Trading recommendations for the EUR / USD pair on October 1

Analysis of transactions

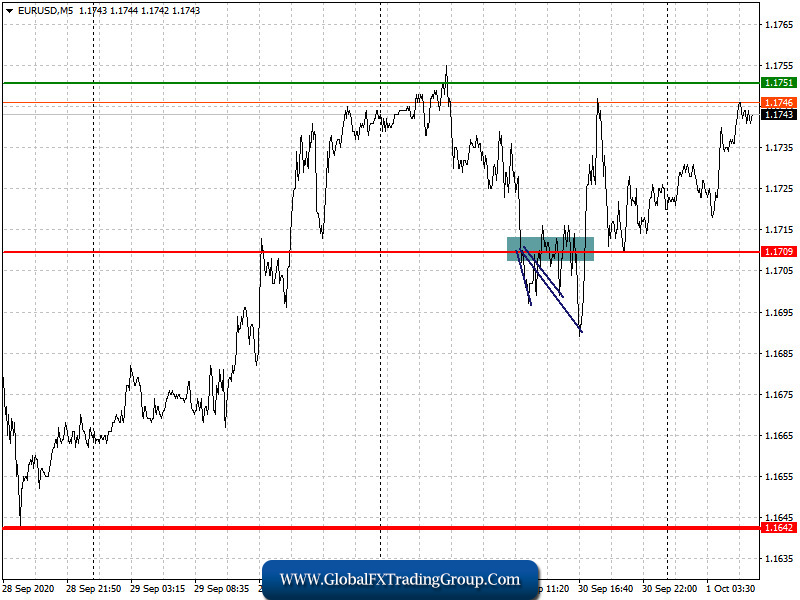

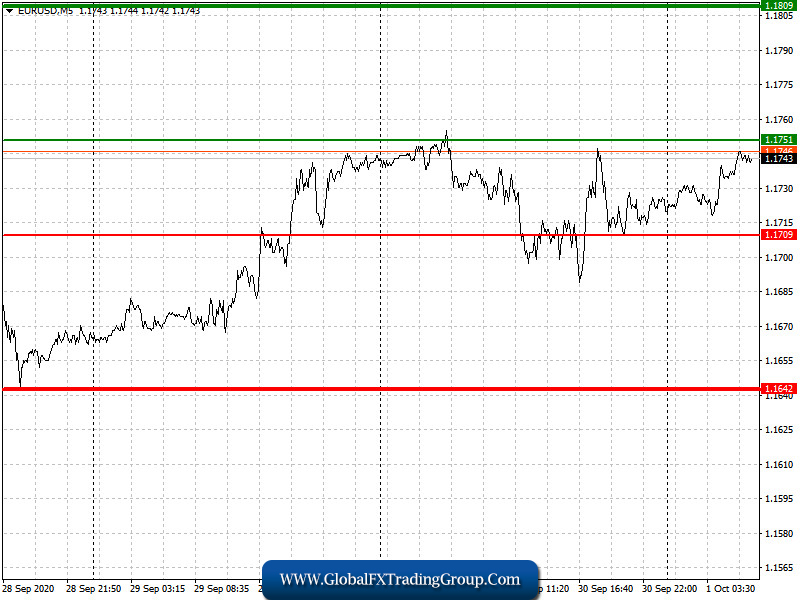

Strong US statistics should’ve brought sharp decline in the EUR / USD pair, however, movement yesterday was a lot smaller than expected, amounting to only 20 pips down from the level of 1.1709.

Today is the same as the upcoming reports also pose certain risks for the euro, one of which is the data on production activity in the eurozone. If the indicator comes out better than the forecasts, a new wave of growth will appear, but if a slowdown was observed on activity, the euro will depreciate even further in the market.

Buy positions when the quote reaches the level of 1.1751 (green line on the chart), targeting a price of 1.1810. However, growth will only occur on the grounds of good data for the eurozone. Sell positions after the euro reaches a price of 1.1709 (red line on the chart), and then take profit at the level of 1.1642.

Trading recommendations for the GBP / USD pair on October 1

Analysis of transactions

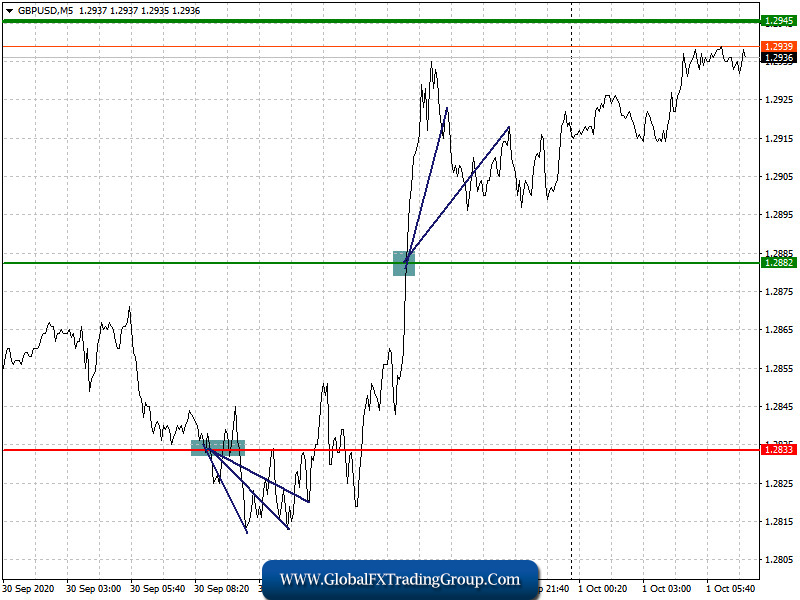

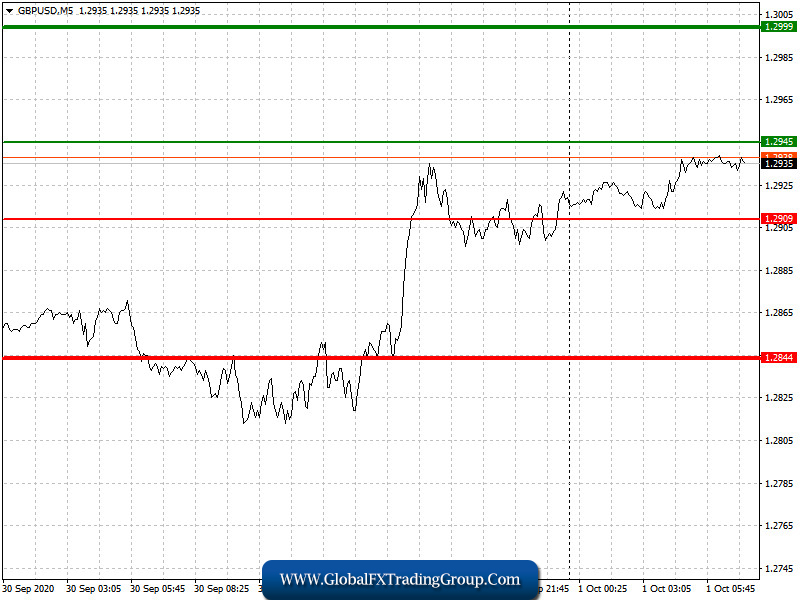

The bearish sentiment was not that strong in the pound yesterday, as a result of which the quote moved down by only 20 pips from the level of 1.2833. Then, in the afternoon, a slight bullish momentum went through the GBP / USD pair, bringing the quote a 40-pip rise from the level of 1.2882.

Today, data for the UK PMI will be published, however, it will not greatly affect the market, as everyone’s attention will be focused on Brexit updates and the spread of the coronavirus.

Buy positions when the pound reaches a price of 1.2945 (green line on the chart), and then take profit at the level of 1.2999 (thicker green line on the chart). Sell positions after the quote reaches the level of 1.2909 (red line on the chart), and then take profit around the level of 1.2844.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom