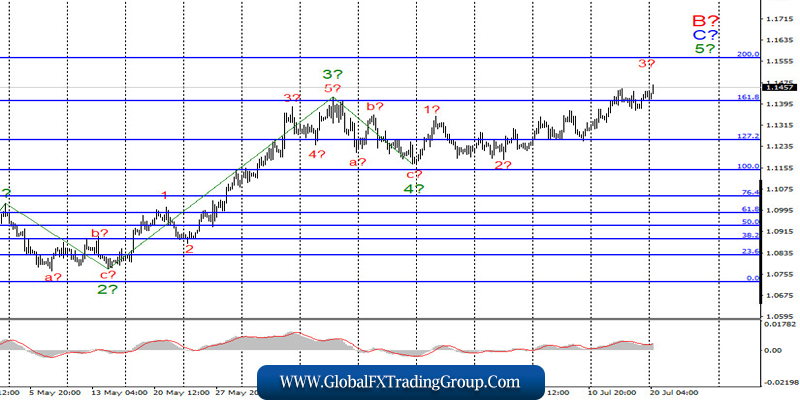

EUR / USD

On July 17, the EUR/USD pair gained about 45 pips. Thus, the instrument presumably remains within the framework of building a 3 in 5 wave in C in B, which takes a very long form. If this is true, then the increase in quotes will continue in the near future with targets located near the level of 200.0% Fibonacci, since an attempt to break the level of 161.8% Fibonacci turned out to be successful. In any case, wave 5 in C in B doesn’t look fully equipped yet.

Fundamental component:

Markets were mostly interested in the results of the meeting of the EU leaders at the end of the previous week. This summit addressed the crucial issue of providing the European economy with financial assistance to overcome the pandemic crisis. However, the summit started on Friday and was due to end on Saturday.

Today is Monday, and the meeting of European leaders is still ongoing, because there is no progress in the negotiations. Thus, there is no positive news from the summit, and the markets are forced to continue to pay attention to other topics that have been of great concern to them lately. One of these topics is the coronavirus in the United States, which is not slowing down at all. Markets are very worried that Donald Trump remains calm despite the fact that the death and morbidity rates in America are the highest in the world.

However, instead of introducing a new quarantine or taking other actions to combat the spread of the COVID-19, he continues to state that the problem is not the virus, but the increased number of tests for the virus, which leads to a strong increase in the number of cases. However, this explanation does little to calm the markets, just like the fact that “the majority of patients have only a mild form of the disease.” The point is that the epidemic still continues to spread, even through those who are ill in a mild form.

This means that a large number of Americans remain in the risk group, who will potentially carry the disease not in an easy form. In general, the markets continue to be very skeptical of Trump’s attempts to calm them down and continue to sell off the US currency, even ignoring the absence of extremely important results at the EU summit.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated level of 1.1570, which equates to 200.0% Fibonacci level, for each MACD up signal in the calculation to continue the construction of wave 5 in C in B.

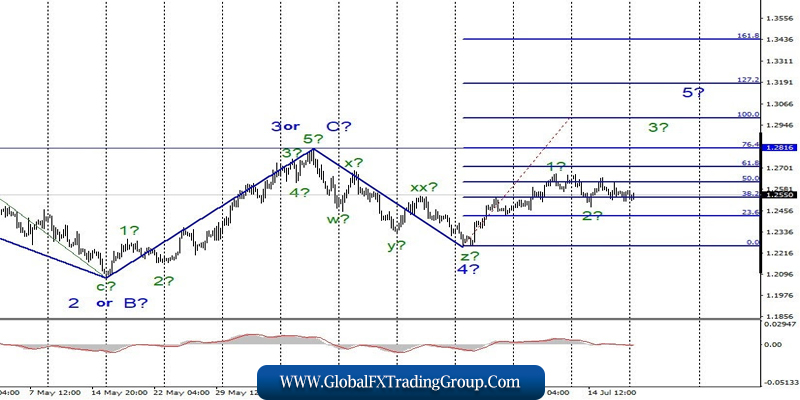

GBP / USD

On July 17, the GBP/USD pair gained just a dozen pips. Wave 2 in 5 is still considered complete, thus, before a successful attempt to break its minimum, I believe that the instrument is in the process of building wave 3 in 5. If this is true, then the increase in the tool will resume with targets located about 28 and 30 figures in the near future. A successful attempt to break the low of wave 2 at 5 will indicate a possible complication of this wave and will postpone the execution of the variation with the construction of wave 3 for some time.

Fundamental component:

There was only little news in the UK last Friday. There was a speech by the Governor of the Bank of England Andrew Bailey, during which he did not tell the markets anything extra interesting. The head of the Bank of England said that the economy began to recover, but the big question is at what pace it is doing this. The latest GDP report showed that the growth was only 1.8% in May, which is very small after falling by 20%.

General conclusions and recommendations:

The pound/dollar pair has made the current wave counting very complicated, which now suggests building an upward wave. Therefore, I recommend buying the instrument this time for each MACD signal “up” with targets located near the levels of 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom