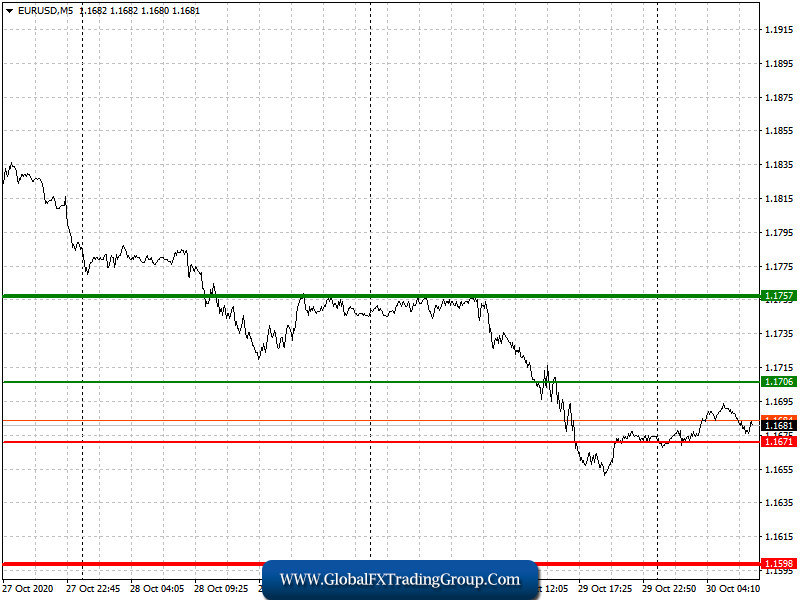

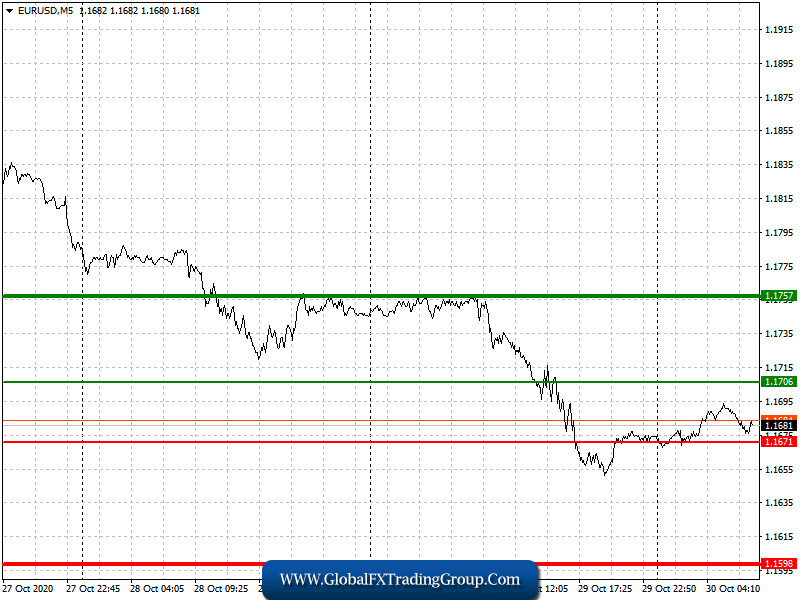

Analysis of transactions in the EUR / USD pair

The euro collapsed in the market yesterday after the ECB hinted of a possible softer monetary policy in December. It led to the quote moving 70 pips down from 1.1738

Trading recommendations for October 30

A number of economic reports are scheduled for release today, however, they will most likely reveal negative data for Europe. Because of this, short positions are expected to be more profitable in the EUR / USD in the morning. But then in the afternoon, reports on the US economy may lead to the closure of short positions in the market, and such will limit the downward potential of the European currency.

Open a long position when the euro reaches a quote of 1.1706 (green line on the chart), and then take profit at the level of 1.1668. Open a short position when the euro reaches a quote of 1.1671 (red line on the chart, and then take profit around the level of 1.1598. A slowdown in economic growth and inflation will put pressure on the European currency.

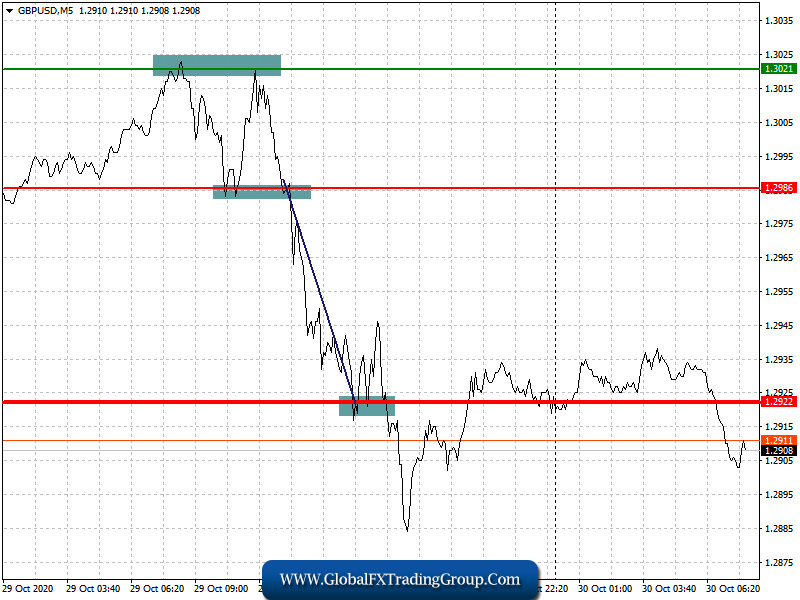

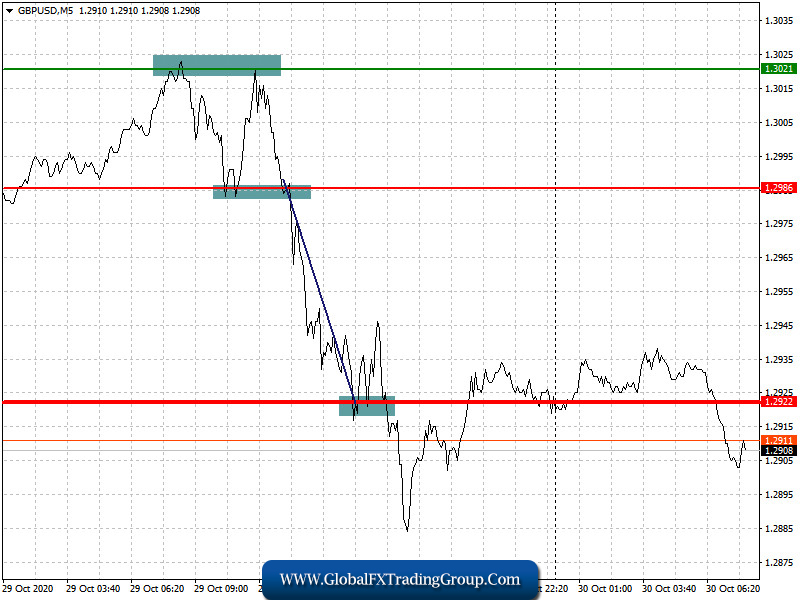

Analysis of transactions in the GBP / USD pair

The uncertainty over the UK-EU trade agreement continues to jiggle the market. Thus, long positions encountered losses yesterday. As for short positions, selling from 1.2982 compensated for the defeat, as the pair moved 60 pips down because of it.

Trading recommendations for October 30

Of great importance is still the ongoing Brexit negotiations, to which good news will lead to a new wave of growth in the GBP/USD pair, while bad news will lead to another decline in the British pound.

Open a long position when the quote reaches the level of 1.2920 (green line on the chart), and then take profit around the level of 1.2982 (thicker green line on the chart). Open a short position when the quote reaches the level of 1.2896 (red line on the chart), and then take profit at least at the level of 1.2852. Bad news on Brexit will continue the downward trend in the GBP / USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom