Analysis of transactions in the EUR / USD pair

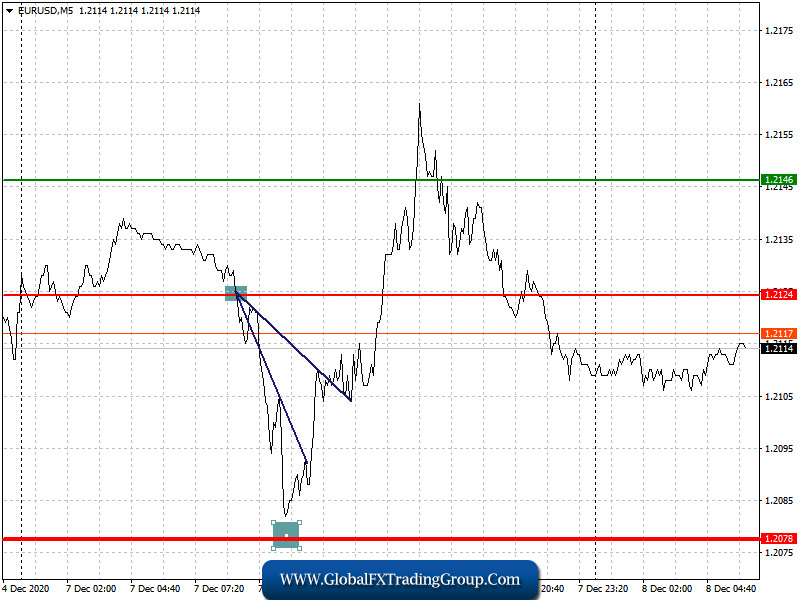

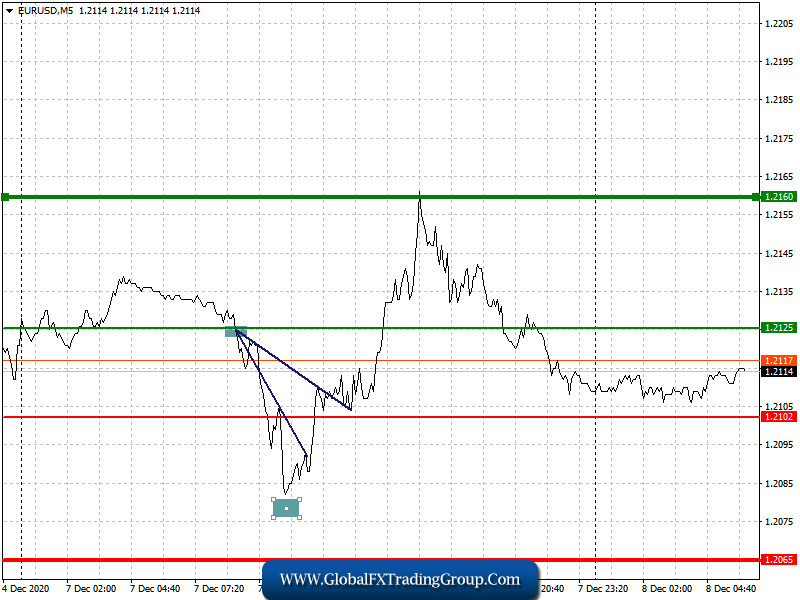

Bad news on Brexit helped euro bears to achieve a good downward movement in the EUR / USD pair. However, the quote was not able to reach the target level which was 1.2078. Nonetheless, short positions at 1.2124 were very profitable, and this due to high volatility even in the absence of important economic reports. In total, the euro moved about 35-40 pips. Apparently, the situation with Brexit continues to dictate market conditions, since the strength of the European currency also depends on whether there will be a deal or none.

Trading recommendations for December 8

Several economic reports will be published for the EU today. For example, business sentiment in Germany and ZEW current conditions index. These two indicators are much more important than the data on GDP and the level of employment, therefore, a sharp decline in their values will negatively affect the European currency. But if their report turns out to be better than the forecasts, the euro could continue rising, in which it may even reach a new yearly high.

At the moment though, the euro is under pressure due to the scheduled meeting of the European Central Bank this week. If at its meeting, the bank decided to make significant adjustments to its stimulus program, or if they resort to verbal intervention, the position of the euro will decrease and weaken further in the market.

Meanwhile, in the afternoon, a report on small business optimism will be published for the United States, however, it is unlikely to affect the position of the US dollar. Bad news on Brexit could also lead to a serious spike in volatility.

Open a long position when the euro reaches a quote of 1.2125 (green line on the chart) and then take profit at the level of 1.2160. However, growth can only happen if the EU releases good economic data. Open a short position when the euro reaches a quote of 1.2102 (red line on the chart) and then take profit around the level of 1.2065. However, do this only if data on the EU comes out worse than expected, and if the risk of not signing a post-Brexit trade deal increases.

Analysis of transactions in the GBP / USD pair

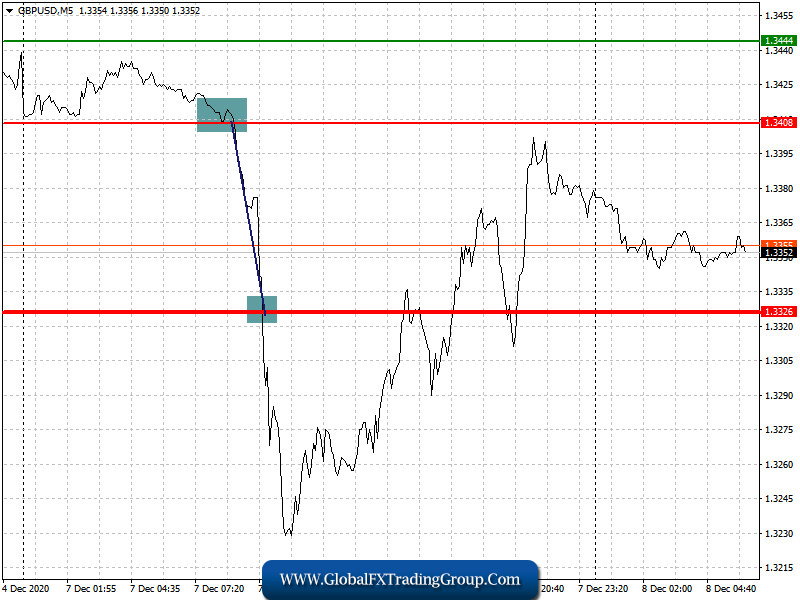

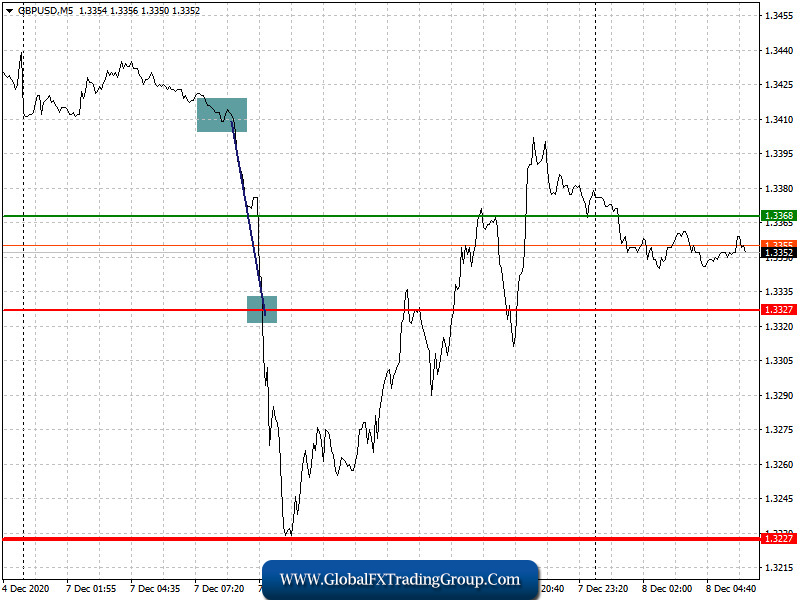

Short positions from 1.3408 moved the pound down by 80 pips yesterday, so as a result, the GBP / USD pair reached a quote of 1.3326. Such decline was caused by bad news on Brexit. Then, in the afternoon, news emerged that UK Prime Minister Boris Johnson will personally deal with the issue of the trade agreement, which eased the pressure on the market and led to the recovery of the pound.

Trading recommendations for December 8

The pound will continue to move depending on the progress of Brexit negotiations. Tomorrow, Wednesday, UK Prime Minister Boris Johnson will meet European Commission President Ursula von der Leyen to discuss key issues, during which, most likely, a final decision will be made. But so far, no one is willing to make concessions, however, the deadline for negotiations is already near. If the issue on fishing is finally resolved, the likelihood of signing an agreement increases, thus, demand for the pound will rise, which will lead to a new wave of growth in the GBP / USD pair.

Open a long position when the quote reaches the level of 1.3368 (green line on the chart) and then take profit around the level of 1.3485 (thicker green line on the chart). Good news on Brexit may strengthen the position of the British pound. Open a short position when the quote reaches the level of 1.3327 (red line on the chart) and then take profit around the level of 1.3227. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom