Analysis of transactions in the EUR / USD pair

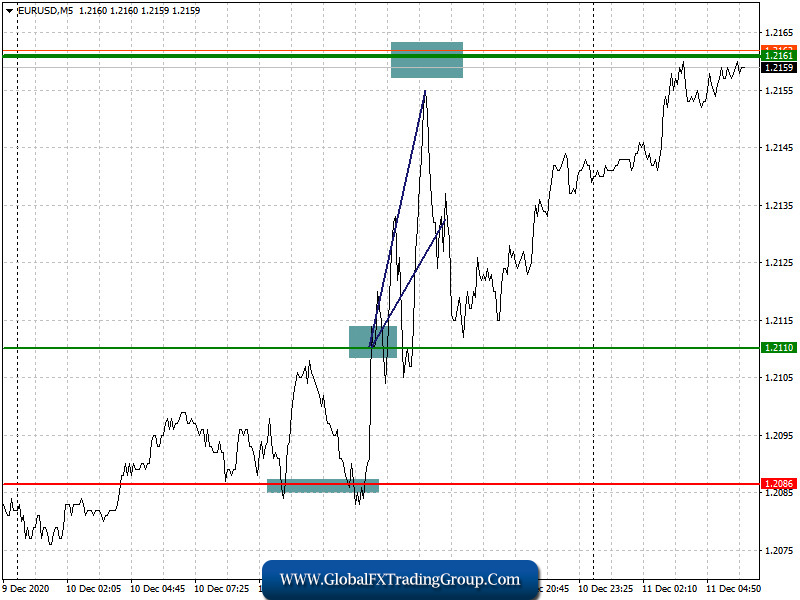

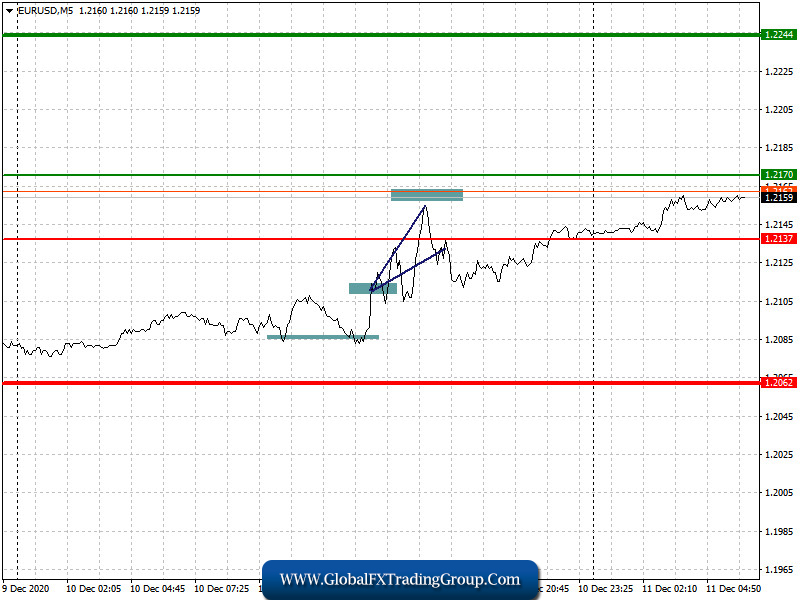

The outcome of the ECB meeting yesterday did not lead to major sell-offs in the European currency. Instead, it created a good buy signal at 1.2110, which made it possible to compensate for all losses from earlier transactions. The total upward movement was over 45 pips.

Trading recommendations for December 11

The proposal of the European Commission yesterday about Brexit did not support the European currency, as they further weakened the likelihood of reaching a trade deal. But since this topic has more influence on the British pound, after the meeting of the European Central Bank, the chances of further growth in the euro increased.

Today, a report on Germany’s CPI will be published, and it is expected to show rather positive figures. Data on Italy’s volume of industrial production will also be released, but more attention will remain on the European Council meeting, where the expanded EU budget and the eurozone economic recovery fund, which was created this summer, will be discussed. If there is good news in all directions, the European currency will continue to grow. As for US statistics that are also scheduled for release today, they are unlikely to increase demand for the US dollar.

Open a long position when the euro reaches a quote of 1.2170 (green line on the chart) and then take profit at the level of 1.2244. However, growth can only happen if there is good news from the EU summit, particularly on the funds of the eurozone for the coming years. Open a short position when the euro reaches a quote of 1.2137 (red line on the chart) and then take profit around the level of 1.2062. Do this especially if the data on the eurozone comes out worse than the forecasts.

Analysis of transactions in the GBP / USD pair

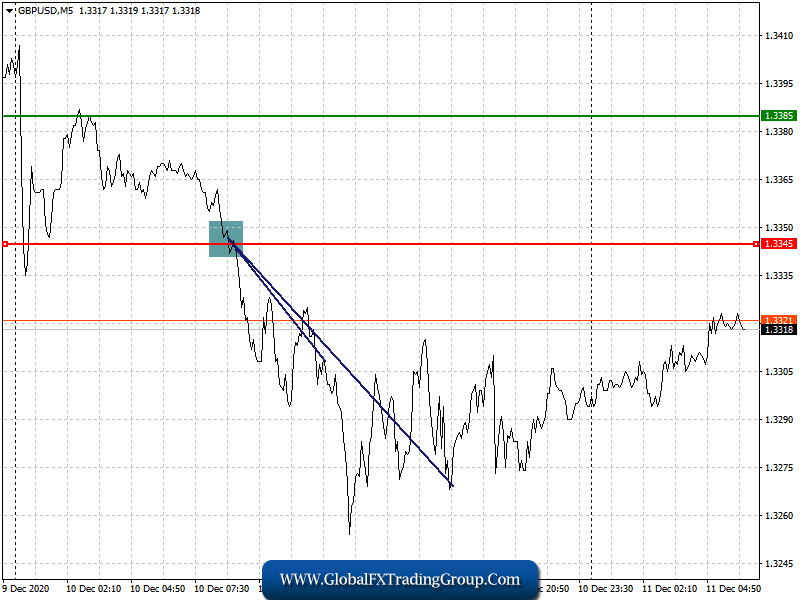

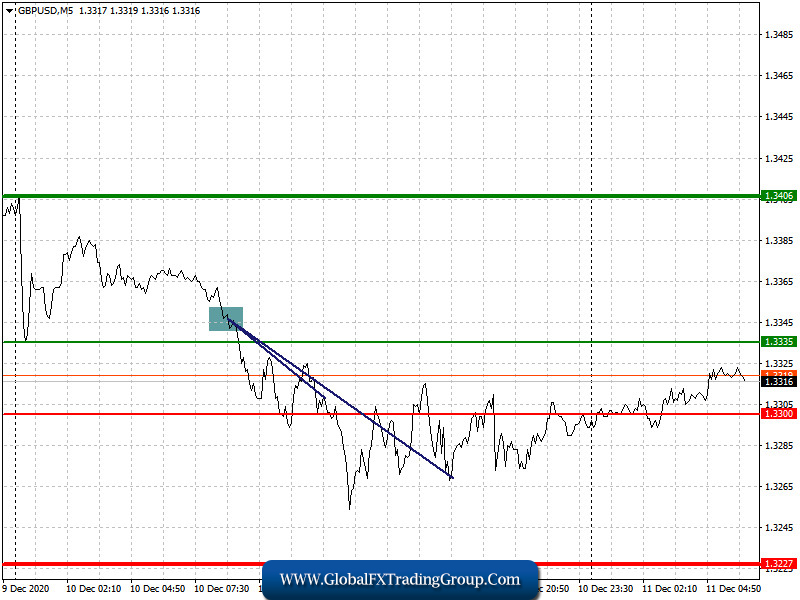

The proposal of the European Commission yesterday was clearly not to the liking of traders, especially the pound bulls. The commission offered the UK a fisheries agreement for only one year, which led to a large drop in the pound, down to this week’s lows. Against this background, a fairly strong sell signal was formed, at the price of 1.3345. Such a deal resulted in a total drop of over 80 pips.

Trading recommendations for December 11

Demand for the pound is expected to decrease, especially since there is a high chance that the UK will not agree to the EU’s proposal, as Boris Johnson does not intend to deviate from the conditions he put forward. Nevertheless, negotiations will continue until Sunday, and it will be decisive in all this hassle. In any case, the optimism of pound bulls has clearly faltered, and today’s minutes of the Bank of England, as well as the speech of Governor Andrew Bailey may even lead to the continuation of the bearish trend. Meanwhile, macroeconomic statistics from the United States, which are expected to be released this afternoon, are unlikely to support the dollar.

Open a long position when the quote reaches the level of 1.3335 (green line on the chart) and then take profit around the level of 1.3406 (thicker green line on the chart). Good news on Brexit, as well as positive statements from the Bank of England, may strengthen the position of the British pound. But since traders are becoming less and less confident that there will be a post-Brexit trade deal, it is best not to leave open positions today, as there is a high risk of serious price gaps after the weekend.

Open a short position when the quote reaches the level of 1.3300 (red line on the chart) and then take profit around the level of 1.3227. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom