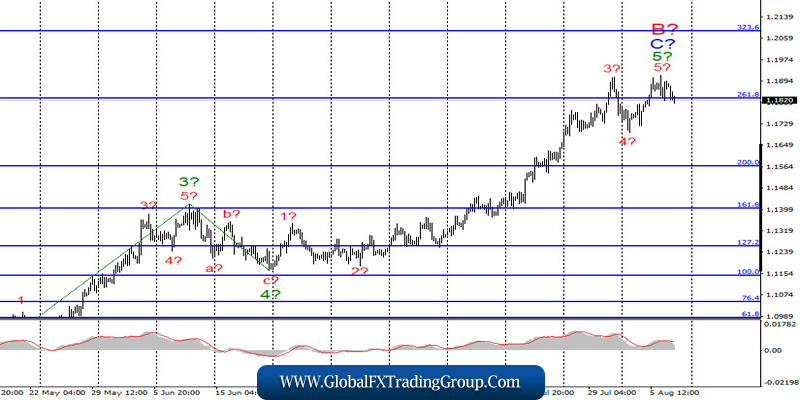

EUR / USD

On August 6, the EUR/USD pair gained about 20 pips, but still presumably completed the construction of a 5 in 5 in C in B. Today, August 7, a new departure of quotes from the reached highs began. The current wave markup looks completely complete. Thus, I expect the completion of the construction of the uptrend section and the transition to a new downward set of waves, which may stretch for several months in the time aspect.

Fundamental component:

Yesterday was fairly neutral in terms of information. There was only one report on claims for unemployment benefits in America, which turned out to be somewhat more optimistic than forecasts. Nevertheless, the demand for the US currency did not change during the past day, that is, it remained rather low. It should be noted once again that the wave counting implies a long rise in the US currency.

However, will the markets only have enough wave counting as reasons? The hopes of the US currency are mainly associated with the Nonfarm Payrolls report today, which reflects the number of jobs created outside the agricultural sector. If the value of the report is higher than the forecast (+1.6 million), then the demand for the dollar may grow significantly in instruments with the European and the British currencies. There is nothing more to hope for the dollar.

On the other hand, the epidemiological situation in America remains quite difficult, with no significant improvement observed. Moreover, Donald Trump continues to discourage Americans almost every day with his “misleading” statements regarding the coronavirus. It is so discouraging that his posts have already begun to be deleted by social networks Twitter and Facebook. For a second: American social networks are deleting messages from the president of the country, as they are “knowingly false.” Nonsense, but this is the American reality now.

The situation in the economy is no better than the situation with the epidemic. Economists are predicting a serious recession for America, from which the country will take a very long time, perhaps several years, in contrast to Trump’s promises to “lift the economy almost by 2021.” We have already seen the GDP report for the second quarter.

General conclusions and recommendations:

The euro/dollar pair has presumably completed the construction of the upward wave C in B. Thus, at this time, I do not recommend new purchases of the instrument, but I recommend closing the old ones. I also recommend starting to look closely at sales with the first targets, which are around 15 and 16 figures, since the instrument can now move on to building a global wave C.

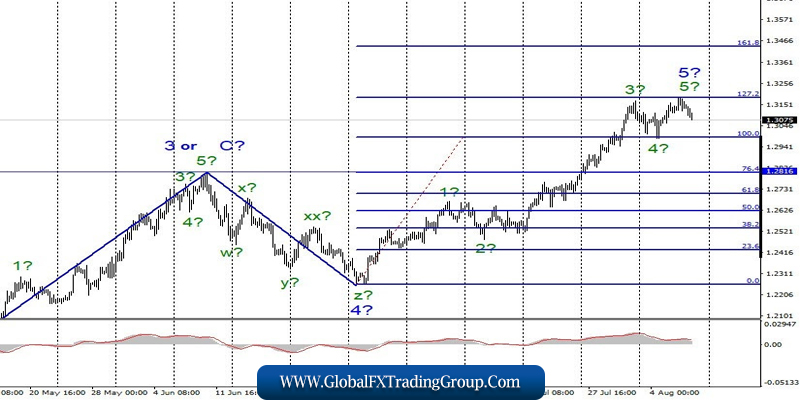

GBP / USD

On August 6, the GBP/USD pair gained about 20 pips, however, an unsuccessful attempt to break through the 127.2% Fibonacci mark indicates that the markets are not ready for new purchases of the pound, and the current wave counting implies the construction of a new downtrend section, as wave 5 took a fully completed view. Thus, before a successful breakout of the 127.2% Fibonacci mark, I believe that the instrument will try to start building a downward set of waves.

Fundamental component:

The demand for the US currency declined yesterday, paired with the pound, although the results of the meeting of the Bank of England and the subsequent speech of its governor Andrew Bailey cannot be called too optimistic for the British currency. Nevertheless, the current wave counting implies the beginning of a decline in the instrument, respectively, the dollar should start to grow, unless the American reports that will be released in the next few minutes spoil everything. The main thing is that if the Nonfarm report is strong, then you can really expect a strong increase in the dollar. No news is expected from the UK today.

General conclusions and recommendations:

The pound/dollar instrument is expected to have completed an upward wave 5 around 1.3183. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break through the 127.2% Fibonacci level and tune in to a possible long-term decline in quotes within a new downward trend section with the first targets around 27 and 28 figures.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom