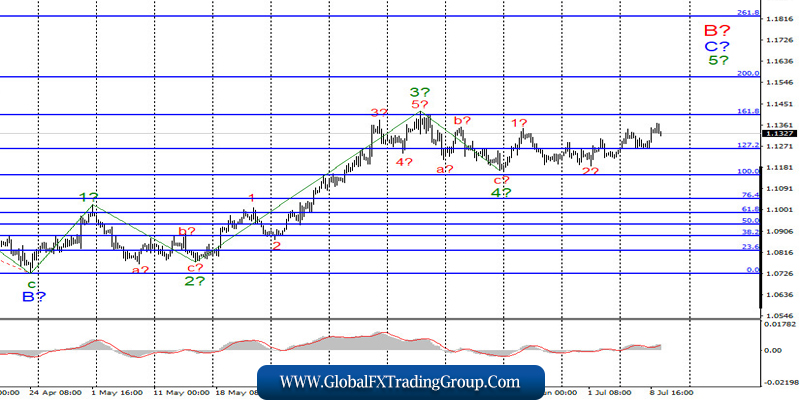

EUR/USD

On July 8, the EUR/USD pair gained about 55 basis points and thus continued to build the expected wave 5, C, or B. I expect a continued improvement of the instrument’s quotes in terms of the building of this wave, after which the prolonged decline in quotes in the framework of the proposed global wave C. However, there are no signs of the completion of the construction of wave 5, C, or B. Wave 5 can also form inside this wave.

Fundamental component:

There have been no economic reports in recent days at all. However, there was a lot of news concerning the political and economic spheres of the European Union and the United States. Today, the meeting of EU Finance Ministers started, where they will choose the new President of the Eurogroup. However, the markets are not interested in this information.

They are more interested if there will be a discussion of a 750-billion package of assistance to the European economy, which the Northern countries of the European Union do not want to approve. Judging by the announcements of the meeting, there will be no discussion on this issue. Thus, it is unlikely that the markets will receive the information that they are waiting for. It was also reported that the Bundesbank and the ECB have found a common language.

The German Central Bank will not leave the jurisdiction of the European Bank and will not go against its will. However, this information will not affect the movement of the instrument in any way. What’s important is the coronavirus epidemic in the United States. Yesterday we passed the threshold of 60 thousand cases per day. Donald Trump continues to distribute completely inappropriate comments and jokes on this topic in the style of “we need to reduce the number of tests to reduce the incidence of disease”.

At the same time, the main competitor of Trump in the race for the US President-2020, Joe Biden, said that 3 million cases of coronavirus in the US – “the merit” exclusively of Donald Trump, and called him “a commander-in-chief who is not able to command anything”. The more the epidemic spreads, the more likely it is that the American economy will shrink again. Or recover at a slower pace.

Accordingly, investors are worried about the future of the United States, especially on the eve of the presidential election, which is unknown how it will end. Now the position of Joe Biden looks stronger, this is confirmed by social studies, however, everything may still change by November.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C or B. Thus, I recommend buying a tool with targets located near the calculated levels of 1.1406 and 1.1570, which is equal to 161.8% and 200.0% for Fibonacci for each “up” signal of the MACD in the calculation of building wave 5, C, or B.

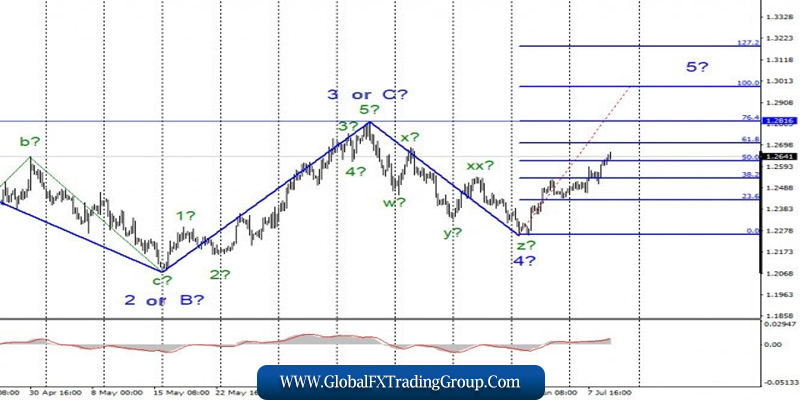

GBP/USD

The GBP/USD pair gained about 65 basis points on July 8. Thus, the construction of the assumed wave 5 continues. If this is true, then the increase in quotes will continue with targets located near the maximum of wave 3 or C or slightly higher. After completing the construction of this wave, it is also expected to build a new downward section of the trend, which can also turn out to be very long.

Fundamental component:

There were no noteworthy economic reports in the UK on Wednesday. There won’t be any on Thursday or Friday. All the attention of the markets is still focused on the negotiations between London and Brussels on Brexit, which still do not end in anything positive. The British pound continues to rise due to the unhealthy political, economic, and epidemiological situation in America.

General conclusions and recommendations:

The pound/dollar tool has greatly complicated the current wave markup, which now involves building a new upward wave. Therefore, I recommend that you buy an instrument with targets around 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom