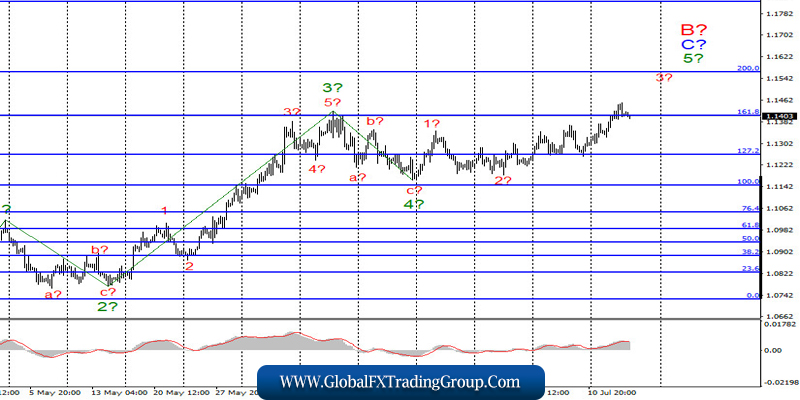

EUR / USD

On July 15, the EUR/USD pair gained about 10 pip and, therefore, continues to build the proposed wave 5 in C to B, in particular its internal wave 3. A successful attempt to break through the 161.8% Fibonacci level indicates that markets are ready for new purchases European currency. Thus, the increase in the instrument may continue. The entire wave 5 in C in B has already assumed a very extended structure.

Fundamental component:

Markets are fully focused on two upcoming events in the European Union. In anticipation of both, the euro is rising. It seems that markets are waiting for positive news from the ECB meeting and the EU summit. The first event will be extremely interesting, and, frankly, it’s hard to imagine now what could be optimistic for the Euro currency. The head of the ECB, Christine Lagarde, has repeatedly stated that the EU is following the worst-case scenario, according to which GDP loss will amount to 8.7%, and possibly more, in 2020.

Everything will depend on the new waves of the pandemic, their scale and the measures that governments of the EU countries will have to take. At the June meeting, the ECB actually admitted that the money provided by the PEPP (Pandemic Emergency Purchase Program) is not enough. And this is as of June, that is, after only a few months of its functioning. I had to rush to increase the program by 600 billion euros and extend it until mid-2021, which indirectly indicates that the ECB is not waiting for a quick end to the crisis.

Thus, today it is unlikely that Christine Lagarde will say that the economy is recovering and that in the European Union “everything is fine”. Most likely, there will again be very cautious comments that will border on pessimistic forecasts for the economy. The second event of the week – the EU summit – will address the issue of a new economic stimulus package of 750 billion euros. And here, too, there may not be any positivity or optimism.

If the “mean four” (Denmark, Austria, Sweden and the Netherlands) do not agree that 500 billion of the 750 will be provided in the form of grants, the recovery Fund will not be accepted. Accordingly, the European economy will not receive any assistance, and the individual economies of Italy, Spain, Greece and Portugal will continue to experience serious difficulties.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated level of 1.1570, which acts as the 200.0% Fibonacci retracement level, for each MACD up signal in the calculation to build wave 5 in C in B.

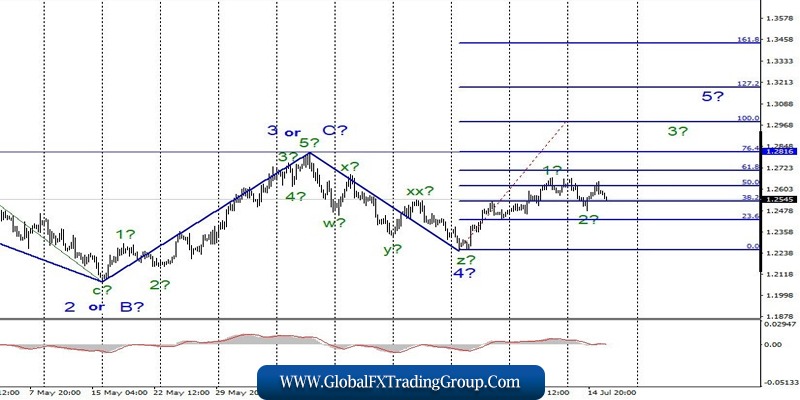

GBP / USD

On July 15, the GBP/USD pair gained about 35 pip. Thus, the assumed waves 2 and 5 are completed. Before a successful attempt to break through its minimum, it is believed that the instrument has moved on to building wave 3 of 5. If this assumption is correct, then the increase in quotes will resume with targets located about 28th and 30th figures in the near future. Meanwhile, a successful attempt to break through the low wave of 2 to 5 will indicate a possible complication of this wave and postpone the execution of the option with the construction of a pulse wave for some time.

Fundamental component:

An inflation report was released in the UK on Wednesday, and this figure increased slightly in June from 0.5% y / y to 0.6%, although this value is still quite low. Today, unemployment data was published which turned out to be much better than expected to see in the markets. In particular, unemployment did not increase in May, remaining at 3.9%. However, on Thursday morning, demand for the pound declined, and the markets will review the US retail report and analyze the statement by Bank of England Chairman Andrew Bailey.

General conclusions and recommendations:

The pound/dollar pair has greatly complicated the current wave marking, which now involves the construction of a new upward wave. Therefore, I recommend buying the instrument at this time with targets near the levels of 1.2816 and 1.2990, which act as a peak of wave 3 or C and the 100.0% Fibonacci retracement level respectively.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom