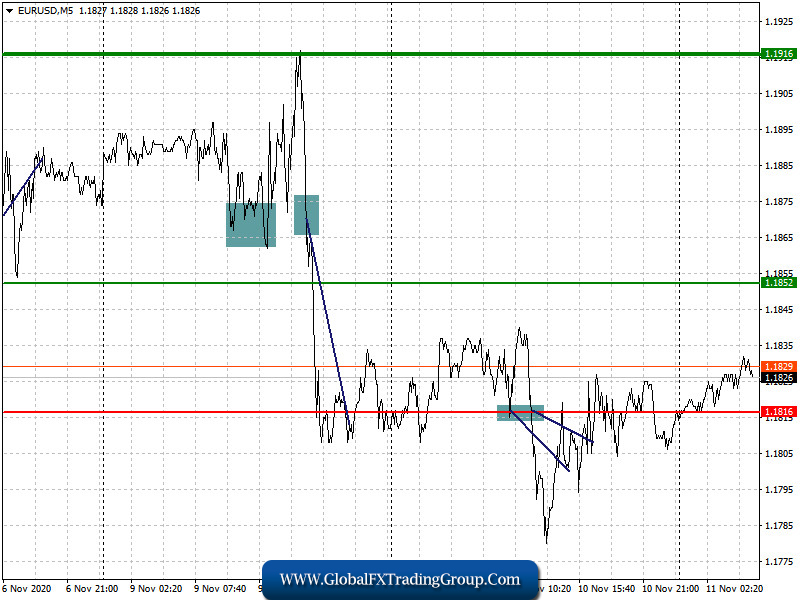

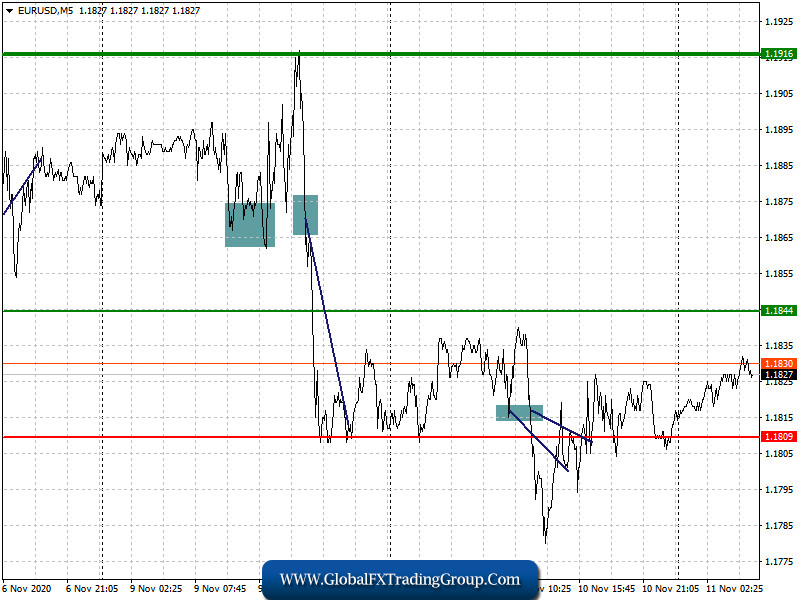

Analysis of transactions in the EUR / USD pair

Very weak indicators for the eurozone economy put serious pressure on the euro yesterday, which triggered a sell signal at 1.1816. But even though a number of short positions arose in the market, there wasn’t any major price decrease, since the quotes moved no more than 30 points down. Then, in the afternoon, the EUR / USD pair went into breakeven.

Trading recommendations for November 11

The European Central Bank is scheduled to have a conference today, during which they will address the economic recovery of the entire euro area. If its president, Christine Lagarde, touches on other topics aside from the coronavirus, demand is likely to increase for the euro.

Open a long position when the euro reaches a quote of 1.1844 (green line on the chart), and then take profit at the level of 1.1916. Growth will only occur if Christine Lagarde gives positive statements. Open a short position when the euro reaches a quote of 1.1809 (red line on the chart, and then take profit around the level of 1.1754. A downward correction is very much expected, after the strong bull market last week.

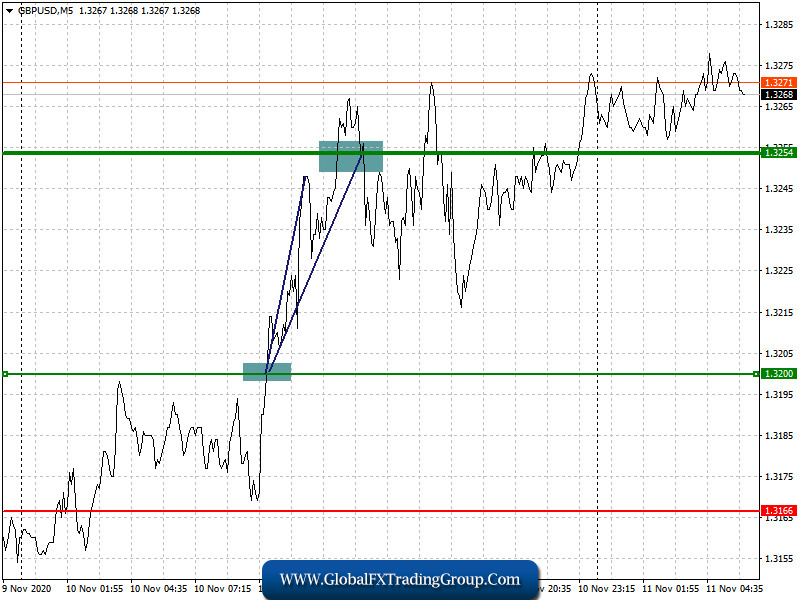

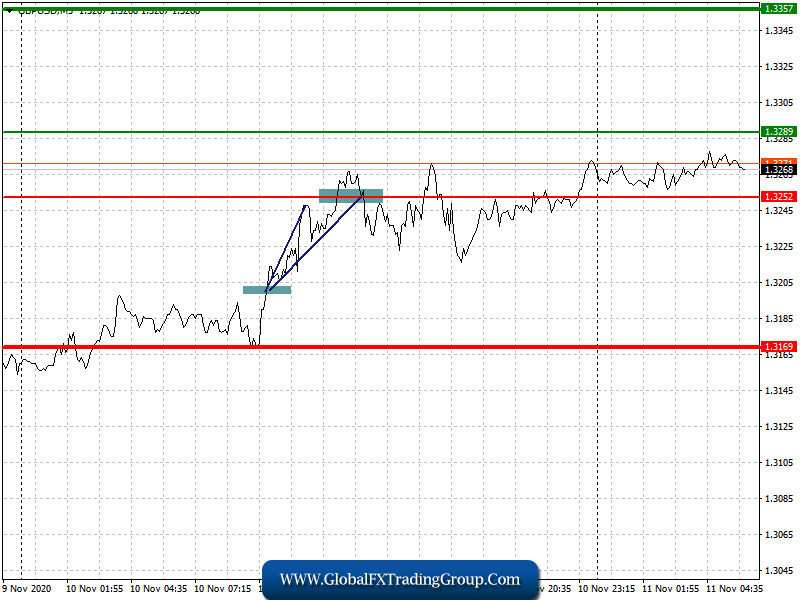

Analysis of transactions in the GBP / USD pair

Good report was published on the UK labor market yesterday, as there was a decrease in jobless claims and increase in average weekly earnings. Such allowed the pound to continue its rise against the US dollar, thus, the bullish trend will most likely continue in the GBP / USD pair. The growth made long positions from 1.3200 to 1.3254 give more than 50 pips of profit to pound bulls.

Trading recommendations for November 11

The market may fall in a lull today, especially since there are no economic statistics scheduled for publishing. Nonetheless, the safest bet is to trade along the current trend, that is, a bullish or further upward move in the GBP / USD pair.

Open a long position when the quote reaches the level of 1.3289 (green line on the chart), and then take profit around the level of 1.3357 (thicker green line on the chart). Good news over Brexit could raise demand for the British pound. Open a short position when the quote reaches the level of 1.3252 (red line on the chart), and then take profit at least at the level of 1.3169. Bad news on Brexit will return the downward trend in the GBP/USD pair. In addition, a breakout at 1.3252 will lead to a technical correction, mainly due to the removal of many buy stop orders.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom