased, after news emerged that the US Congress continues to disagree over the details of the new stimulus package. If a program is not approved by the end of the year, the US dollar will rise.

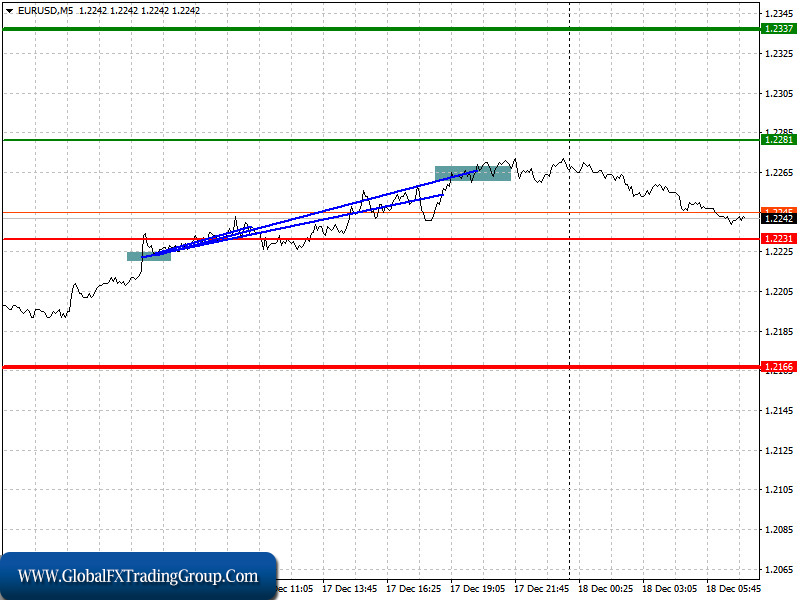

Trading recommendations for December 18

EUR / USD will grow if economic reports from Germany show better-than-expected values. Accordingly, if these data come out worse than the forecasts, the euro will continue its downward correction. In the afternoon, there is nothing that could significantly affect the market.

Therefore, in the absence of bears’ activity in the area of 1.3513, the pair will most likely hover in a sideways channel. At the same time, the chances of the bulls to continue the upward trend next week will increase.

Open a long position when the euro reaches a quote of 1.2281 (green line on the chart) and then take profit at the level of 1.2337. However, growth can only happen if the data from Germany comes out better than expected. A stronger leap may also occur if a trade agreement is reached. Open a short position when the euro reaches a quote of 1.2331 (red line on the chart) and then take profit around the level of 1.2166.

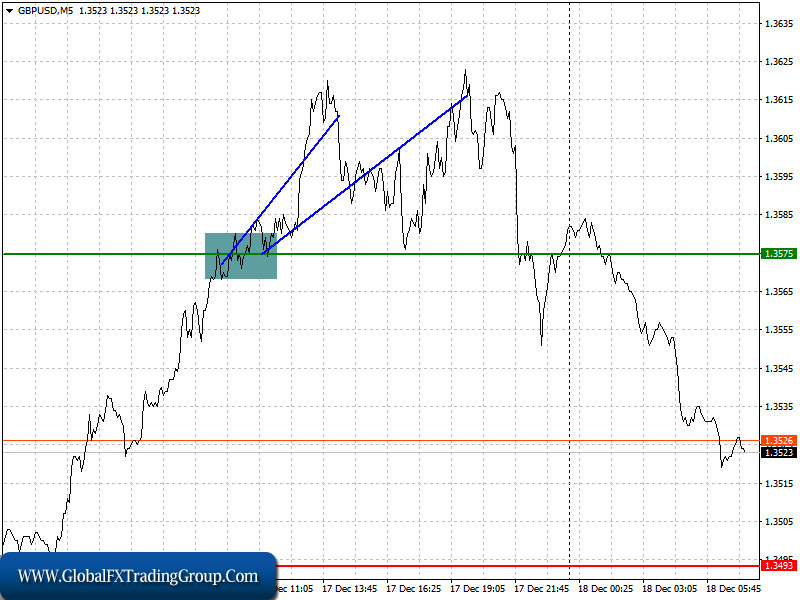

Analysis of transactions in the GBP / USD pair

Although the pound did not reach the target price level, long positions in the market still gave quite a lot of profit, since the quote climbed 40 pips up from the level of 1.3575 yesterday. The main reason for this was the statements from European Commission President Ursula von der Leyen, who said that disagreements between the UK and the EU remain only about how European fishing vessels will have access to UK waters.

But the failure to reach an agreement on this issue will result in the cancellation of the entire UK-EU trade deal. In another note, the pound also rose after the Bank of England left its key interest rate at 0.1%.

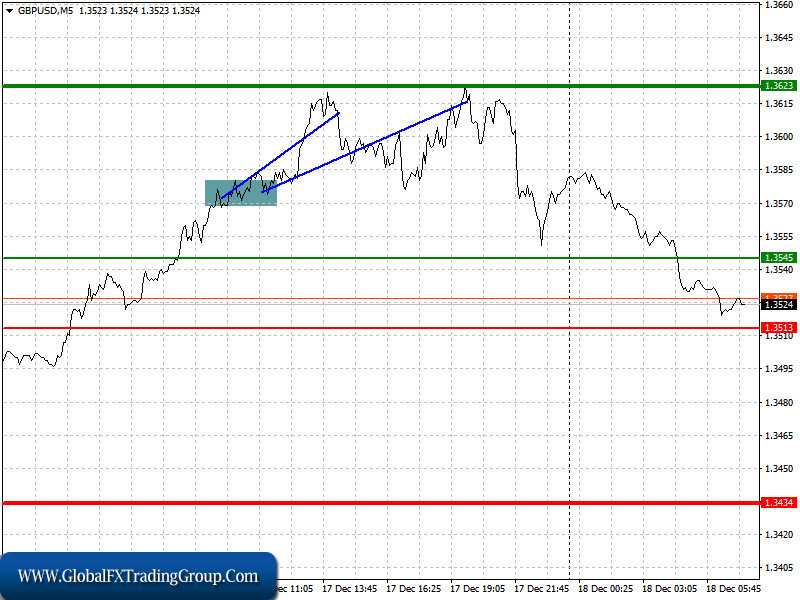

Trading recommendations for December 18

Demand for the pound is gradually decreasing as many are starting to lose faith that a trade deal will be signed this week. At the same time, a report on UK retail sales will be published today, which could lead to a surge in volatility. Good data will bring demand back to the British pound, while bad data will put pressure on the pair and maintain the observed bearish trend in the short term.

Open a long position when the quote reaches the level of 1.3545 (green line on the chart) and then take profit around the level of 1.3623 (thicker green line on the chart). Good news on Brexit, as well as strong data on UK retail sales, may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3513 (red line on the chart) and then take profit around the level of 1.3434. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom