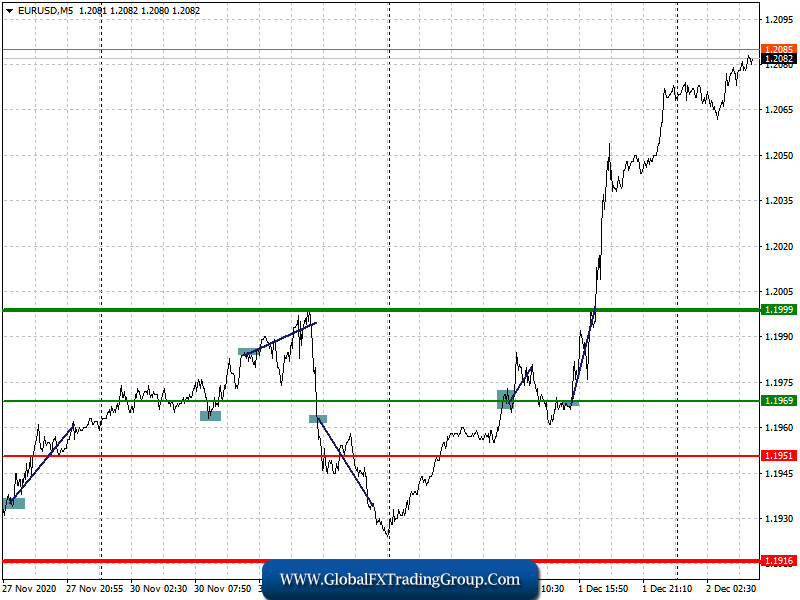

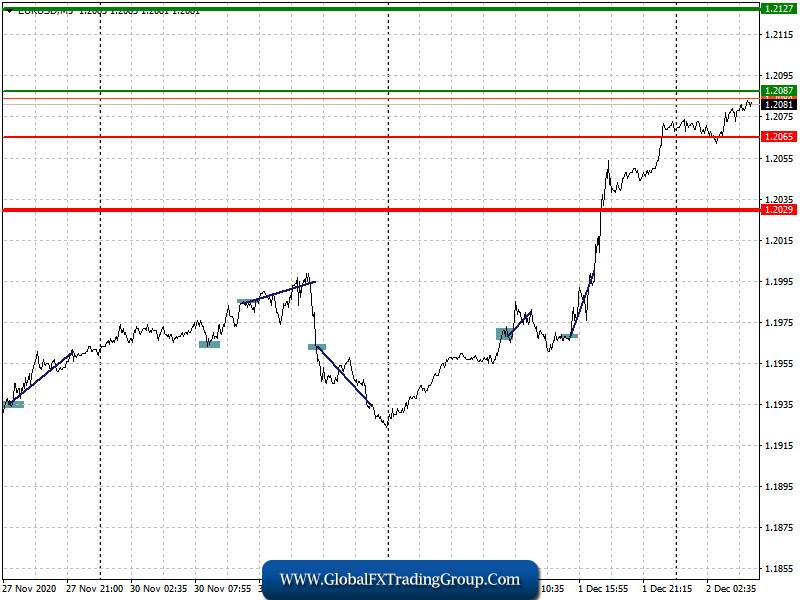

Analysis of transactions in the EUR / USD pair

Euro bulls were very active in the market yesterday, as a result of which the EUR / USD pair moved up by about 40 pips, continuing the upward trend. The news that the United States is planning to separately accept another package of economic assistance (worth about $ 1 trillion) also put pressure on the US dollar, while the latest data on the European economy, on the contrary, supported the euro.

All this led to a technical breakout in the 20th figure, which canceled the plans of many sellers for a downward correction at the end of the year. Positive news on COVID-19 vaccines also added support to risky assets.

Trading recommendations for December 2

Quite a lot of economic reports are scheduled to come out today, one of which is producer prices in the euro area, which should come out rather weak. Unemployment rate may also rise due to the coronavirus pandemic, but this is unlikely to put significant pressure on the euro’s current bullish trend. ADP’s report on the state of the US labor market will also only slightly dampen the optimism of euro bulls, so as the upcoming statements of Fed representatives. Only bad news on Brexit will bring harm to the euro today.

Open a long position when the euro reaches a quote of 1.2087 (green line on the chart) and then take profit at the level of 1.2127. However, growth will occur only if inflation in the euro area comes out better than the forecasts, and if good data is published in the EU’s labor market. Open a short position when the euro reaches a quote of 1.2065 (red line on the chart) and then take profit around the level of 1.2029. However, do this only if data on the eurozone economy comes out worse than the forecast, and if the risk of not signing a post-Brexit trade deal increases.

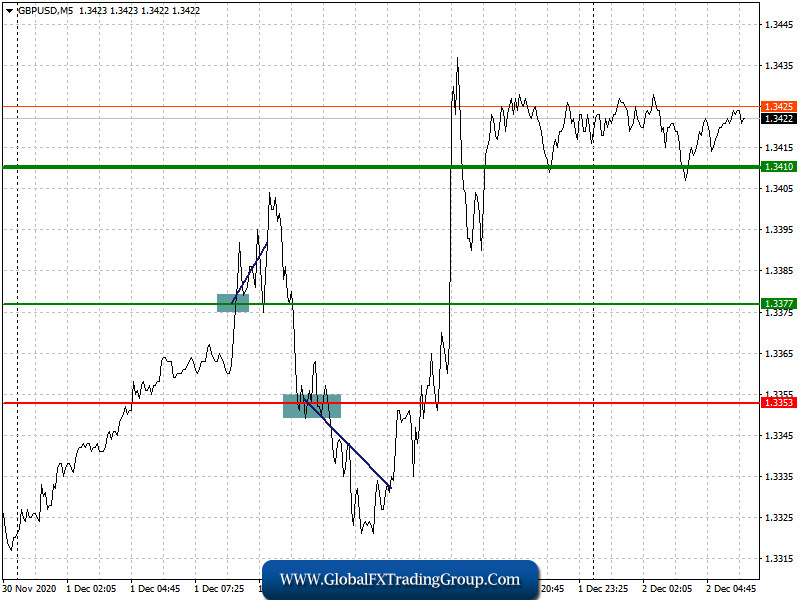

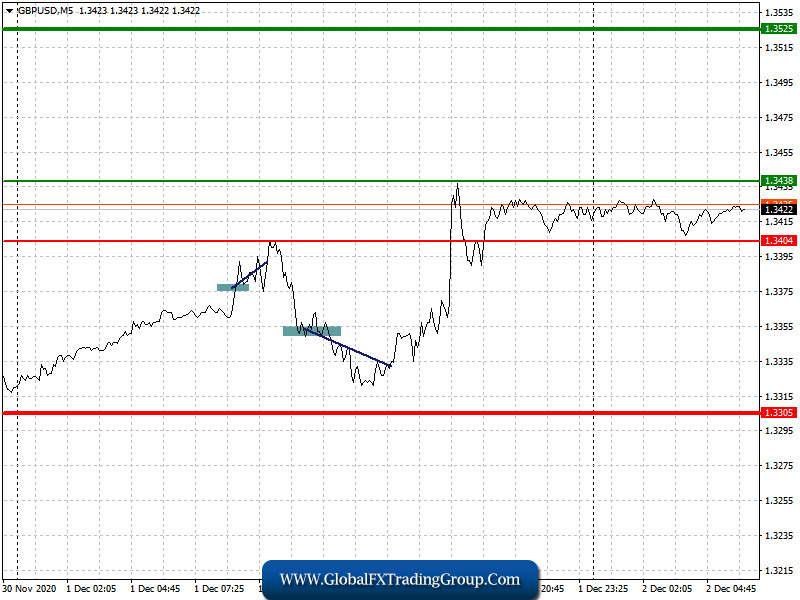

Analysis of transactions in the GBP / USD pair

A rather stubborn struggle unfolded between pound buyers and sellers yesterday, so as a result, both long and short positions gave good profit in the market. In the morning, long positions at 1.3377 raised the currency up by 20 pips, but in the afternoon, the quote pulled back by about 30 pips from 1.3353. However, in reality, the movement was just about 20 pips, since the pound did not reach the target value.

Trading recommendations for December 2

The pound will continue to move depending on the progress of Brexit negotiations. Yesterday, the head of the European Commission, Ursula von der Leyen, noted the importance of reaching an agreement, pointing out the risks that the EU and the UK could face if there is no compromise, which put temporary pressure on the pound.

Therefore, if positive news comes out, that is, a trade deal between the UK and the EU after Brexit, the market will see an immediate rally of the pound. But if it is announced again that both parties failed to make any concessions, the pressure on the currency would increase.

Open a long position when the quote reaches the level of 1.3438 (green line on the chart) and then take profit around the level of 1.3525 (thicker green line on the chart). Good news on Brexit may strengthen the British pound. Open a short position when the quote reaches the level of 1.3404 (red line on the chart) and then take profit around the level of 1.3305. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom