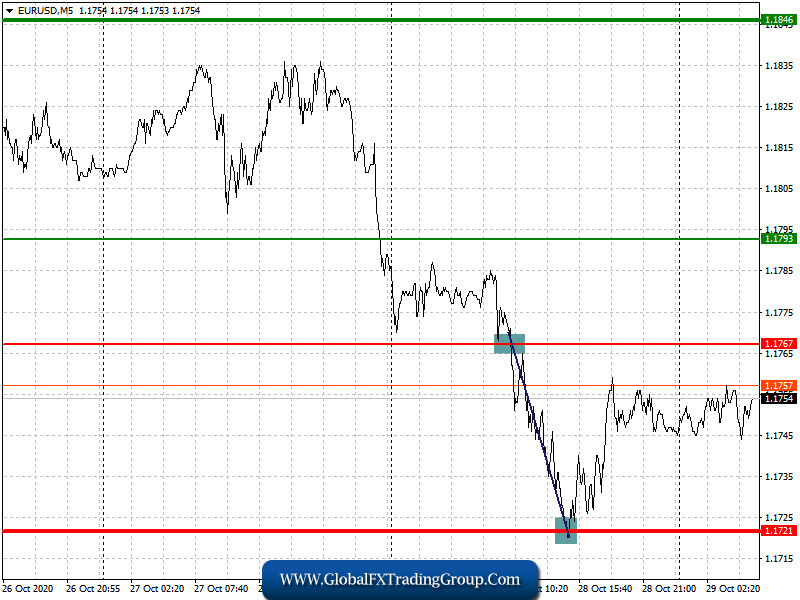

Analysis of transactions in the EUR / USD pair

The bears got ahold of the market yesterday, as a result of which the euro moved 45 pips down from the level of 1.1767. It was one of the most profitable days this week.

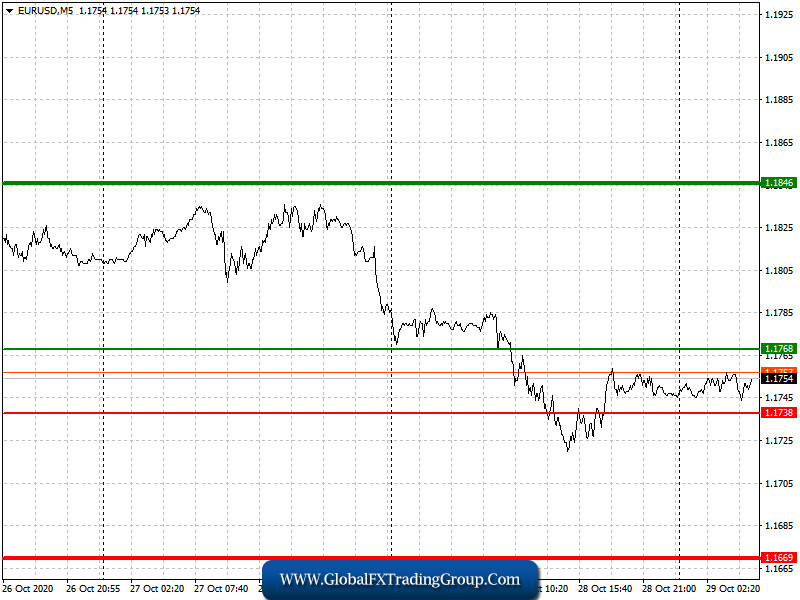

Trading recommendations for October 29

A number of economic reports are scheduled for release today, one of which is the data on US GDP. At the same time, the European Central Bank will announce its decision on interest rates, which is expected to lead to a surge in volatility in the EUR / USD pair. If the ECB softens its monetary policy, the pressure on the euro will increase.

Open a long position when the euro reaches a quote of 1.1768 (green line on the chart), and then take profit at the level of 1.1846. Open a short position when the euro reaches a quote of 1.1738 (red line on the chart, and then take profit around the level of 1.1669. If the ECB hints of a rate cut, the pressure on the euro will intensify.

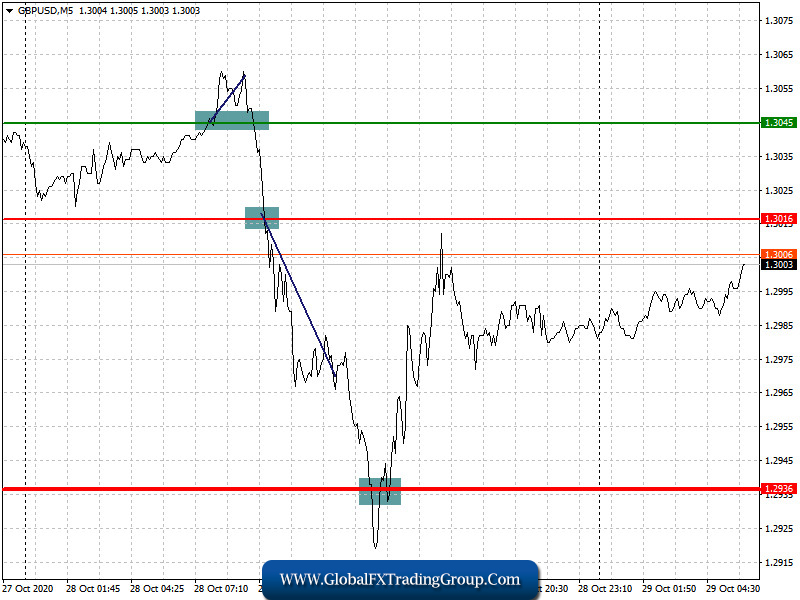

Analysis of transactions in the GBP / USD pair

The pound moved 20 pips up from 1.3045 yesterday, however, afterwards, it fell down again from the level of 1.3016. And although the quote failed to reach the target price of 1.2936, closing at 1.2970 was still profitable.

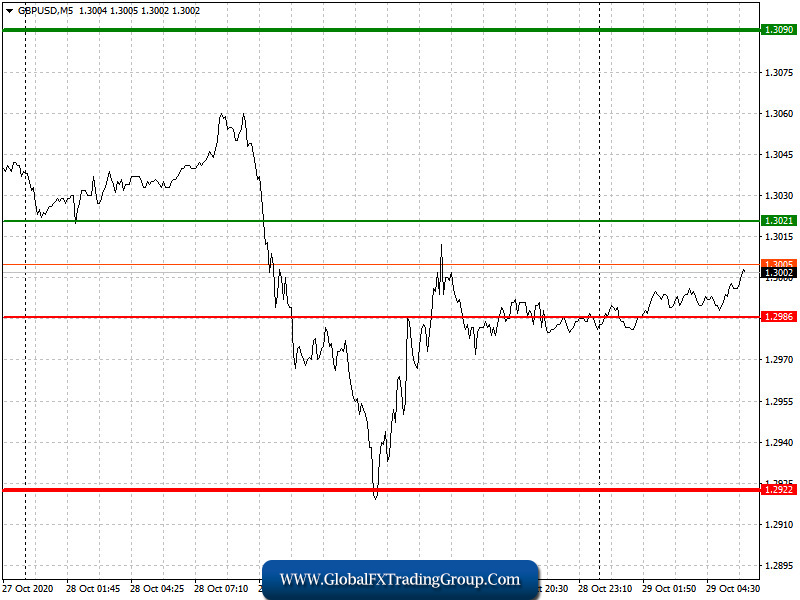

Trading recommendations for October 29

Since there are no economic reports scheduled for release today, the attention of traders will be shifted on the next round of negotiations between the UK and the EU over the long-disputed post-Brexit trade deal. Good news about it will lead to a new wave of growth on the British pound, whereas a bad news could lead to another decline in the GBP / USD pair.

Open a long position when the quote reaches the level of 1.3021 (green line on the chart), and then take profit around the level of 1.3090 (thicker green line on the chart). Open a short position when the quote reaches the level of 1.2986 (red line on the chart), and then take profit at least at the level of 1.2922. Bad news on Brexit will continue the downward trend in the GBP/USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom