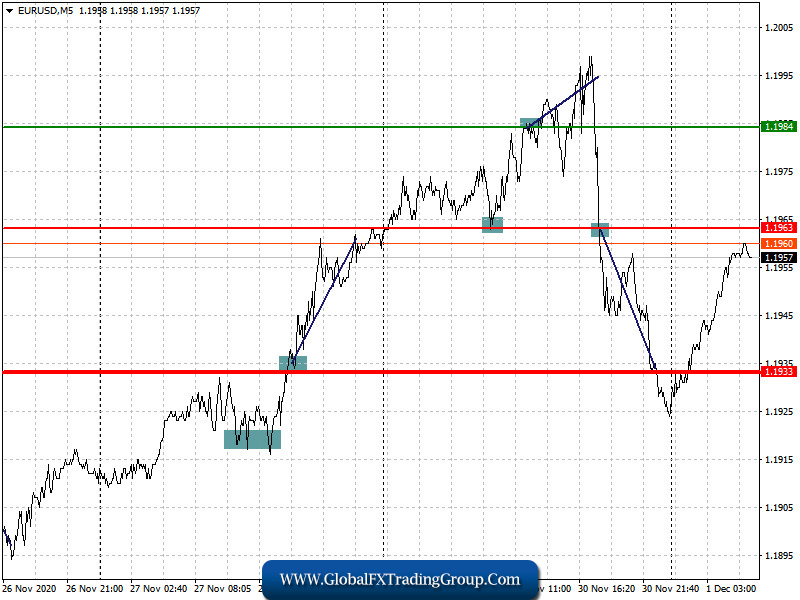

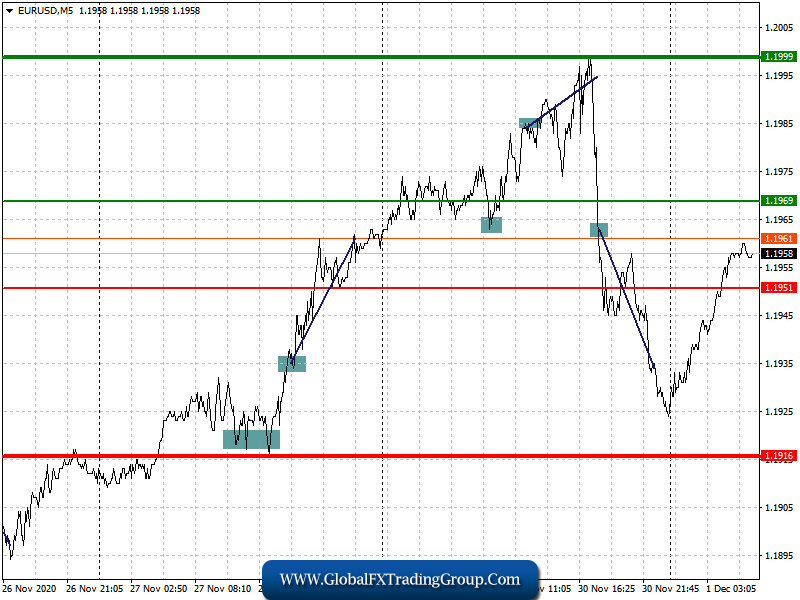

Analysis of transactions in the EUR / USD pair

The optimism of euro bulls disappeared immediately yesterday amid terrible inflation report from Germany. Then, short positions set at 1.1963 led to losses, but long positions from 1.1984 gave better price movement. However, the climb was only up to 15 pips, and the repeated test of level 1.1963 was the one that was more effective. After that though, the euro sank down by 30 pips, which is not bad, considering the uneven market that we can observe now.

Trading recommendations for December 1

Quite a lot of economic reports are scheduled to come out today. One of which is Manufacturing PMI in the euro area, which should have no problem since the sector has suffered the least pressure from the coronavirus. Meanwhile, the upcoming data on inflation can lead to a new fall in the euro, so it is best to monitor and pay close attention to it. If the figure turns out to be worse than forecasted, the EUR / USD pair will collapse in the market.

In the afternoon, there will be similar reports from the US, as well as statements from representatives of the European and US central banks, which may further undermine the stability of the euro in the current environment. Based on this, the currency has a high chance of declining sharply today.

Open a long position when the euro reaches a quote of 1.1969 (green line on the chart) and then take profit at the level of 1.2015. However, growth will occur only if good inflation data comes out in the euro area, and if activity in the manufacturing sector turns out to be better than expected. Open a short position when the euro reaches a quote of 1.1951 (red line on the chart) and then take profit around the level of 1.1916. However, do this only if data on the eurozone economy comes out worse than the forecast, and if ECB President, Christine Lagarde, hints at new measures to stimulate the economy.

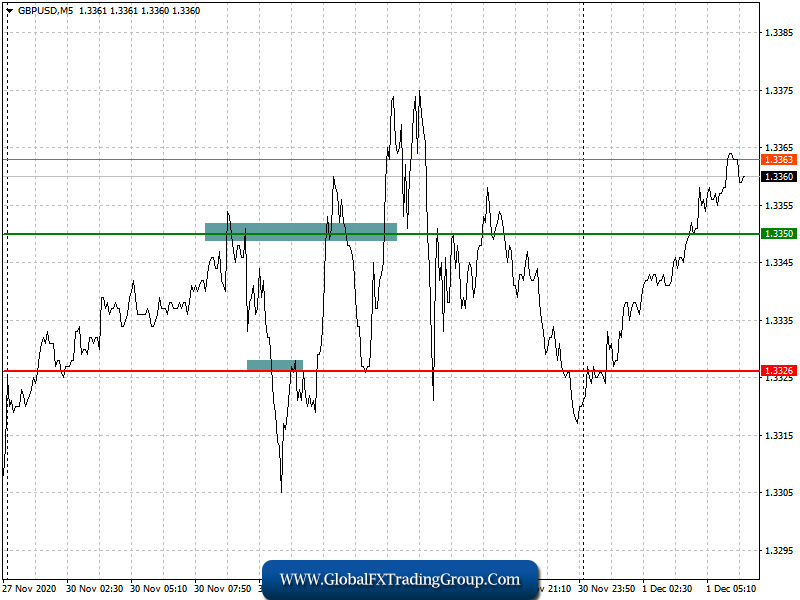

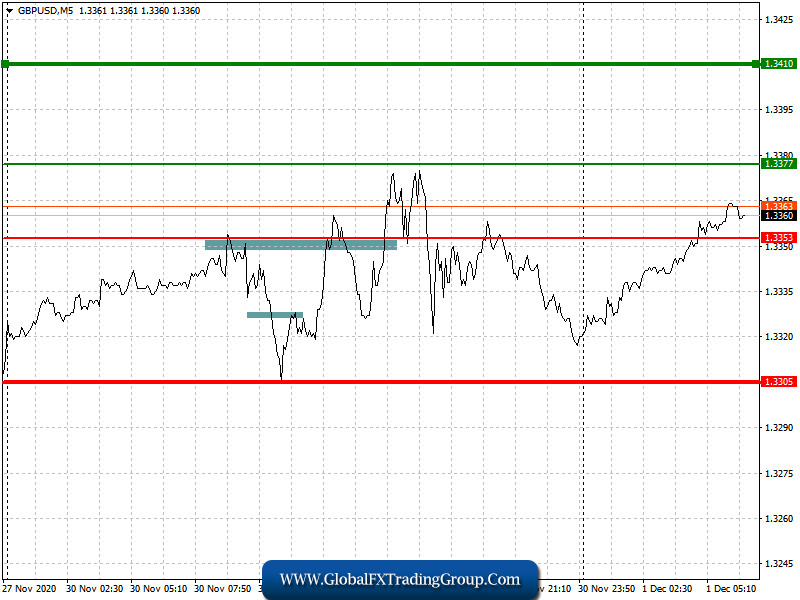

Analysis of transactions in the GBP / USD pair

The pound seems to be quite unlucky this week, as long positions from 1.3350 yesterday turned out to be unprofitable, so as the short positions set at 1.3326. All attempts made by traders to undermine the market were unsuccessful, and this is mainly due to the persisting uncertainty over the post-Brexit trade deal.

Trading recommendations for December 1

The pound will continue to move depending on the progress of Brexit negotiations. Yesterday, EU chief negotiator, Michel Barnier, said he hopes to reach an agreement soon, so if positive news comes out, that is, a trade deal between the UK and the EU after Brexit, the market will see an immediate rally of the pound. But if it is announced again that both parties failed to make any concessions, the pressure on the currency would increase.

Another thing that is quite important is the speech of Bank of England Governor Andrew Bailey, during which he may shed light on the central bank’s further plans to increase stimulus measures. But until there is no clear picture on the post-Brexit trade agreement, such is unlikely to happen.

Open a long position when the quote reaches the level of 1.3377 (green line on the chart) and then take profit around the level of 1.3410 (thicker green line on the chart). Good news on Brexit may strengthen the British pound. Open a short position when the quote reaches the level of 1.3353 (red line on the chart) and then take profit around the level of 1.3305. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom